A report from French startup Kaiko indicates that Binance has lost about 16% market share in the last 2 weeks due to rumors, CFTC actions and the end of its no-fee trading program. However, Binance still leads the market with 54% share, followed by Upbit. Exchange Coinbase also lost more than 10% of its market share in the U.S.

Binance losing momentum

A recent report from Kaiko, the French startup that compiles and analyzes data for institutional and professional use, highlights the recent loss of ground for cryptocurrency exchange platform Binance.

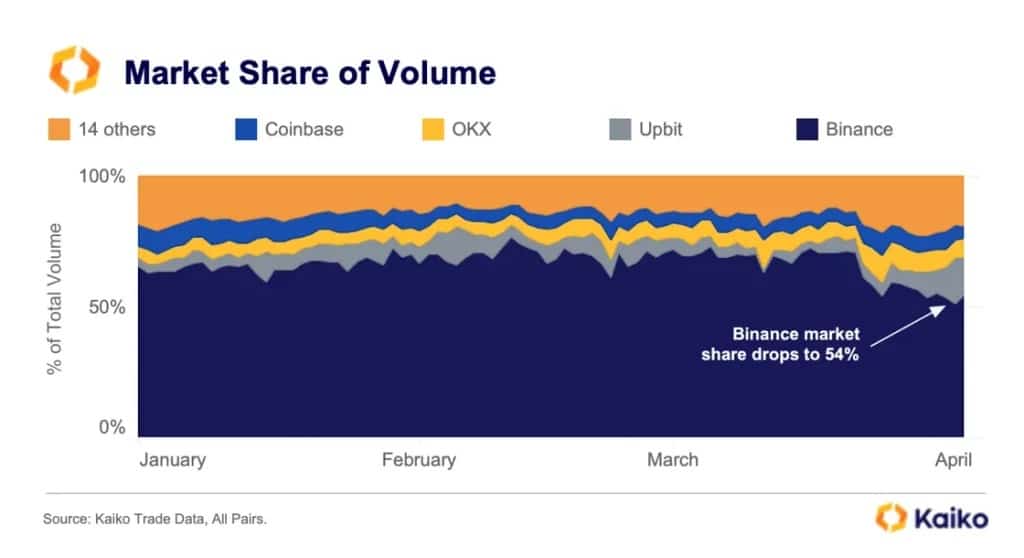

According to on-chain data, Binance has lost about 16% of its market share in the last two weeks. This loss of momentum can be attributed on the one hand to the recent rumors about the Commodity Futures Trading Commission (CFTC) actions against it, but also to the end of its “Zero fee trading” program.

However, as we can see from the chart below, Binance still has a 54% dominance in the crypto exchange market, far ahead of its main competitor Upbit. A second place vacated by the former giant FTX last November, when Sam Bankman-Fried’s platform was the only one able to shade Binance.

Figure 1 – Market share split between major cryptocurrency exchanges

The gain we can see regarding Upbit, a South Korean exchange, is part of a locally located frenzy among South Korean traders who are actively betting on XRP, Ripple’s cryptocurrency, as the outcome of the lawsuit targeting the company approaches. Thus, this trend is also visible on the exchange Bithumb, also South Korean.

US market particularly weakened

The giant Coinbase has also been shaken lately, mainly due to the Wells Notice issued against it by the U.S. Securities and Exchange Commission (SEC) last month. According to Kaiko, Brian Armstrong’s exchange has lost more than 10% of its share in the U.S. market:

” Even Coinbase, which has historically made very strong efforts with regulators, received a Wells notice focused on its staking service, while Kraken was forced to close its service earlier this year. Throughout the first quarter, Coinbase’s [U.S.] market share fell from a weekly average of 60 percent to just 49 percent. “

However, Binance.US, the US subsidiary of Binance, seems to be doing seriously well in this section of the market, as its share has increased 3-fold since the beginning of this year.

The current regulatory blur in the US doesn’t seem to be stopping anytime soon: while Kraken, one of the oldest cryptocurrency exchange platforms, was hit with a $30 million fine, it also found itself forced to stop its staking services last February.

Most recently, it was the Bittrex platform that decided to end its operations in the US, also citing the surrounding regulatory uncertainty.