The fundamental challenges facing the crypto market have all joined forces to act in concert: issues of fund security, legal, regulatory and judicial issues, inter-asset class correlation and restrictive monetary policy. In the face of these combined and virulent attacks, the bitcoin price finds itself quite alone on its major chart support of $24,000/25,000.

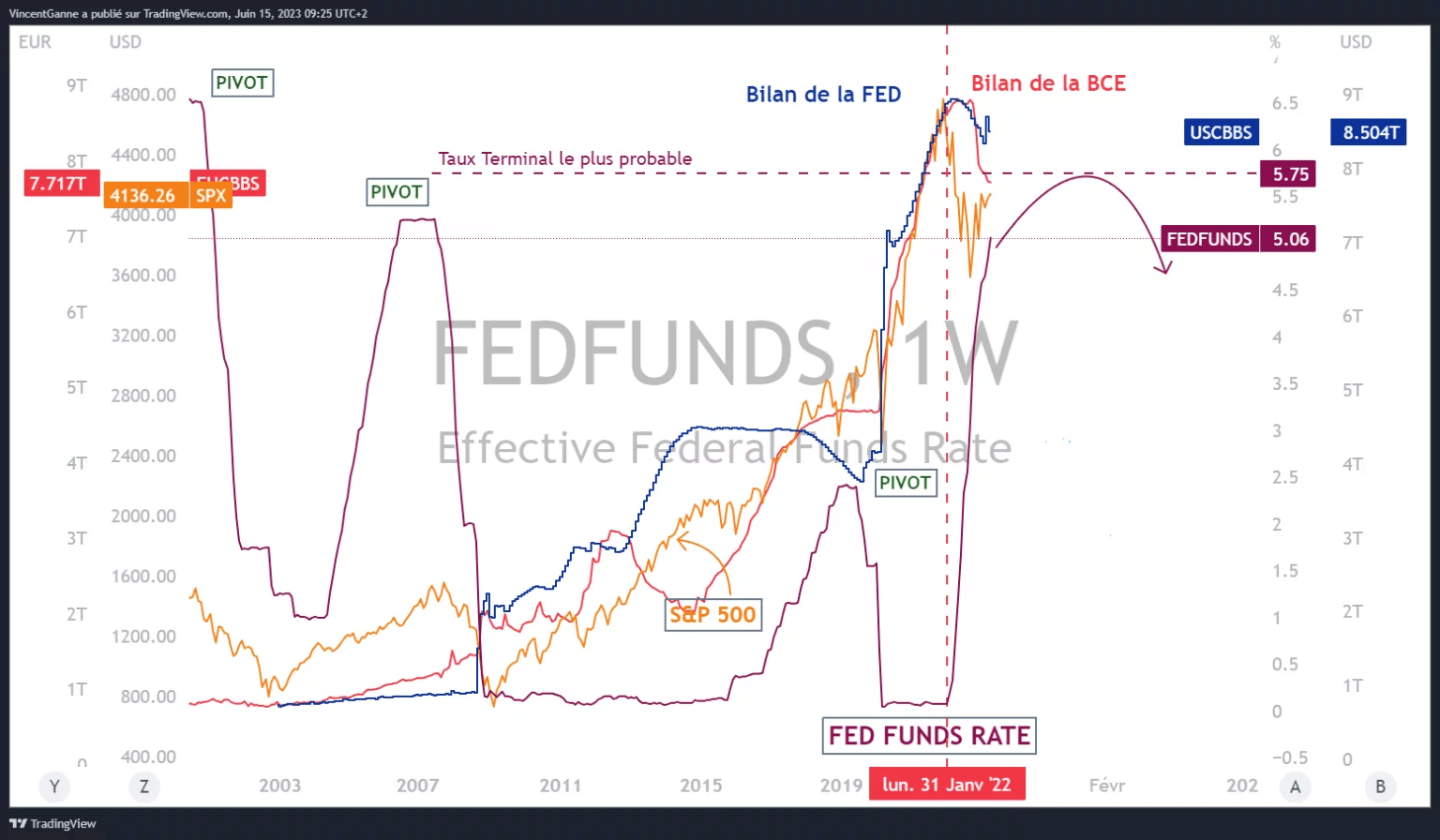

The FED Terminal rate could be 5.75%

TCN’s columns have described and still describe perfectly the endogenous difficulties that the crypto market has faced in recent weeks. These are illustrated by the resurgence of fund security, regulatory and even legal issues arising from the crusade of the US stock market regulator, the Securities and Exchange Commission (SEC).

This first dimension of the difficulties is medium- to long-term in nature and will be resolved over the next few months, if not longer. This is probably the main reason why crypto prices have been falling since the beginning of May (Sell in May and Go Away, did you say?).

As Bitcoin (BTC) has a lot in its belly, it also has to contend with a backdrop of financial markets and monetary policy of confirmed intransigence with, in particular, the rebound in the US dollar and market interest rates since the middle of April.

It is true that the latest monetary policy decision by the Federal Reserve (FED) this week dashed hopes of a rapid pivot by the US central bank. The Fed reiterated that the current level and trend of underlying inflation measures were still far too high, despite leading inflation indicators which continue to point to a further fall in inflation rates over the coming months.

But the Fed will only be satisfied and fully satisfied when the underlying consumer inflation rate is well established below the 2% threshold, and we are still a long way from that. It has therefore told the market that its “terminal” rate will probably be 5.75%, which means another 1 or 2 rate hikes this summer.

If you add to this the fact that the stock market indices are now technically overbought, you get a set against which Bitcoin will have to deploy all its forces to see its price stabilise.

Graph produced with the TradingView website and showing the following information: the Fed funds interest rate, the most likely FED terminal rate, the FED balance sheet and the ECB balance sheet

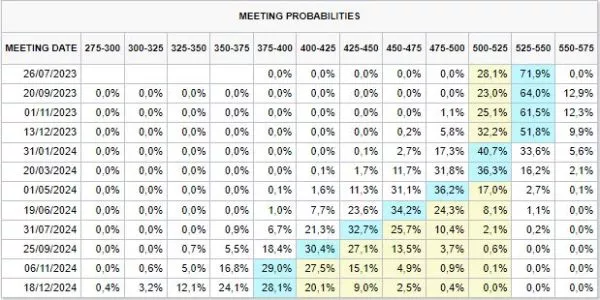

Table from the CME FED WATCH TOOL showing the likelihood of action by the FED at its next monetary policy meetings

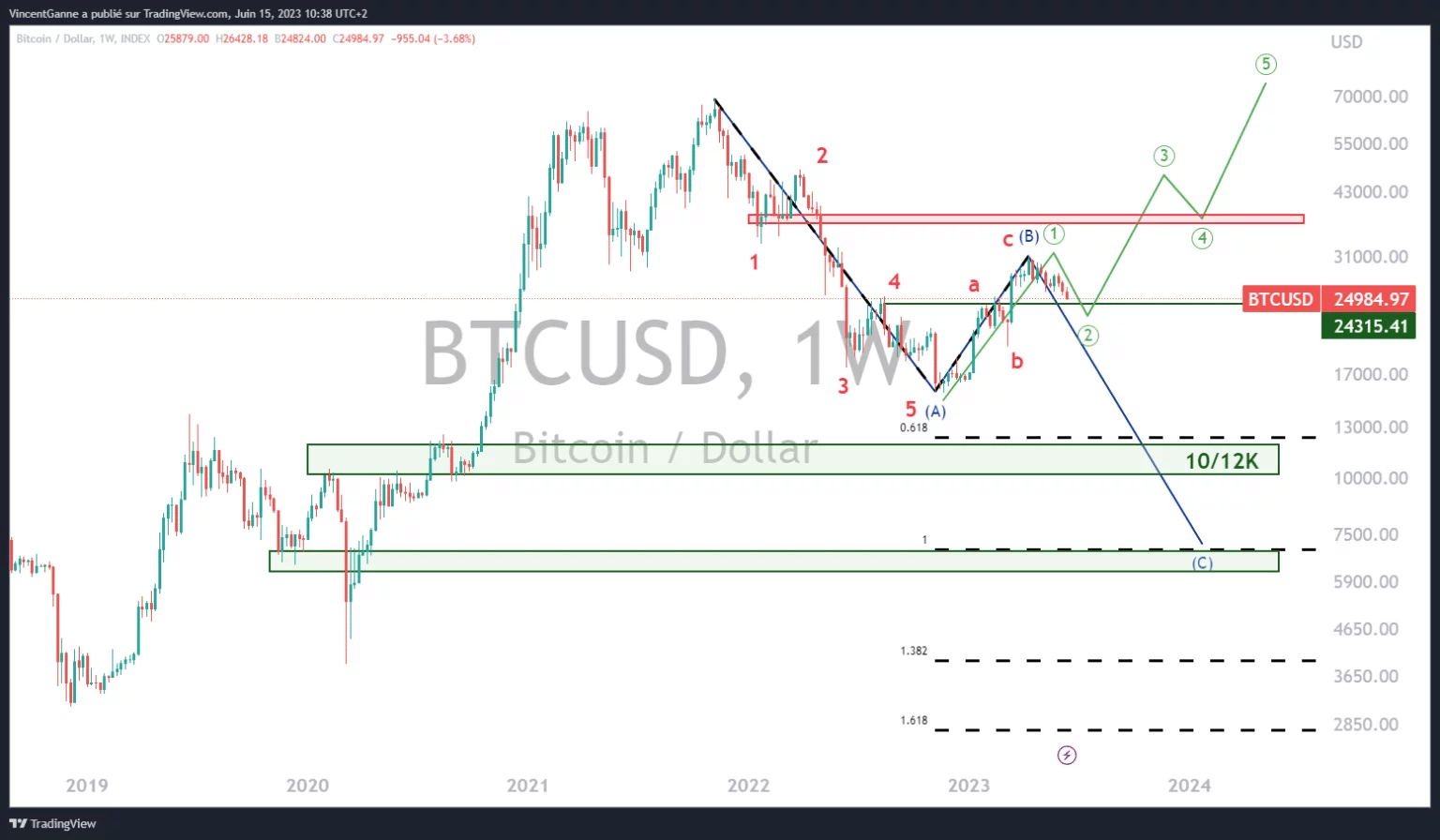

Bitcoin is in contact with the medium term chart pivot

The bitcoin price therefore currently has (almost) no allies to defend a decisive technical support zone, the one we discuss here every week and which constitutes the graphical border between two worlds

- The first world is that of the annual uptrend, which has seen the market rebound from $15,000 to $31,000 and which could be the first stage of the new bull market.

- The second world, on the other hand, interprets this rebound as an intermediate stage in the great bear market that began in November 2021 at $70,000 and whose final target is $10,000/12,000.

This chart border is at 24000/25000 dollars, the weekly close this weekend will provide the answer.

Graph produced with the TradingView website and which juxtaposes the weekly Japanese candlesticks of the BTC/USD price