An important milestone in this fundamentally-charged week has just passed: the US Federal Reserve’s monetary policy decision. Despite raising its rate to 5.50%, the Fed proved to be more accommodating than anticipated in its press release and press conference. What impact will this have on the bitcoin price?

The U.S. Federal Reserve (FED) is less aggressive than expected

This last week of July is the busiest of the summer in terms of stock market fundamentals, and on Wednesday evening we learned of the most important piece of data: the new monetary policy decision by the US Federal Reserve (FED).

As expected by the market consensus, the FED raised its key rate from 5.25% to 5.50% and, notably through its press release, used language, tone and certain words that seemed to take on a more accommodating tone than expected. Let’s take a look :

- First of all, the FED reiterated that it was “data-dependent”, monitoring US inflation and labor market figures, so far no surprises ;

- But above all, it insisted on the notion of “lag”, i.e. the time needed for the new credit cost conditions to produce a truly constraining effect on inflation (the target remains 2% annualized);

- Clearly, the FED may have suggested that its terminal rate has been reached at 5.50%, but that this 5.50% rate could remain in place for several months.

For the market, the only thing that matters is to avoid a terminal rate at 6% that would put maximum downward pressure on the equity and bond markets, a rate that bitcoin wouldn’t resist either.

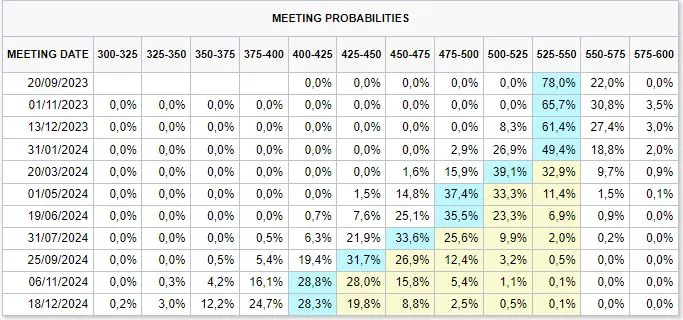

On the other hand, let’s be quite clear: there is, at this stage, no certainty that the FED has reached its terminal rate of 5.50%. Market expectations are merely a game of probability, and according to the price of futures contracts traded on the Chicago Stock Exchange on the FED funds interest rate, there is still a 25% chance that the terminal rate will exceed 5.50%.

What happens next will therefore depend, as Jerome Powell (FED boss) repeats, on macro-economic data from the US economy, especially employment and the price regime.

A chart from the Chicago Stock Exchange’s (CME) CME Fed Watch Tool that reveals the implied probabilities of Federal Reserve action in the coming months.

Resistance at $31,800 is the bear market’s last chance

In terms of technical analysis of the bitcoin price, the market continues to play with traders’ nerves and patience, still failing to make a technical choice that is clear in terms of trend.

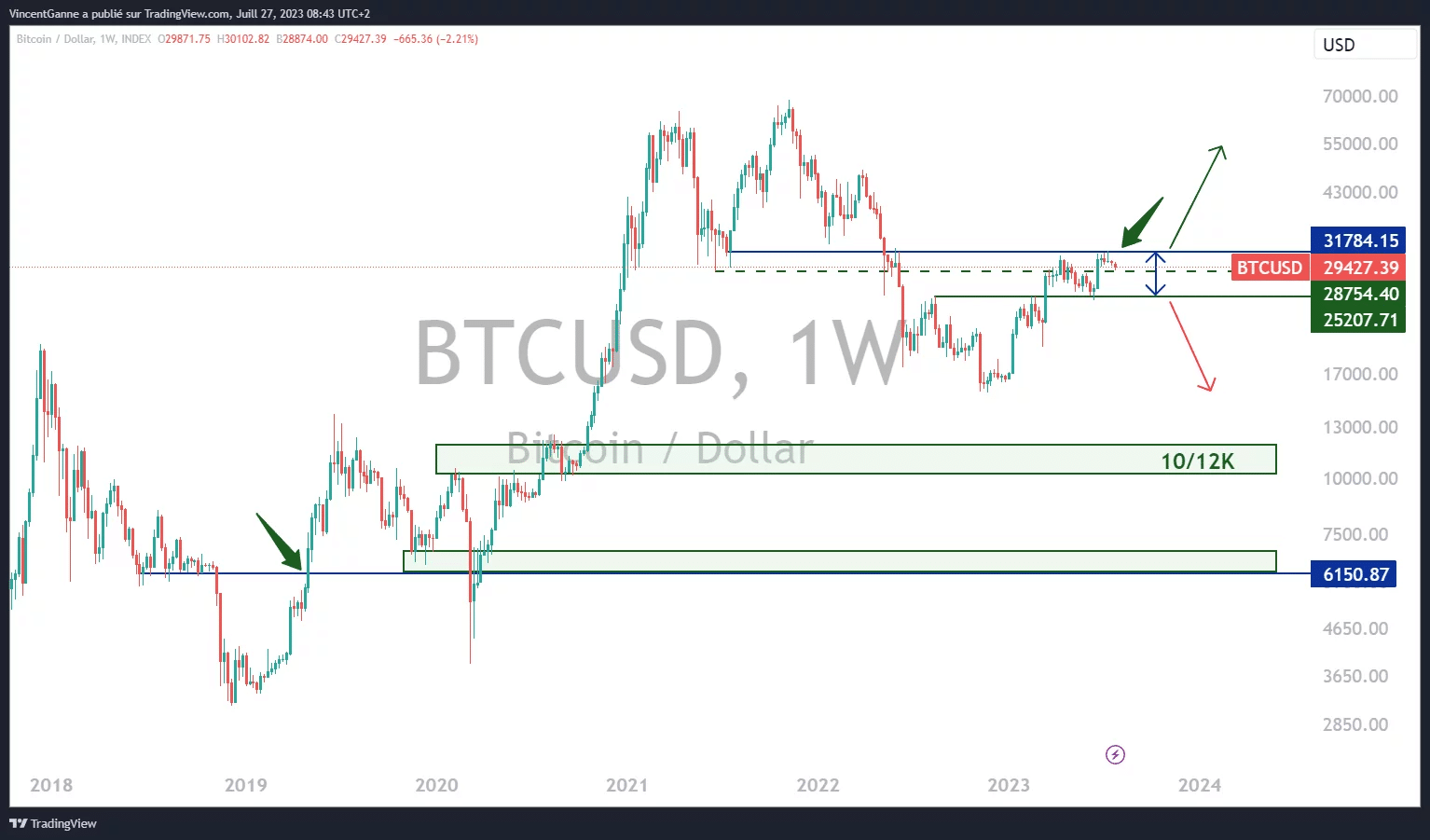

For the bullish camp, I’ve constructed a chart below that reminds us that, historically, it’s necessary to break through a chartist pivot to put an end to the previous bear market and move into bull run mode. Let’s not be too hasty in talking about the next bull run, as I believe it’s the halving in spring 2024 that will give us the starting gun.

On the other hand, ahead of the bull run, we need to break this chartist pivot, and the pivot of our time is at $31,800, and we’d need to break above it with a firm weekly close to make the V of victory. So be patient, as the sideways phase between $25,000 and $31,800 could still last a while, before the bullish signal is given.

Chart created with the TradingView website, displaying weekly candlestick bitcoin prices