The Web3 application friend.tech, which allows the tokenisation of creator shares in exchange for exclusive content, experienced a major craze before suffering a spectacular drop in user interest. The volume of exchanges, the number of users and revenues all fell by more than 80% in just a few days. But in the end, wasn’t this predictable?

Friend.tech already sidelined?

The Web3 application friend.tech, after having been very popular, now seems to have lost all its appeal for users. Built on Base, Coinbase’s layer 2, friend.tech allows users to tokenise the shares of a personality on the platform in exchange for exclusive content and private chat channels.

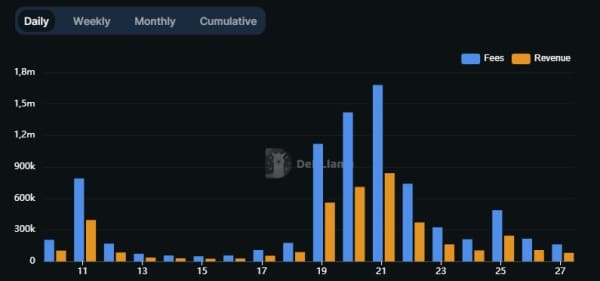

After reaching a peak of $16.9 million in terms of volume traded on 21 August alone, the platform is struggling to maintain a stable level of interest. On 27 August, only $1.61 million was traded, compared with $2.16 million the previous day and $4.88 million the day before.

In other words, the volume traded fell by more than 90% between 21 August and 27 August.

At the same time, the number of friend.tech users is also plummeting: after peaking at over 35,000 on 21 August, there were just 7,800 users yesterday, a 78% drop in this metric.

Naturally, this also affects the platform’s revenues. After generating $840,000 on 21 August, friend.tech earned just $80,000 on 27 August, another drop of more than 90%.

Fees generated by friend.tech (blue) and revenues (orange)

In the end, friend.tech lost 80% on most metrics. But is that really surprising?

A surprise? Not really

According to a Messari report, early users of friend.tech were quick to report a number of issues, including slowness, high transaction fees and “a steep price curve” when it came to valuing stocks.

At the same time, many of them pointed to a glaring lack of functionality on friend.tech (the platform only offers private discussion groups, so it is up to the owner of the shares to offer other benefits). The signs of a short-lived platform were already there, as Ryan Wyatt, former president of Polygon Labs, pointed out:

And in it’s current form you’re basically looking at an unintended ponzi w/ first in/first out because there isn’t any product feature depth to create stickiness or retention, so creators will churn quickly, users will be left exiting creators, etc. A lot of work to be done.

A lot of work to be done.

– Ryan Wyatt (@Fwiz) August 21, 2023

“And in its current form, you’re essentially seeing an unintended Ponzi on a first-in/first-out basis, because there’s no depth of product functionality to create rigidity or retention, so creators will quickly lose interest, users will be let go from creators, etc. “

The only feature added by friend.tech was the ability to import images into chat channels. The platform was quickly snapped up by content creators from the OnlyFans platform. However, this was not enough to breathe new life into the application.

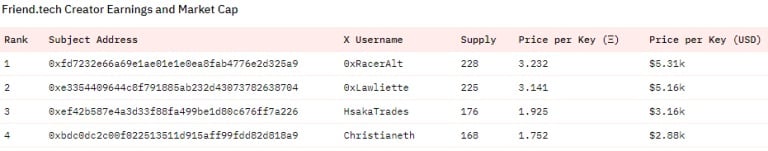

We could also mention the particularly high entry price for shares in major friend.tech personalities, with the most prominent ones trading at more than ETH 3.2, or more than $5,300 at the current ETH rate.

Top 4 creators on friend.tech with price per Key (share)

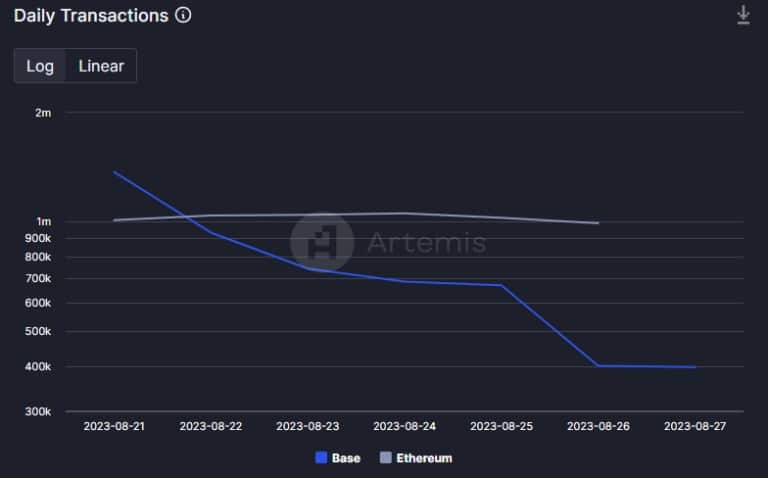

Finally, it’s worth noting that since Base’s activity was propelled by the craze surrounding friend.tech at its peak, it has naturally suffered from the decline in interest in the application. So, after overtaking Ethereum with more than 1.3 million transactions per second (TPS) on 21 August, Base fell back below the 400,000 TPS mark.

Daily transactions on Base (blue) and Ethereum (grey)

The end of friend.tech, then? With the application still in beta for the next 6 months, it’s hard to say. But one thing’s for sure, the platform will have to work hard to regain its appeal with users.