Miners have suffered greatly during the last few months of the bear market, especially between November and December. As the BTC market environment moves towards a bullish bias, how are miners doing? And how are they behaving? On-chain analysis of the situation

Bitcoin retreats from $30,000

For nearly a month, the price of Bitcoin (BTC) has been struggling to break through the $30,000 pivot from above. Last week, the market led an attempt to break above this resistance, which remains unsuccessful for the moment.

Having demonstrated that the transition phase between the end of the bear market and the beginning of the next bull market is not quite complete, it seems that the BTC price needs more time to prepare for an outright break of $30,000.

While we wait to see how the market reacts, today we’ll take a look at the mining cohort. This group of participants, with a distinct psychology, suffered greatly during the final months of the bear market between November and December.

As the BTC market environment improves and moves towards a bullish bias: How are miners doing? How are miners behaving as we enter 2023?

Figure 1: BTC daily price

Measuring the profitability of the mining sector

To answer these questions, we will first attempt to estimate the average production cost of 1 BTC in order to assess the current profitability of the Bitcoin mining industry.

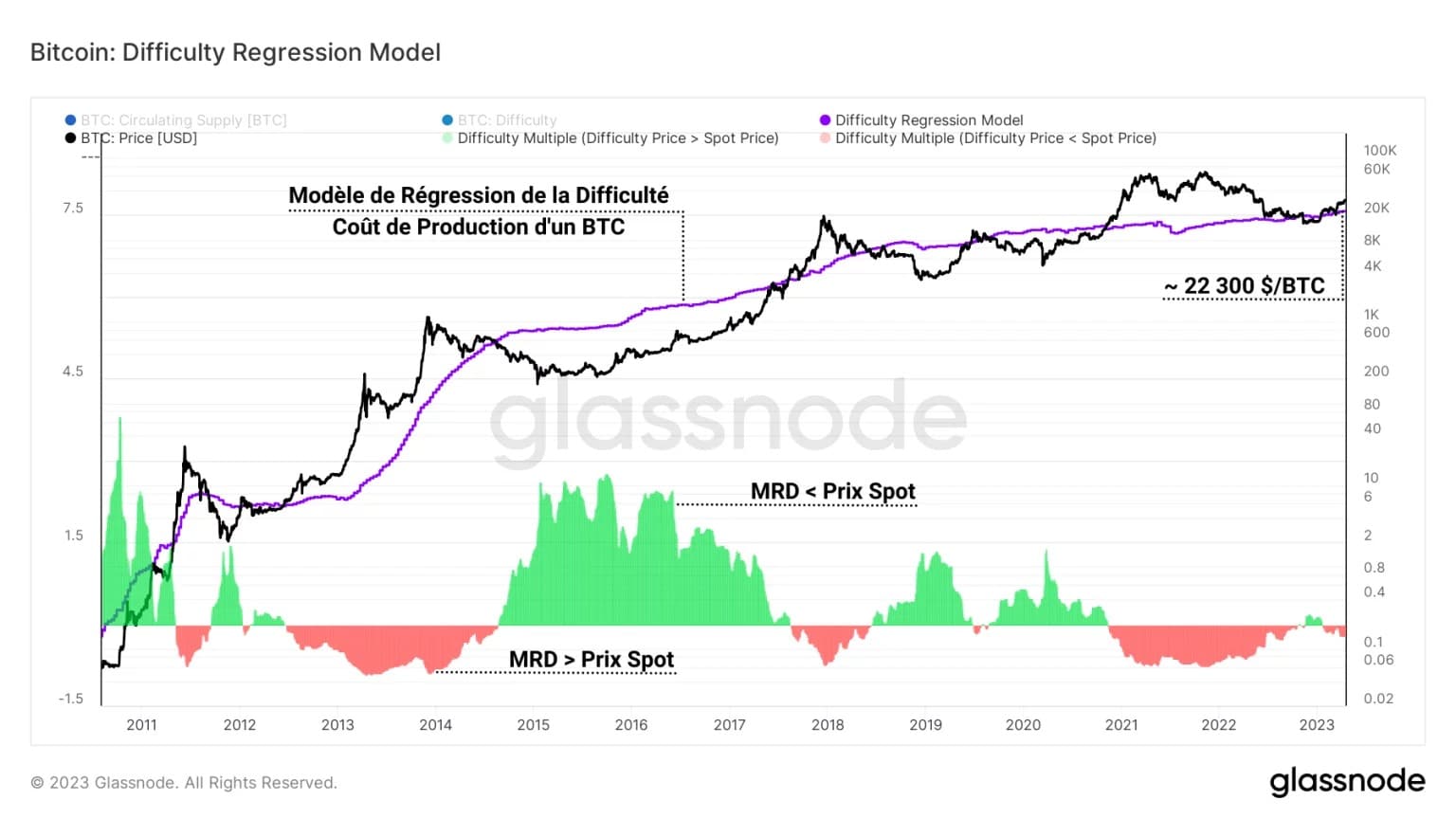

The difficulty regression model (DRM) is used to estimate this production cost by considering the difficulty as a representation of the “entry price” charged to miners to participate in the competition.

A log-log regression between market cap and difficulty (entry price) relates the market value of the BTC mined to the competition within the mining sector.

According to Glassnode, the price derived from this model reflects an average cost of production for the entire mining industry, without the need for an in-depth study of all the parameters involved.

This “all-in cost of production” of 1 BTC is now estimated to be close to $22,300, which at first glance indicates that mining seems to be a profitable business. Let’s take it a step further and see what’s going on.

Figure 2: Difficulty Regression Model

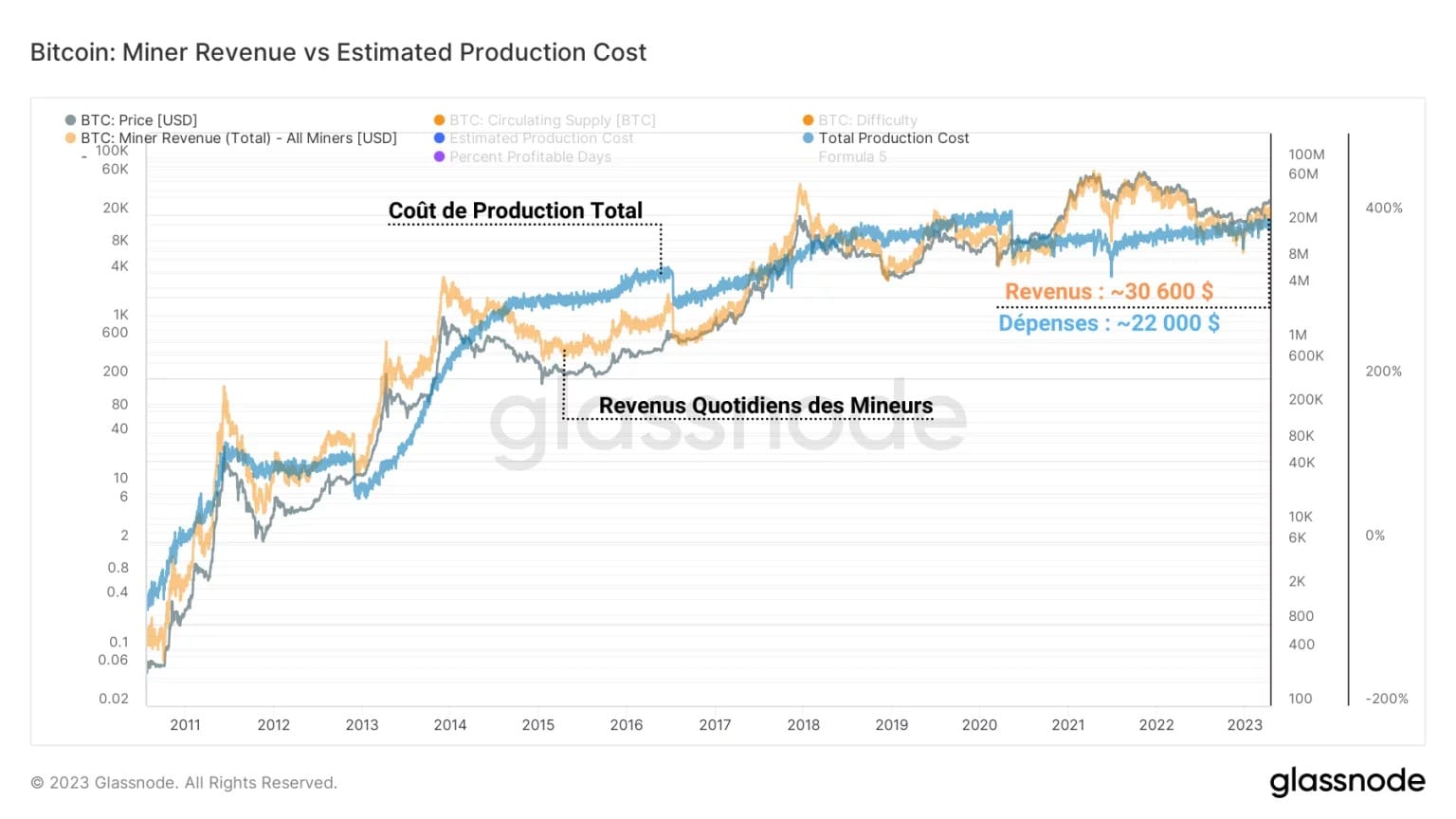

Multiplying the result of the difficulty regression model by the supply of BTC in circulation gives an approximation of the total production cost for all existing BTC.

As a result, it is possible to calculate the estimated total expenditure for the entire mining industry. The following graph represents:

- In blue, the total production cost, which is an estimate of the value spent to produce the BTC mined each day. It is currently about $22,000 per day;

- In orange, the total revenue of miners, which is a measure of the spot value of each BTC at the time of extraction. It now stands at nearly $30,600 per day.

Thus, it appears that miners’ revenues are indeed higher than their expenses, which places this group of participants in a context of positive profitability.

Caution: This model is based on the assumption that operational expenses (OPEX) and capital expenses (CAPEX) are fully included and reflected in the difficulty adjustment. Other estimates of the cost of producing miners exist and offer different results depending on the assumptions made.

Figure 3: Total Production Cost and Daily Income of Miners

What position do miners take?

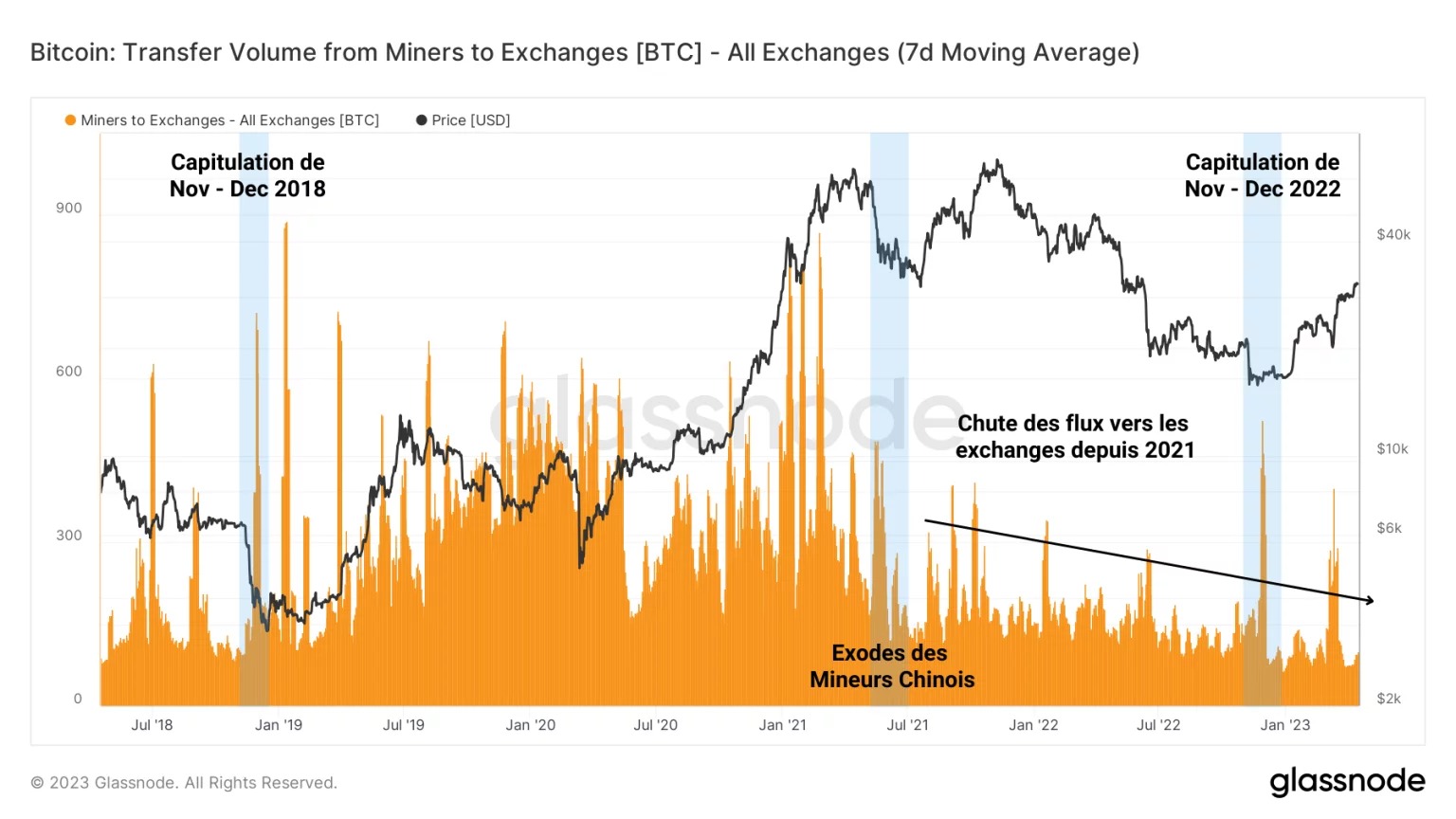

By observing the outflow of reserves from miners to exchanges, we can obtain a proxy of the profit/loss behaviour of these entities.

Moreover, by taking the markers of notable hashrate drops (in blue), we can highlight periods of significant spending by miners, correlated with a bear market context.

Thus, we can determine that, during capitulations, miners tend to send large volumes (500 BTC – 600 BTC per day) to the exchanges, probably to access the capital necessary for their financial survival.

Furthermore, it appears that since 2021, the incoming flows to the exchanges have tended to fall, indicating a form of increased HODLing on the part of these entities.

Figure 4: BTC flows from Miners to Exchanges

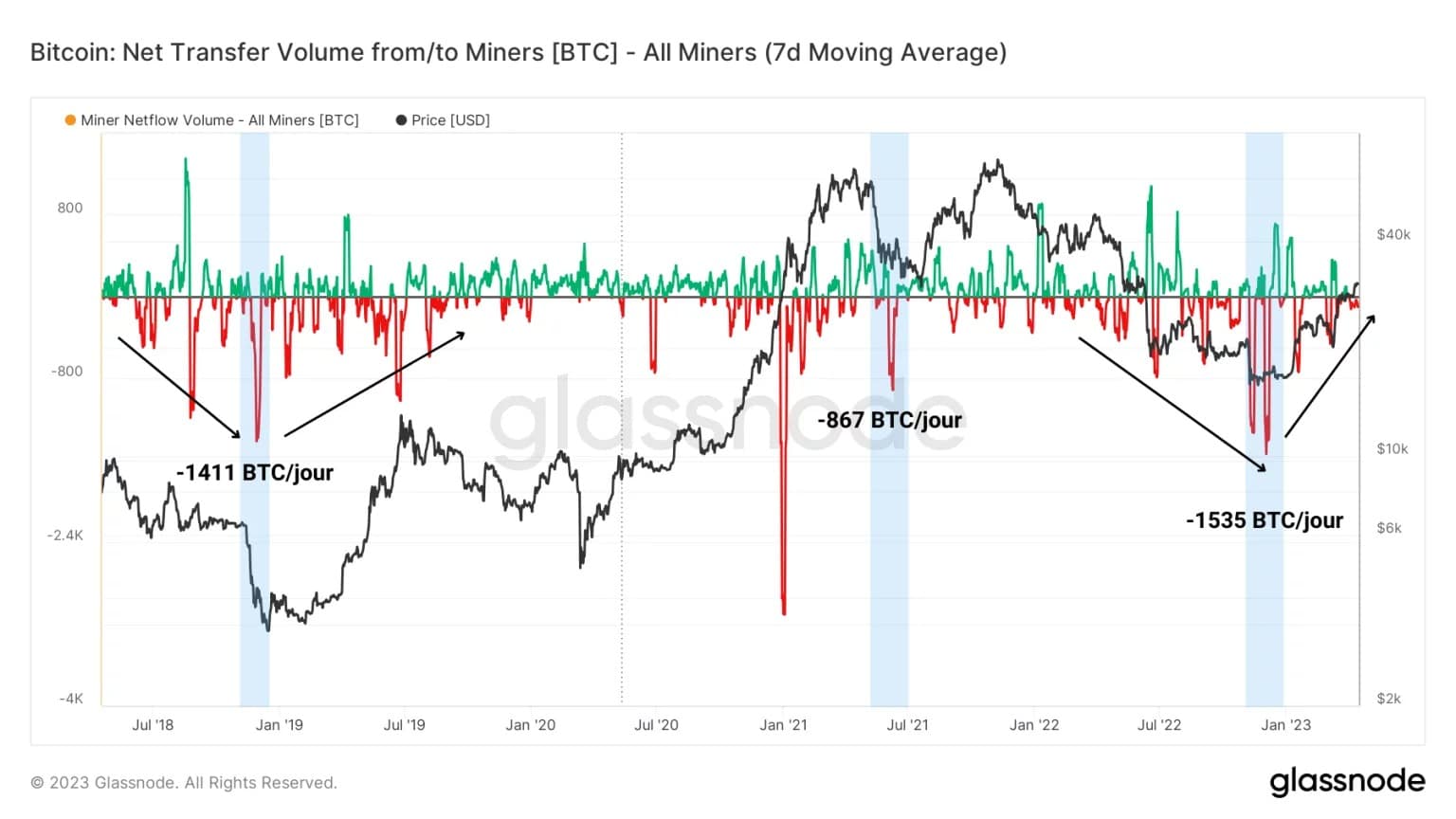

This observation is corroborated by the study of the net flows (inflows + outflows) of miners to/from the exchanges.

Here we notice that the capitulations of November 2018 and November 2022 recorded net deposits on the exchanges of between 1400 and 1500 BTC per day.

We can also note that the dynamics of net deposits (in this context: loss taking/liquidations of BTC) tend to increase during the final phases of bear markets, before resorbing following the passage of the cyclical low.

Currently, the 7-day net flows show values close to 0, meaning that miners are taking a rather neutral position.

Although the average miner’s operations are profitable again, we are not witnessing significant inflows to the exchanges.

And for good reason: miners looking to take profits know that it is still too early. They will patiently wait for the bull run to take hold and for prices to rise before selling their precious BTC.

Figure 5: Miners’ Net BTC Flows to/from Exchanges

Summary of this on-chain analysis of BTC

This week’s data suggests that miners have recovered rapidly in early 2023, now favouring saving over spending.

Indeed, with a production cost per BTC of around $22,300, mining activity is once again profitable, following a period of capitulation between November and December 2022.

Despite this context of profitability and the resulting competition, miners’ flows signal a relatively neutral behaviour, with decreasing outflows.

Preferring to wait before taking massive profits, miners seem to adopt a bullish regime behaviour. The latter is characterised by reduced spending until the price of BTC is high enough to encourage them to sell.

*** Translated with www.DeepL.com/Translator (free version) ***