Launched in August 2021, Pyth is an oracle that delivers reliable and fast data on more than 300 price streams, covering various sectors, for both cryptocurrencies and traditional finance. Since becoming cross-chain in 2022, the Pyth oracle has continued to develop and conquer new networks. What is Pyth Network developing and what is the state of adoption of this unique oracle?

Pyth Network, the oracle that’s developing at the speed of sound

Initially built on the Solana (SOL) blockchain, Pyth Network is an oracle with the unique ability to deliver highly reliable financial data thanks to an ingenious system that drastically reduces the time it takes for information to travel through the system.

Launched in August 2021 on its Pythnet mainnet, Pyth currently delivers more than 300 price feeds on sectors as varied as crypto-currencies, equities, ETFs, commodities and currency pairs. Building on its success, the Pyth oracle became cross-chain in August 2022, both on leading blockchains such as Ethereum and Aptos and on layer 2s such as Base, Arbitrum and Optimism.

Pyth’s arrival in the cross-chain world has been made possible by Pyth V2, a version that natively boosts the performance of Pyth V1 tenfold, with cross-chain data transfer handled by Wormhole, all at ever lower costs. And the entire Pythnet ecosystem is auditable.

Pyth has also become a partner of choice for key tools such as TradingView, which has also adopted its high-frequency data. On the blockchain side, Pyth has also won over many protocols present in all types of verticals requiring high-reliability data, including Sui, the BNB Chain and zkSync Era.

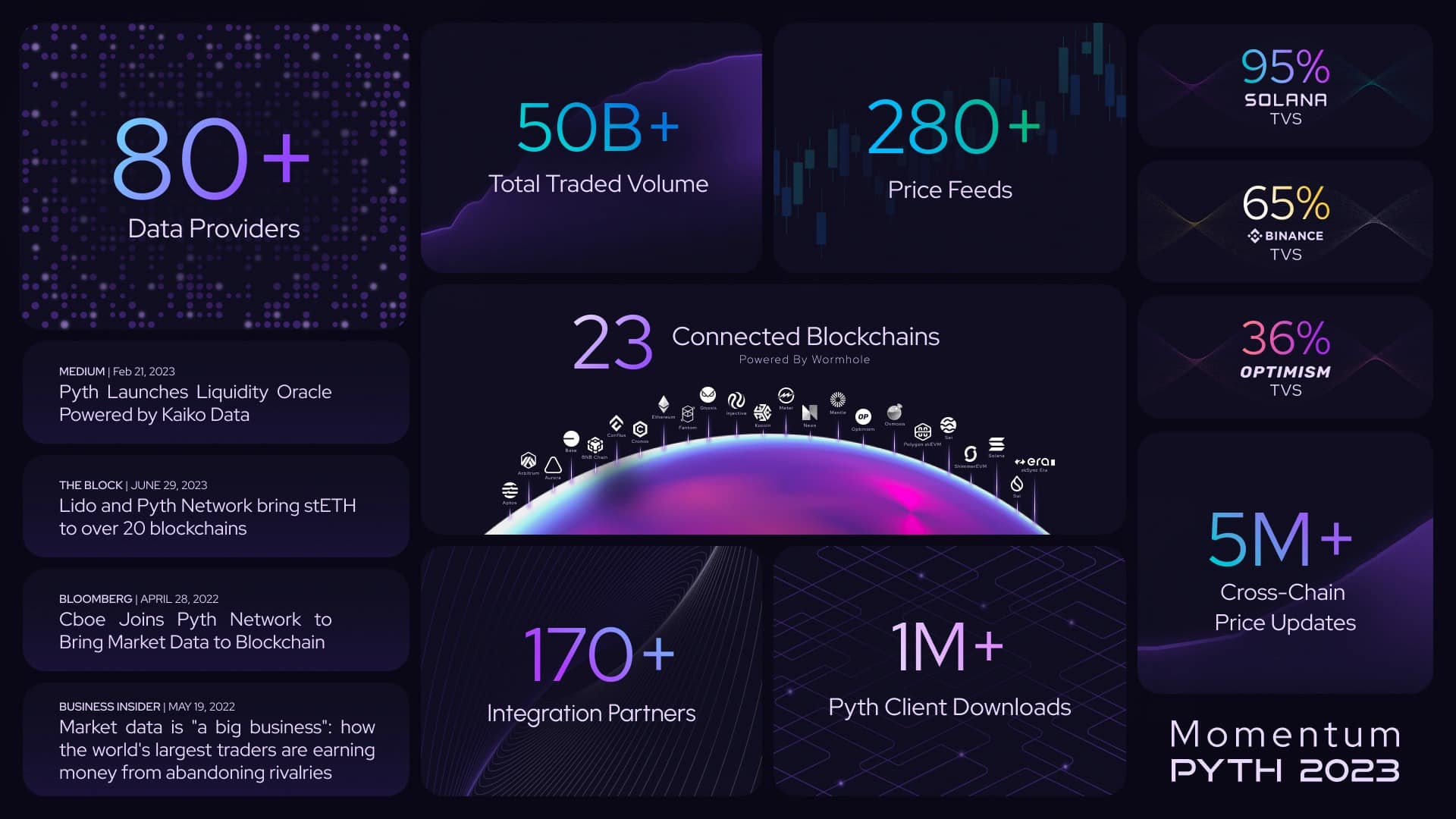

Infographic reflecting Pyth data

Far from resting on its laurels during the bear market, Pyth continues to work on innovative new products. In particular, this has enabled it to develop Pyth Benchmark, a solution for storing data passing through Pyth in order to carry out in-depth on-chain analyses. This enables Pyth and its partners to establish new standards such as those we have seen in traditional finance with indices or benchmark rates, for example.

With the integration of Wormhole, Pyth has also been able to implement ‘Pythnet Price Feeds’, which incorporates the innovative ‘low-latency pull oracle’ concept. Where the classic ‘push’ model delivers data that can be consulted continuously, Pyth has adopted a model with reduced latency and a better refresh rate, in particular by offering the possibility of consulting the latest off-chain prices.

The year 2023 will be marked by the arrival of new tools

Although 2022 was far from being the easiest year for companies operating in the crypto ecosystem, particularly due to the bankruptcy of FTX, this in no way stopped Pyth from developing and attracting new users. The quality of its products combined with the reliability of its data led it to be adopted by Synthetix, the cross-chain liquidity protocol.

Thanks to Pyth, Synthetix has saved its users more than $10 million in transaction fees on Optimism’s perpetual contracts, where Pyth is now its benchmark oracle. Venus, a major DeFi protocol on the BNB Chain, for example, was able to evolve to its V4, its most important update to date, thanks to data from the Pyth oracle.

Lido, the largest ETH staking protocol, has also chosen Pyth for its stETH/USD price feed, which is shared across more than 30 blockchains.

Most recently, Pyth landed on Arbitrum, opening up access to its high-reliability data for the main layer 2 protocols, including Vela, Vyper, Beluga, Deri, Duet and Cap Finance. Through a partnership with Aptos, Pyth has introduced an automated price scheduler to natively maintain a set of regularly updated price feeds for blockchain developers.

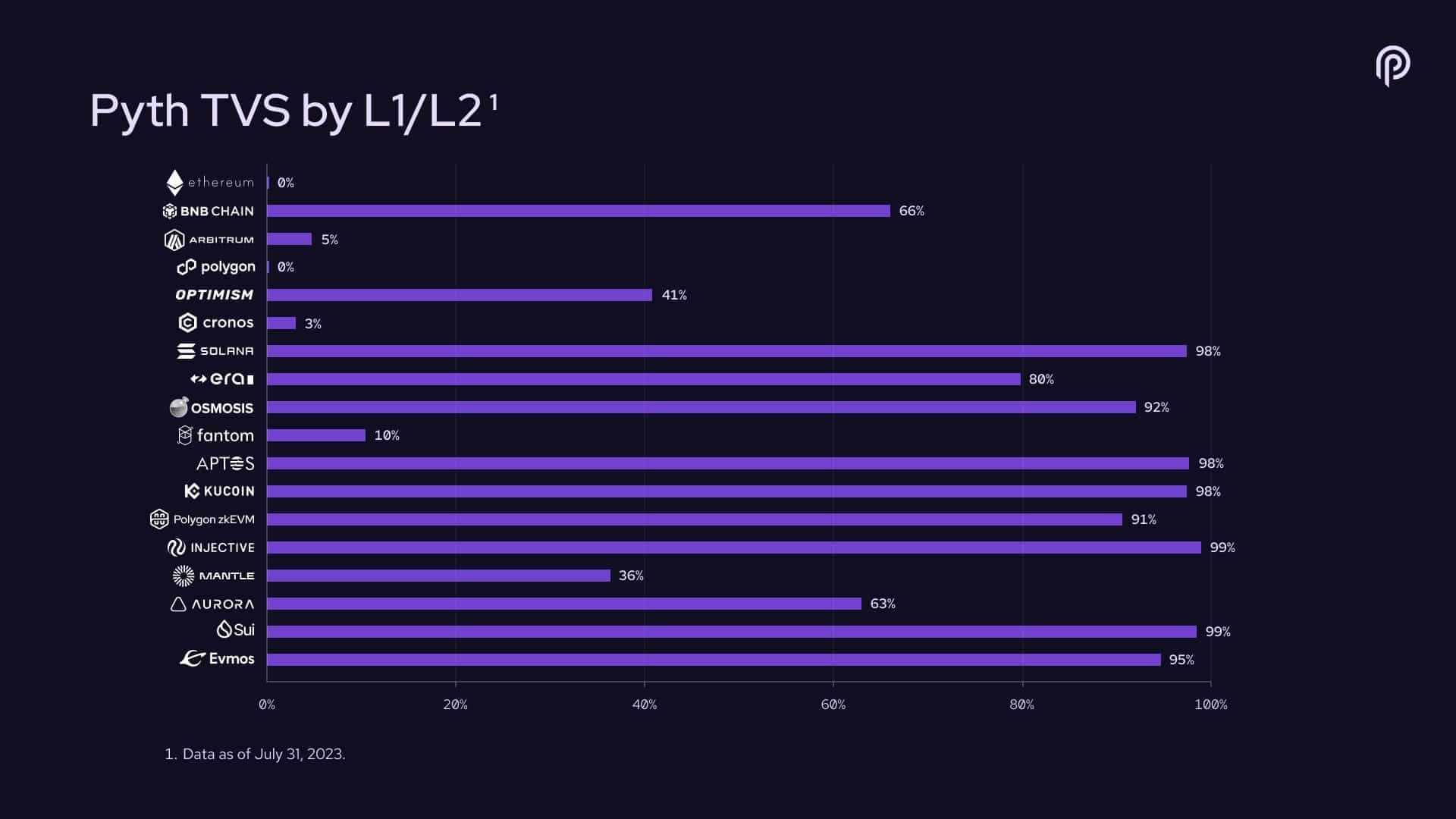

As its own data demonstrates, Pyth is undoubtedly tending to become a benchmark for blockchains and the networks on which it operates:

Percentages of total value secured (TVS) by Pyth per network

Today, the biggest challenge for decentralised finance protocols is to be able to rely on reliable, available and up-to-date data as close as possible to the real value of their assets. Pyth understands this, which is why its range of products continues to develop, with a more than solid foundation that has now been tried and tested