While the bitcoin price is still retracing from the $30,000 technical resistance, the market is facing immediate monetary uncertainty with the US debt ceiling deadline now just around the corner (June 1) and the US Federal Reserve expected to raise rates one last time this summer.

The challenge of the US debt ceiling

There are now just a few days left for the Republican and Democratic parties to agree to raise the ceiling on the US public debt. After Janet Yellen, the US Secretary of the Treasury and former head of the US Federal Reserve, the ratings agency Fitch has issued a reminder that from Thursday 1 June, the United States will no longer be able to meet certain interest payments if the public debt ceiling is not raised.

Fitch has even placed the USA’s triple-A rating on negative watch to put pressure on both sides to reach a bipartisan agreement.

So much time has passed that the US federal government’s financing needs will be substantial and immediate as soon as the bill to raise the ceiling is passed, with an estimate of several hundred billion dollars that would drain the bond market for the federal government’s needs and thus withdraw liquidity from the financial markets.

This point is all the more important to emphasise given that there is a very positive correlation between the price of risky assets on the stock market (the equity market and the crypto market) and the general level of net liquidity in the United States.

Whatever happens on the political front over the next few days, this is a reminder that bitcoin is not and will not be impervious to this current fundamental issue of raising the public debt ceiling in the US.

Graph produced with the TradingView website showing the evolution of the general amount of net liquidity on the US financial markets, with a correlation between the price of the S&P 500 index and the price of bitcoin

The FED could raise rates again this summer

Adding to the challenge for bitcoin is the FED’s new monetary policy expectations, which have hardened in recent days. Some voting members of the FED’s monetary policy committee, the FOMC, have come out in favour of a final rate hike this summer, raising the terminal rate from 5.25% to 5.50% and postponing the FED’s pivot to late 2023 or early 2024.

This postponement of the FED’s expected pivot is a constraint for the bitcoin price, whose inverse correlation with the US interest rate cycle has been marked since 2020.

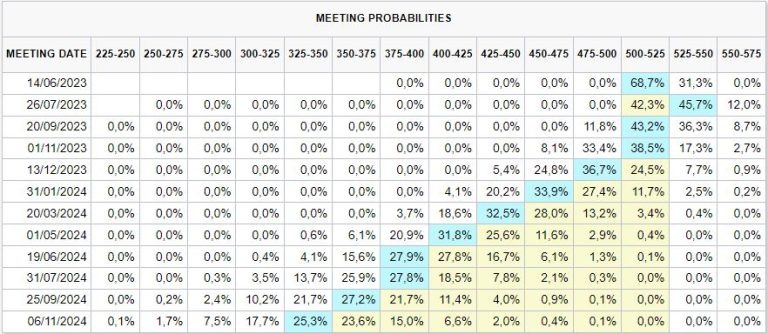

Chart depicting market expectations of the FED interest rate cycle

$25,000 technical zone remains key for bitcoin

In terms of technical analysis of the bitcoin price, the configuration has not changed, with the market retracing from resistance at $30,000, which is the dominant technical factor. This correction sequence will last as long as no resistance is breached on a daily closing basis, and the resistance that has border status is still at $27,500.

The nearest chartist support zone is between $24,000 and $25,000, the former major resistance and the first interval of significant spot and derivative liquidity. This is the technical guarantor of the annual upturn, and bitcoin is “playing” its hand here

Graph produced with the TradingView website showing the price of the bitcoin future contract in daily Japanese candlesticks