One year after its launch, what has become of EUROC, Circle’s euro-backed stablecoin? To find out, we interviewed several members of the company, which also issues the second most capitalised US dollar-backed stablecoin on the market. What blockchains will EUROC be based on, and what are the possibilities for its development in the light of European regulations? Find out all the answers from Circle

What is Circle’s EUROC?

Launched nearly a year ago, what’s become of EUROC, Circle’s stablecoin backed by the euro? At the time of writing, its market capitalisation is in excess of $48 million, well below that of USDC, its big brother backed by the US dollar, which is worth over $29 billion.

More generally, however, dollar-backed stablecoins are outperforming the market compared with those backed by the euro. Tether, Circle’s main competitor, dominates both markets with its USDT (dollar) and EURT (euro). However, Circle’s EUROC is much younger and is already proving promising, as demonstrated by its recent arrival on the Avalanche (AVAX) blockchain, symbolising its multi-chain future.

As announced in its press release for launch in June 2022, Circle’s EUROC aims to foster the frictionless exchange of value within European markets. As with the USDC, the EUROC is backed at a 1:1 ratio with euros placed in reserves managed by Circle in regulated banking institutions in the United States. Circle’s teams have also told us that they plan to move EUROC’s reserves to Europe in the near future.

At the time, Jeremy Allaire, Circle’s CEO, reported significant investor demand for a stablecoin backed by the euro:

Circle has set leading standards for the circulation of financial value on the Internet with USDC. There is clear market demand for a digital currency denominated in euros, the second most traded currency in the world after the US dollar. With USDC and Euro Coin, Circle is helping to usher in a new era of fast, low-cost, secure and interoperable value exchange worldwide. “

One year after its creation, how is Circle’s EUROC doing?

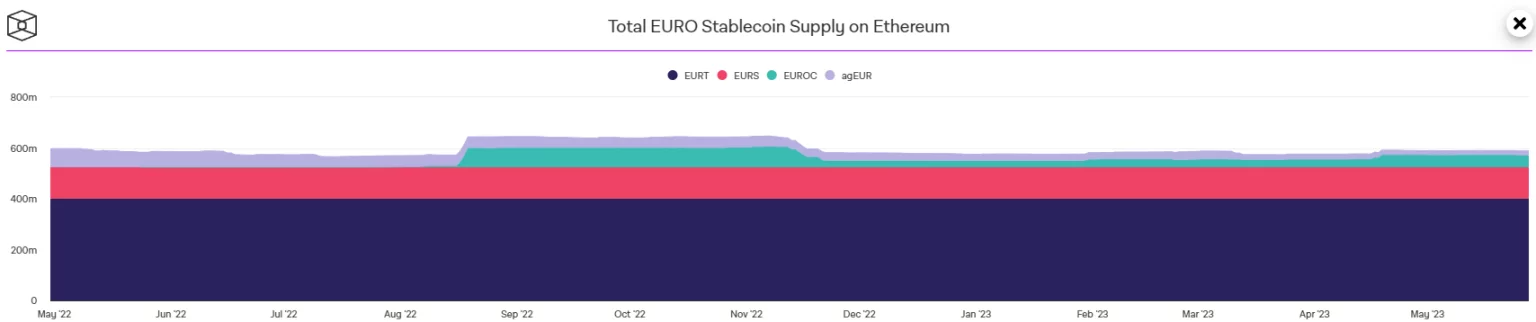

As we can see from the chart below, Tether dominates the euro stablecoin market with its EURT (purple), but it should be noted that this was created in 2016 and is therefore much older and therefore mechanically more democratised among investors. EUROC’s second competitor remains the EURS issued by Statis, which at the time of writing has a market capitalisation of over $130 million.

Evolution of the 4 main euro stablecoins on Ethereum (ETH): EURT (purple), EURS (red), EUROC (green) and agEUR (grey)

So, overall, we can see that euro stablecoins represent a very small part of the stablecoin market, hovering around $500-600 million in market capitalisation. By way of comparison, if all euro stablecoins were to represent a single stablecoin, it would not even make it into the top 10 US dollar-backed stablecoins in terms of market capitalisation.

Furthermore, we can see that euro stablecoins are almost always issued by non-European entities, such as Tether and Circle. Some 100% European solutions do exist, however, such as the decentralised stablecoin agEUR issued by the French company Angle, but its market capitalisation remains marginal at less than $20 million.

As Hugo Bordet of the Association pour le développement des actifs numériques (Adan) explained to us, issuers of centralised euro stablecoins face major regulatory constraints from the European Central Bank (ECB) and MiCA regulations, which is not the case for players on the other side of the Atlantic.

This raises a number of questions: what role has EUROC played in the euro stablecoin market, what can we expect from it over the next few years, what is Circle’s relationship with MiCA, and how does the company plan to extend its reach to new blockchains?

Our questions to Circle about the development of the EUROC

To answer all these questions and get a clearer picture, we directly interviewed several people at Circle.

Do you intend to extend EUROC to other blockchains?

We are constantly in contact with developers who are building innovative applications in multiple blockchain ecosystems. We have introduced the USDC on several blockchains to enable these applications, and therefore their end users, to benefit from the power of an open infrastructure for the digital dollar. We have seen the same demand for EUROC. Whether it’s cross-border transfers, regional payments and settlements, or currency risk exposure and hedging, developers across multiple ecosystems are demanding access to the Digital Euro infrastructure, and we look forward to continuing to extend EUROC to other blockchains in the future.” Joao Reginatto VP, Product Management for Circle

Almost a year has passed since the launch of EUROC, are you satisfied with the market capitalisation, the volume and the implementation of EUROC (exchanges, DeFi protocol…)?

We launched EUROC less than a year ago, and since then we’ve seen a steady increase in interest and adoption. The use cases for non-dollar stablecoins like EUROC are more embryonic, but also more specific. In recent months, we have seen the introduction of EUROC on major platforms such as Coinbase and Mercado Bitcoin in Brazil, despite a period of turbulence in the crypto markets. We are very optimistic about the combined potential that open digital currency platforms such as EUROC and USDC offer developers, enabling them to reimagine international financial services in a more efficient and accessible way.” Joao Reginatto VP, Product Management for Circle

Are you in discussion with the European authorities about MiCA and stablecoin regulation?

“We have filed applications in France to become both an authorised electronic money institution (application for authorisation as an electronic money institution) and a registered digital asset service provider (DASP) (application for registration as a Digital Asset Service Provider).” Teana Baker-Taylor VP, Policy and Regulatory Strategy, EU/UK for Circle

Last March, Jean-Noël Barrot, the French Minister for the Digital Transition and Telecommunications, welcomed Circle’s decision to make France its European headquarters. As EUROC was partly designed for professionals and businesses, Circle’s move to France will enable it to fully develop its business and products, including this stablecoin:

“.

“France’s overall efforts towards innovation-led cryptocurrency regulation closely align with our vision for the future of the digital payments industry, which made establishing our European regulatory centre in the country an obvious choice. The approvals granted under this regime would allow Circle to on-shore EUROC, our euro-backed payment stablecoin, and begin the process that will enable it to become a Markets in Crypto-Assets (MiCA) compliant e-money token.” Teana Baker-Taylor VP, Policy and Regulatory Strategy, EU/UK for Circle

We often hear European investors complaining about the market dominance of euro stablecoins by players located on the other side of the Atlantic, which implies that their reserves are also located in the United States. As we have seen, this is also the case with EUROC. Circle has confirmed to us that following its move to France, it plans to host its EUROC reserves in Europe.

Finally, with regard to the reserves in question, Circle publishes monthly audits of these reserves, which are available on its website. At the time of writing, 48.1 million euros of EUROC are in circulation, and Circle holds more than 48.7 million euros in its EUROC reserves.