Early this week, the third most capitalised stablecoin on the market, namely Terra’s UST, saw its price collapse and lose more than 75% of its value. We explain what actually happened and why it’s a big threat to the cryptocurrency and decentralised finance (DeFi) ecosystem.

UST price collapses by almost 75%

In just a few days, the UST price of the Terra ecosystem (LUNA) has been in a nightmare. The stablecoin broke away from the dollar’s price and initially fell to $0.65, before temporarily recovering and falling back to a low of $0.22, sending the entire cryptocurrency industry into a tailspin.

Figure 1: UST price against the US dollar

It may seem surprising, or even counter-intuitive, but stablecoins can actually detach from the price of the currency they are supposed to be pegged to. At least some of them do. To understand this, one needs to understand the different categories of stablecoins.

Stablecoins such as USDT or USDC are backed by the dollar price by being directly backed by a pool of tangible assets. Conversely, algorithmic stablecoins, such as the UST, rely on an algorithm to maintain their peg to the dollar.

In simple terms, the UST price is maintained through a user-orchestrated arbitrage mechanism. In concrete terms, when the UST price decreases, it is possible to exchange 1 UST for 1 dollar of LUNA to reduce the total supply and increase its value until equilibrium is reached. The phenomenon also applies in the other direction.

However, this strategy carries a major risk. In the event that a lot of USTs are sold in a very short period of time, the volumes would be such that arbitrage would not have time to react and reverse the trend. And this is precisely what happened.

In concrete terms, why did the UST collapse?

UST and LUNA, a downward spiral

In just a few months, UST has managed to climb to the third most capitalized stablecoins on the market. The main reason for this is Anchor, which has so far captured 52% of the total amount in circulation, or $10 billion. And for good reason, the protocol offers an annualised return of 19.5% for UST staking.

As the rewards were paid in UST, new coins were created daily. As explained above, 1 UST mined results in 1 LUNA dollar burned. In other words, a constant upward pressure was imposed on it, which saw its price multiply by 10 within a few months.

As you can see, everything is fine as long as the market remains bullish. But obviously, this system has a counterpart and we have experienced this in recent days. At the end of last week, amidst a tense geopolitical context and following the US Federal Reserve’s announcements, the cryptocurrency market finally gave in.

Like all altcoins, LUNA is following the fall of the king Bitcoin (BTC). In the panic, UST holders exploit the arbitrage mechanism and burn UST to mine the equivalent in LUNA, which they immediately sell to cover themselves. This creates a double bearish pressure on the LUNA price which inevitably drags it down to the abyss.

UST de-indexes, safeties don’t work

We have all the ingredients for an explosive cocktail, ready to ignite at any moment. The trigger came at the weekend. An alleged attack on a liquidity pool on Curve Finance used $350 million of UST to drain liquidity, causing the UST to initially depeg as low as $0.97. However, the arbitrage mechanism failed to work.

However, the arbitrage mechanism jammed and failed to properly restore the UST’s price indexation. This is where the Luna Foundation Guard (LFG) comes in. Charged with ensuring the security of stablecoin, the foundation sold its bitcoin reserves to buy back UST and try to raise the price.

As a reminder, since the beginning of 2022, the LFG has accumulated 2 billion dollars of Bitcoin to build up a security reserve. In particular, it has teamed up with investment funds to buy Bitcoins Over The Counter (OTC) in exchange for LUNA at a discount.

Unfortunately, LFG’s strategy is struggling to restore UST’s price. Faced with a stablecoin capitalised at $20 billion, the $2 billion in reserves was not enough. Moreover, these bitcoins bought for an average of $42,000 had already lost more than 15% of their value by the time they were forced to be sold.

While $2 billion worth of BTC sold may seem paltry in the face of the $600 billion capitalization of the market’s leading cryptocurrency, the impact was enough to introduce panic.

Panic takes over the market

It is a well-known fact that emotions dictate the state of the cryptocurrency market. Faced with suspected attacks on the UST, its depeg from the dollar and the failure of the stablecoin security system, a huge panic began.

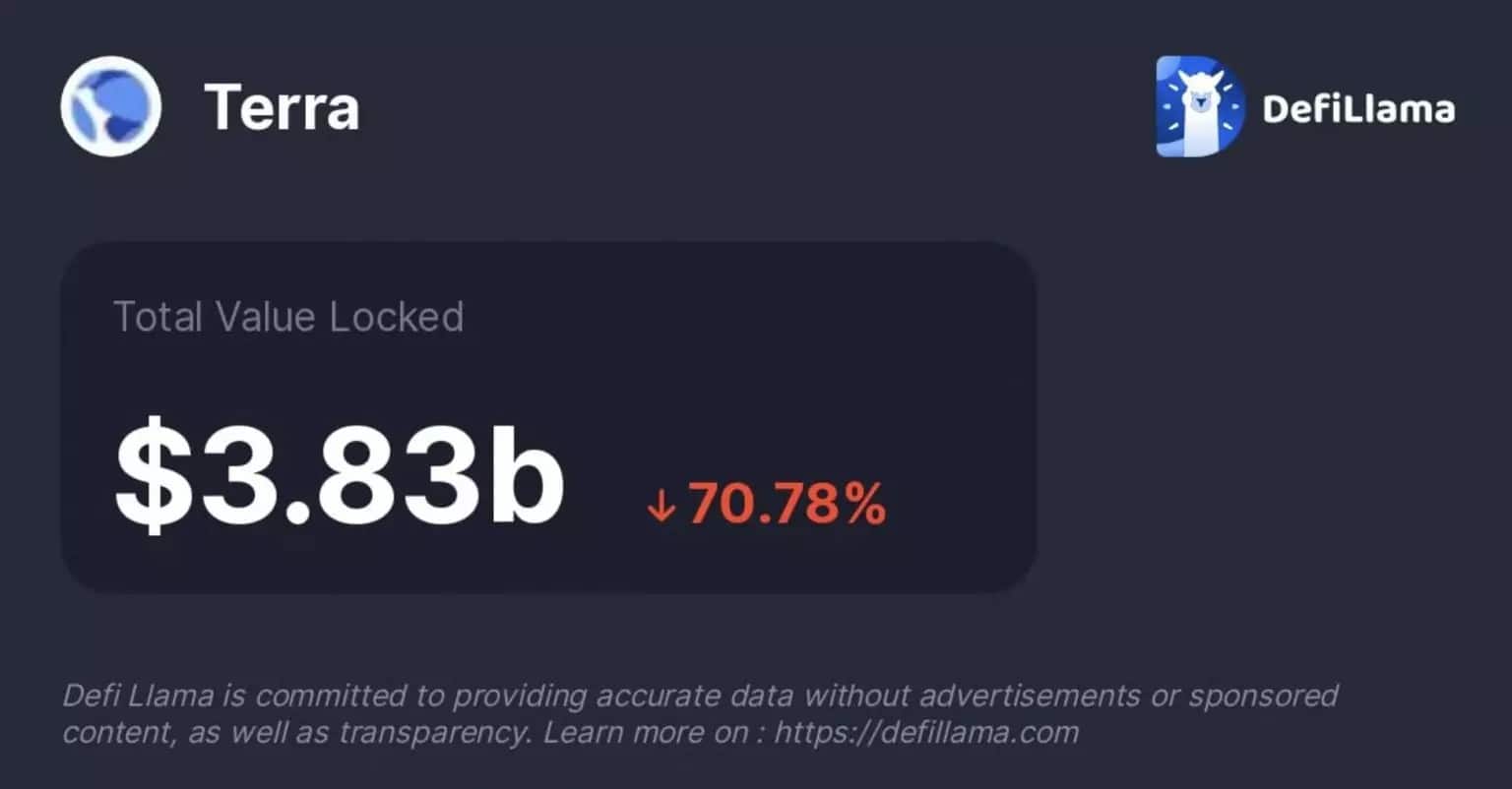

Users are selling their USTs en masse, as evidenced by the total value locked up on the Anchor protocol, which has collapsed by 85% in just one week:

Figure 2: Total Value Locked (TVL) on Anchor

As a result, the UST price continues to fall. The LFG security pool is empty, as are the various Bitcoin wallets owned by the Terra Foundation. There are no longer any security measures to hold stablecoin, trust is totally lost, panic continues to hit the ecosystem.

The order books are empty

On the other hand, the situation on the centralized trading platforms is getting worse. Faced with the panic selling, Binance decides to temporarily block UST withdrawals from its platform, adding fuel to the fire.

However, the exchange was taken over and the order book was completely emptied: no more buy orders and no more possibility to sell USTs.

To understand this, you have to realize that stablecoins don’t work like other cryptocurrencies. If Bitcoin falls, there will still be buy orders placed on the old supports: $28,000, $20,000, and lower. For a stablecoin, there is no such thing. Its price lies between two mountains of order volume around $1.

Once the price of UST dropped below the low end of the buy order volumes, there was nothing to hold the price, since no buy orders were set.

What about the impact on the ecosystem?

The future of LUNA and UST

At this stage, it is virtually impossible to determine to what extent the problems with Terra and its stablecoin UST are a result of the cryptocurrency market’s downturn or to what extent they are the cause.

During the day on 10 May, after hitting an initial low of around $0.6, the UST managed to climb back above $0.93. At the end of the day, Terra’s creator, Do Kwon, reassured the community: “Close to announcing a recovery plan for the UST. Hold on to your hats”

Close to announcing a recovery plan for $UST Hang tight.

– Do Kwon (@stablekwon) May 10, 2022

However, it was later revealed that the Terra Foundation had reached an agreement with various investment funds to raise an additional $1.5 billion to restore the UST peg. In exchange, the sale of LUNA tokens to investors at half price.

The euphoria was short-lived, as the UST price fell sharply back to $0.22. For the moment, there is no indication that it will manage to re-index to the dollar. Furthermore, as long as the UST price remains below the dollar, the LUNA price will continue to fall, due to the burn and mint mechanism mentioned above.

The whole of DeFi impacted

In the space of 24 hours, the Terra blockchain lost 75% of its Total Value Locked (TVL). Leading the way, Anchor went from $18 billion to just $2.3 billion in TVL. Similarly for Mirror Protocol, whose MIR token fell by nearly 60%, causing a huge sell-off among users.

Figure 3: Total Value Locked (TVL) on the Terra blockchain

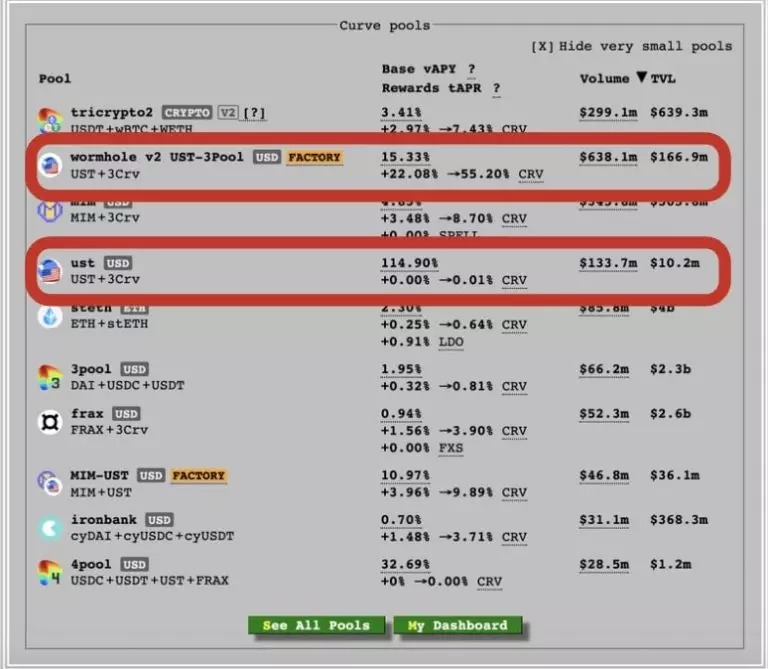

The collapse of the Terra ecosystem and its stablecoin UST is a terrible threat to the entire DeFi. The UST was branched to many other ecosystems, through the “4pool” on Curve Protocol in particular, whose loss of liquidity directly impacted some protocols such as Convex (CVX) or Frax (FXS).

Moreover, on Curve Protocol, the liquidity pools composed of USTs are being emptied. Concerning the USDT-3Pool and USDT + 3Crv wormhole v2 pools, trading volumes are respectively 5 and 10 times larger than the liquidity that composes it.

Figure 4: Different pools on Curve Finance

Moreover, the pools are no longer balanced at all. This shows a capitulation of the users and a total loss of confidence in the ability of UST to recover its peg.

The Terra community is eagerly awaiting news from its leader, Do Kwon. Will UST and LUNA be able to bounce back? What will be the future impacts on the DeFi ecosystem and the cryptocurrency market? Only time will tell.