While the cryptocurrency market is in the midst of a bear market, the next Bitcoin (BTC) halving is inexorably approaching. Will this event, as usual, be the trigger for the next bull run or has this narrative run out of steam? What elements will signal the end of the bear market? TCN offers its analysis

What is a bear market?

It’s no secret that the cryptocurrency market is going through a bear market period. The technical and fundamental indicators are present: the Bitcoin (BTC) price is at -70% of its historical high and the majority of altcoins are at -90% of their highs, companies in the industry are laying off en masse while others are declaring bankruptcy.

With this in mind, there is only one question left in the minds of investors: when will this bear market end? To find out, TCN has looked at Bitcoin data since 2010 to analyse previous bull and bear cycles.

First, let’s set out what a bear market is. In addition to “a painful period to go through”, this concept has an official definition in traditional finance. An asset is said to be in a bear market when its price has fallen by more than 20% from its recent peak and has been moving below that price level for more than 2 months.

As the cryptocurrency market is particularly volatile, we have decided to modify this definition as follows:

The cryptocurrency market is in a bear market when the price of Bitcoin has fallen by more than 30% from its ATH and has been moving below this price level for more than 2 months.

Conversely, a bear market ends – and a bull run begins – when the price of the asset is up 30% from its recent low and remains above that price for more than 2 months. With this foundation in place, let’s dive into the analysis of Bitcoin’s historical data.

Quantitative analysis of Bitcoin bear markets

Part of the answer to the question “when will this bear market end?” lies in Bitcoin’s past. History is made up of repeating cycles and until proven otherwise, this pattern holds true. So we looked at Bitcoin’s price data from 2010 – when it was worth a fraction of a dollar – to the present.

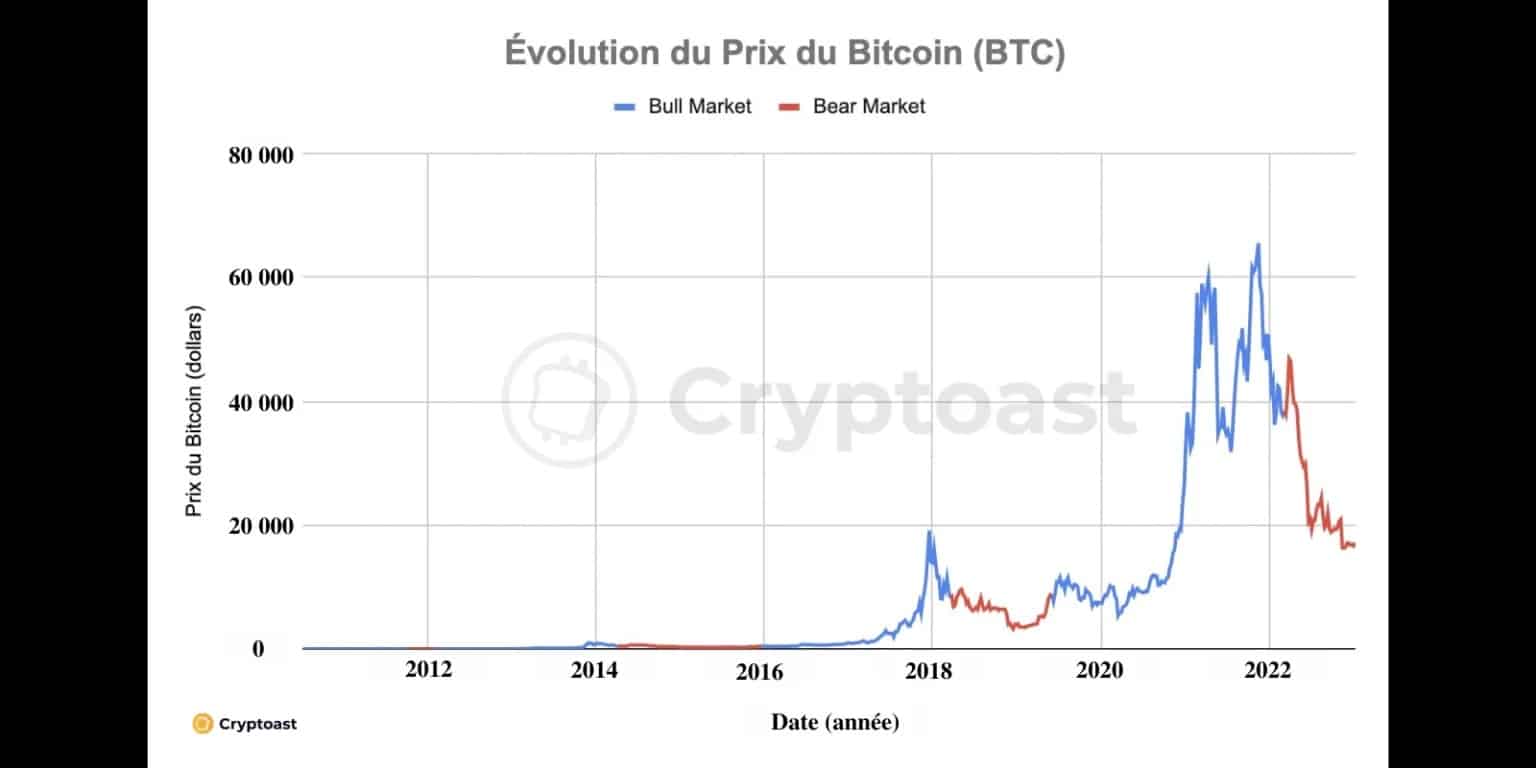

According to the definition set out earlier in this report, the bear market we are currently experiencing started on 7 March 2022 and has therefore lasted for approximately 315 days. The share price has fallen by about 55% from $38,000 to $17,000 at the time of writing.

By the same calculation, the bear markets of 2014 and 2018 lasted 630 and 448 days respectively. Thus, the statistics tell us that the current bear market is well underway, but we still have room to run from the record longevity of 2014.

Figure 1: Linear evolution of Bitcoin (BTC) price with mention of Bear Market and Bull Market periods

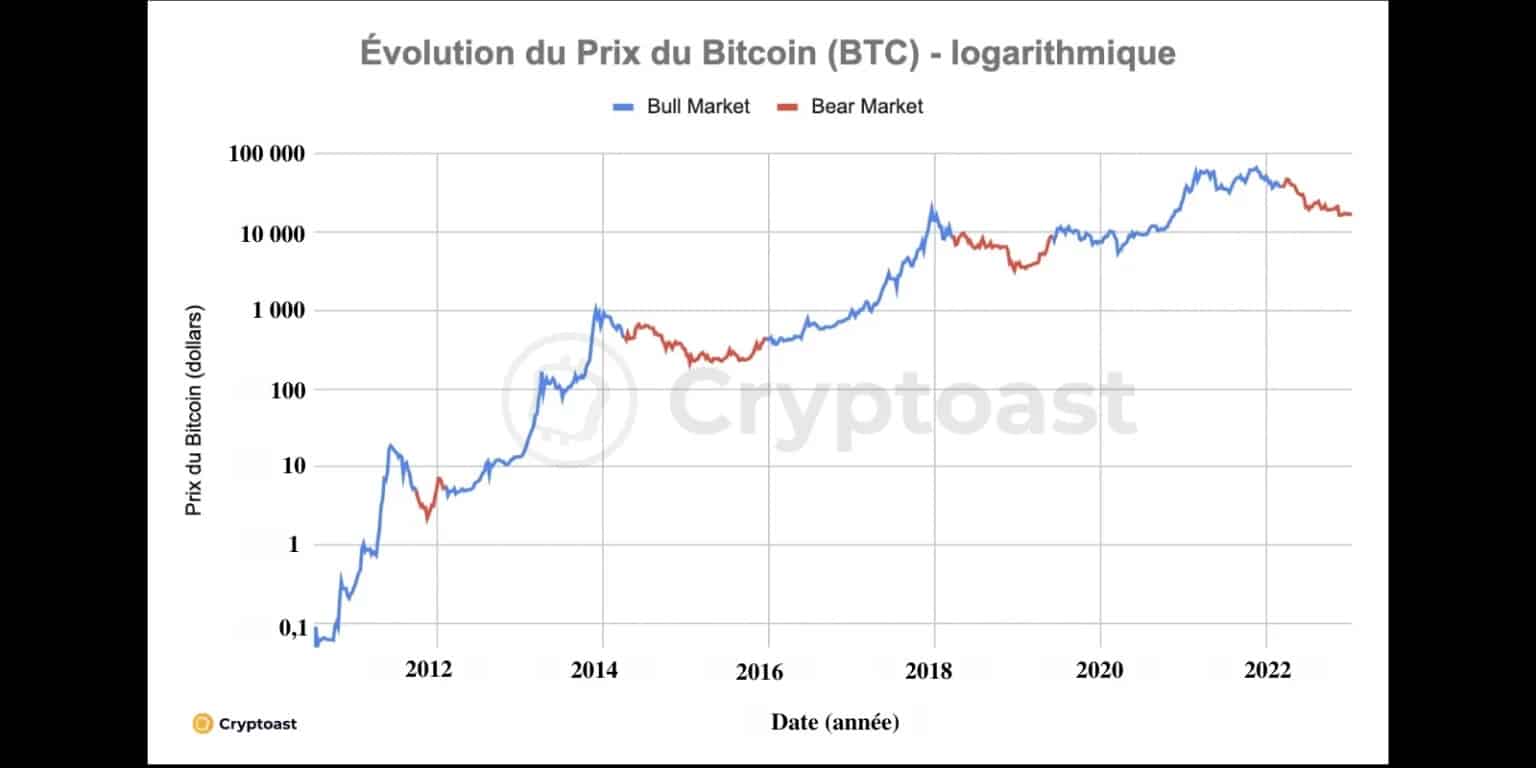

Figure 2: Logarithmic evolution of the Bitcoin (BTC) price with mention of Bear Market and Bull Market periods

Moreover, we realize that the bottom of Bitcoin is found after 287 days in 2014 and 322 days in 2018. So, being currently at day 315 of our bear market, we may be approaching the low point – or it may even be behind us.

On average, the previous three bear markets ended 287 days before Bitcoin halved. Currently, we estimate that the next event will occur on March 17, 2024, or 430 days from now. Thus, these statistics lead us to an end of the bear market around May 25, 2023.

As a reminder, the definition implies that a bear market ends when Bitcoin has risen more than 30% from its recent low and holds that price level for more than two months. In the current situation, this would be equivalent to settling permanently above $20,000.

Is halving still important?

Statistical data is interesting, but it’s worthless if not put into perspective. According to them, the inevitable approach of the 2024 halving would allow us to consider a bull market return by May 2023. But is the halving phenomenon as important as in the past? Or has this narrative run out of steam?

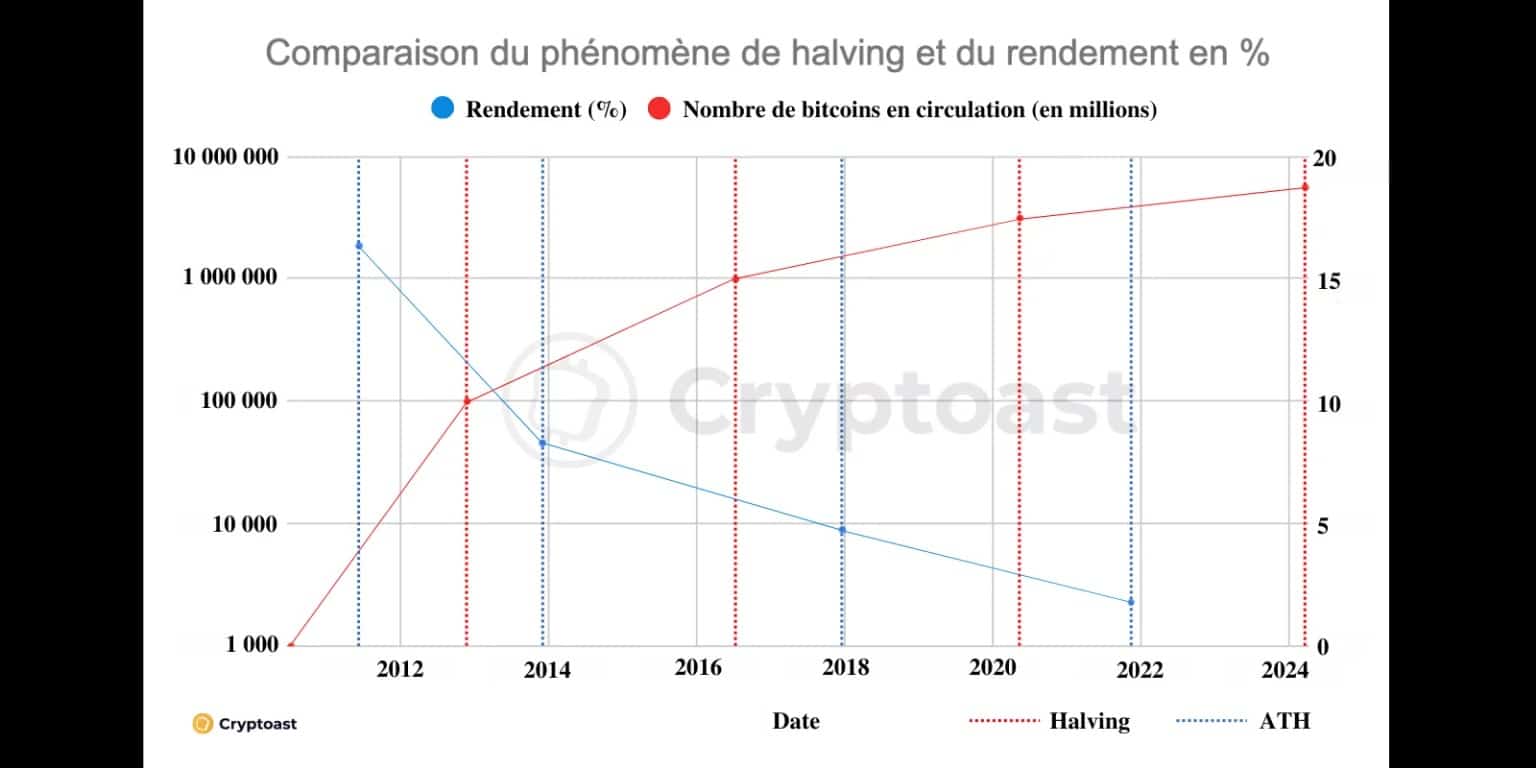

It is true that systematically, halving allows the amount of bitcoins mined per block to be divided by 2. However, the impact of this event tends to diminish over time, as the amount of bitcoins in circulation increases. As the following graph shows, the impact of halving is logically correlated to the yield of bullruns:

Figure 3: Correlation between halving/quantity of bitcoins produced and bullrunning returns

Concretely, let’s go back to 2012 when the first halving took place. The amount of bitcoins in circulation was 10,500,000 and the halving reduced production to 5.25 million bitcoins over the next 4 years (or more accurately the next 210,000 blocks). This corresponds to a 50% reduction compared to the quantity then in circulation.

If we look at the last halving, in May 2020, it therefore reduced production to 1.312 million bitcoins over the following 4 years. However, this was still only 7.1% of the total amount of bitcoins in circulation, then 18.375 million BTC.

What about the next halving? It will decrease the production of bitcoins to 656,250 over the next 4 years, or only 3.3% of the total amount already distributed. Obviously, this change will have a much smaller impact on the scarcity of bitcoin and the same goes for the power of the narrative.

A bear market unlike any other

A new macroeconomic context for Bitcoin

Will this bear market follow the pattern of the previous ones, roughly in line with the statistics? We don’t have a crystal ball, but the answer tends to be no. The first reason is that the halving narrative as a bull market trigger has run out of steam. The second is the general macroeconomic context.

For the first time in its history, Bitcoin is facing a global economic crisis, which is turning into a general recession. In the hope of countering the galloping rise in consumer price indices around the world, central banks are raising their key rates.

For a long time, these rates were zero – or even negative – which had the effect of encouraging commercial banks to borrow and create artificial money. For years, and particularly following the Covid-19 crisis, this liquidity poured into the financial markets and into crypto-currencies.

However, this system has now broken down and the magic spigot has ended. Liquidity is fleeing the risk markets until the situation is resolved. In summary, it is difficult to see a bullish recovery in cryptocurrencies until the following tangible things happen:

- The US Federal Reserve halts its key rate hike;

- consumer price indices/inflation figures start to fall again;

- moderate monetary stimulus is being revived.

Bitcoin in better shape than previous bear market

However, there are positive points that reassure us in our belief of a bullish recovery in the cryptocurrency market by 2025. Indeed, despite the above-mentioned context, Bitcoin currently seems to be in a better position than it was in the previous bear market.

First of all, the big market drop has cleaned up any excess leverage. This is especially true with all the lending platforms and hedge funds that have gone bankrupt this year. The market has been cleaned of their huge risky positions, which have been liquidated to meet their repayment needs.

Also, unlike 2018, mainstream companies that got into cryptos are not abandoning their projects and seem to have grasped the promising future of this industry. At worst, they are putting them on pause, at best, they are continuing to build while waiting for a possible bullish recovery.

Finally, the market is no longer as dependent on Bitcoin as it once was. Its dominance is diminishing in favour of Ether (ETH), the second largest crypto in the market. What if the future of the market could also be dictated by Ethereum? After a successful – albeit controversial – move to Proof Of Stake (PoS), Ethereum could attract more and more institutional investors, especially for environmental reasons.

Conclusion: bear market vs bull run

In conclusion, if a bear market is defined as a period where Bitcoin is trading at 30% below its ATH for more than two consecutive months, then we’ve been there for about 315 days. The question now is when will this bear market end.

The reciprocal of this definition implies that in order to resume a bull run, Bitcoin would have to climb more than 30% from its recent low and hold that price level for more than two months. In the current situation, this means sustainably exceeding $20,000.

By transposing the historical data of previous bear markets to the current one, we estimate an end of the bear market around 25 May 2023. These statistics are based on a model where the halving of Bitcoin still has such a strong importance on the market. But is this really the case?

In our view, the power of halving fades with each cycle (see Figure 3) and it is not clear that its impact will be truly significant in 2024. In other words, we are certainly experiencing a bear market different from previous ones.

This feeling is reinforced by the complicated macroeconomic context. The widespread recession is leading to a monetary tightening policy by central banks that is drastically curbing the progress of the financial markets, including the cryptocurrency market.

In conclusion, if we look at the statistics and data, we will have to wait for the FED to lower its key rates, for inflation to decrease and for a resumption of monetary stimulation to be seen before we can envisage the beginning of the next bull run.