Error on the part of a “fat finger” or simple wash trading? A user of the OpenSea marketplace spent 100 Ether (ETH), or about $190,000, to acquire a free non-fungible token (NFT). The floor price on the secondary market was 0.04 ETH, 2,500 times lower.

100 ETH for a free NFT

A user of the Blur marketplace just made a terrible mistake. Presumably, he spent 100 ETH to acquire a non-fungible token (NFT) distributed for free by OpenSea. This amounted to $191,000 at the time of the incident.

This NFT was part of the Gemesis collection, commemorating the launch of OpenSea Pro, a marketplace aggregator inaugurated on April 4. Users of GEM (the former name of OpenSea Pro) were able to obtain it for free. The floor price of this collection was 0.04 ETH on the secondary market, or about 76 dollars.

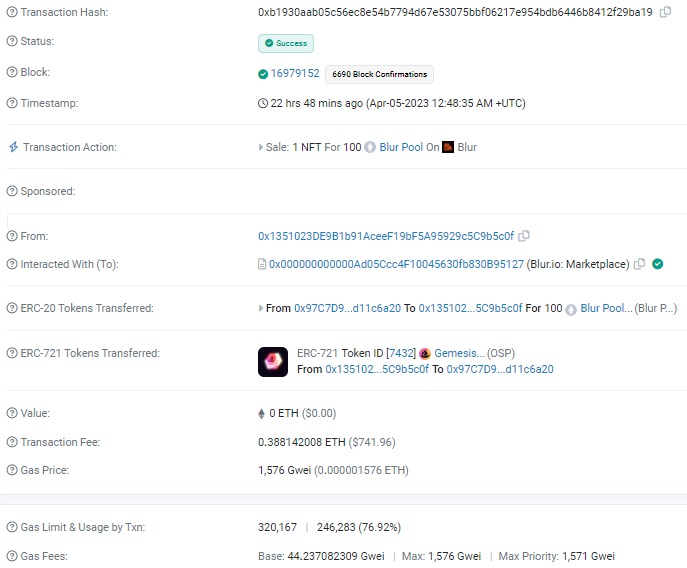

Details of the transaction on Etherscan

As we can see from the transaction details on Etherscan, the user did buy this NFT from the Gemesis collection for a price of 100 ETH. The transaction took place on the Blur marketplace and even cost him 0.38 ETH in fees, or about 740 ETH. A trifle in comparison with this error, if it is one.

Fat finger or wash trading?

If the error seems too big to be true, it has also alerted other users. Nevertheless, while some people mention wash trading, others confirm the track of a user error. This is what is commonly known as a fat finger, since he made a mistake when carrying out his transaction.

As a reminder, wash trading is a common practice in the world of finance, cryptocurrencies but also NFTs. It is a maneuver by which a user will put on sale an NFT at a very high price and buy it back himself in the process. It is a practice used for various purposes, but in the majority of cases, it allows to inflate the volume of transactions of the collection.

Nevertheless, this practice is risky. In our case, since the offer was public, another user (or a bot) could have rushed to validate the transaction before the user and thus collect the 100 ETH instead.

Presumably, the fat finger theory is preferred. With a floor price of around $70, there is a good chance that the user wanted to place a $100 bid, which turned out to be 100 ETH, or 2,500 times more.

This is a mistake that may seem silly on the surface, but it happens very regularly. Whether it’s the purchase price or the transaction fees, mistakes happen quickly if you’re in a hurry. To avoid falling victim to this, take your time and make sure your transaction fields are filled out correctly.