Coinhouse and Deloitte have conducted a joint study on the challenges of Web3 within companies. This is an opportunity to dive into these statistics in detail, to become aware of the progress of the democratization of cryptocurrencies in the professional world.

Web3 in business: Coinhouse and Deloitte present their study

Deloitte, one of the “Big Four” audit firms, has partnered with Coinhouse to deliver a barometer on the use of blockchain technologies in business: “Web3, a strategic and financial challenge for companies”.

Nicolas Louvet, CEO of Coinhouse, came back on the growth of these technologies and the place of his company in this transition:

“We first helped companies establish a presence in the metaverse by allowing them to select and purchase land, and for the past several months we have been accelerating our development by allowing companies to generate revenue with Web3 and cryptos. The coming quarters will see a surge in consumer Web3 projects across a variety of industries. “

This study was conducted with about 100 companies, 59% of which are traditional players in the French economy, and the remaining 41% are Web3 specialist companies. Among this population, half are very small companies with less than 10 employees (VSE), 22% of SMEs with less than 250 employees, 13% of companies with up to 5,000 employees, and 14% of large companies.

A growing interest

On the occasion of this study, we interviewed Marie-Line Ricard, Global ISP, Blockchain & Web3 Leader at Deloitte, about the interest of companies in cryptocurrencies:

“At Deloitte we are seeing a growing interest from companies to understand digital assets: 63% of respondents have already organized or are planning to organize training sessions related to Web3. Our clients are now looking to diversify their portfolios and/or experiment with the financial innovations that this technology offers, such as decentralized finance (DeFi) or the tokenization of real assets (Real World Asset). “

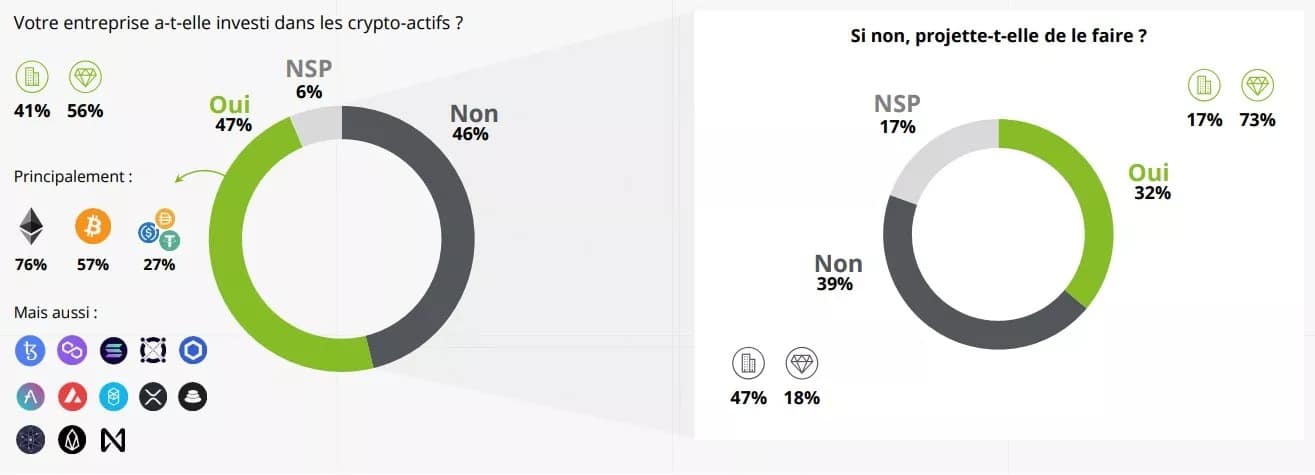

Among the respondents to the study, 47% of companies have already invested in cryptocurrencies: 41% for traditional companies, and 56% regarding specialized companies. ETH tops the list for 76% of the companies involved, Bitcoin (BTC) with 57%, but also some altcoins like AVAX, AAVE or even BAL from Balancer.

Interestingly, among the companies that do not plan to invest in crypto-currencies, 18% are nevertheless specialized web companies3 :

Figure 1 – Overview of companies investing or not in cryptocurrencies

The reasons given by companies staying away from such investments are volatility and lack of understanding, but also a possible negative impact on their reputation. For specialized players, the refusal of their banking partners is also invoked in addition to these justifications.

In addition, 39% of the respondents to this survey have a department responsible for dealing with Web3 issues. Among these departments, we find the Innovation Department in the lead (33%), as well as the Strategic Department and the Digital Department. The Legal Department and the Financial Department are also part of the lot, but no company surveyed has assigned the Web3 to the Marketing Department.

Cryptos: a quality substitute for bank transfers

Another part of the study focuses on the issue of international transfers as well as settlements. Of the respondents, 30% use cryptocurrencies for the former, and 42% for the latter.

The reasons given for this type of use at the expense of the traditional financial system are as follows:

- The cost ;

- The delay;

- The exchange rate hedge;

- Traceability.

As far as transfers are concerned, stablecoins are logically in the lead, ahead of ETH and BTC, but it will be interesting to note that for payments, it is ETH that takes the first place, before stablecoins and BTC.

Unsurprisingly, this application case will be found mostly on the side of specialized Web3 players, with a strong contrast to traditional companies:

Figure 2 – International wire transfers and cryptocurrency payments

The reluctance of traditional players can be explained by several aspects:

- A lack of knowledge, especially about its accounting treatment;

- The bad press of players like FTX and Terra (LUNA);

- Lack of regulatory clarity.

The barometer also highlights the importance of dollar-backed stablecoins among French players using them for their international settlements and transfers, inviting reflection on the future uses of euro stablecoins.

The case of NFTs and the metaverse

As for the case of non-fungible tokens, 92% of the companies that participated in the study know what an NFT is, and 35% of traditional companies have already carried out an NFT project, compared to 72% of specialized players.

The reasons are varied, for example, we can cite an internal experimentation to initiate the employees, but also for a need of traceability of certain products, collections giving right to advantages or play-to-earn games.

Companies that do not use NFT technologies cite a lack of resources, maturity, opportunities, the fact that it is not a priority or that they have accompanied other companies on this path, but have not launched themselves.

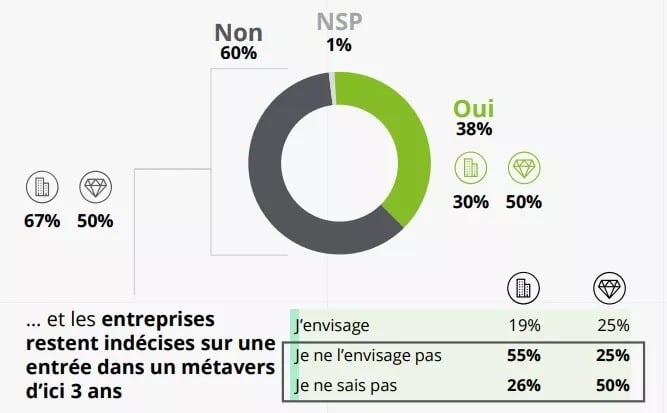

Regarding the presence of the population surveyed in the metaverse, or at least regarding past experience, 30% of traditional companies answered “Yes” compared to 50% of specialized players:

Figure 3 – Presence of companies in the metaverse

Let’s note that the metaverse is primarily perceived as a marketing tool, offering a new sales or communication channel. Among the current obstacles to the expansion of the metaverse, we find various reasons such as the need for physical interactions, the cost of virtual reality headsets or the lack of realism of current projects.

The democratization of the ecosystem is well and truly underway, and if educational work still needs to be done, companies are increasingly aware of the benefits of Web3 technologies.