Now that a new year is starting, Chainalysis has released 2022 data on illicit activity in the cryptocurrency ecosystem. While this analysis is very informative, we will note the limitations that qualify the numbers provided.

The state of illicit trading in cryptocurrencies in 2022

This week, Chainalysis published an excerpt from its report to be released in February on illicit transactions in cryptocurrencies in 2022.

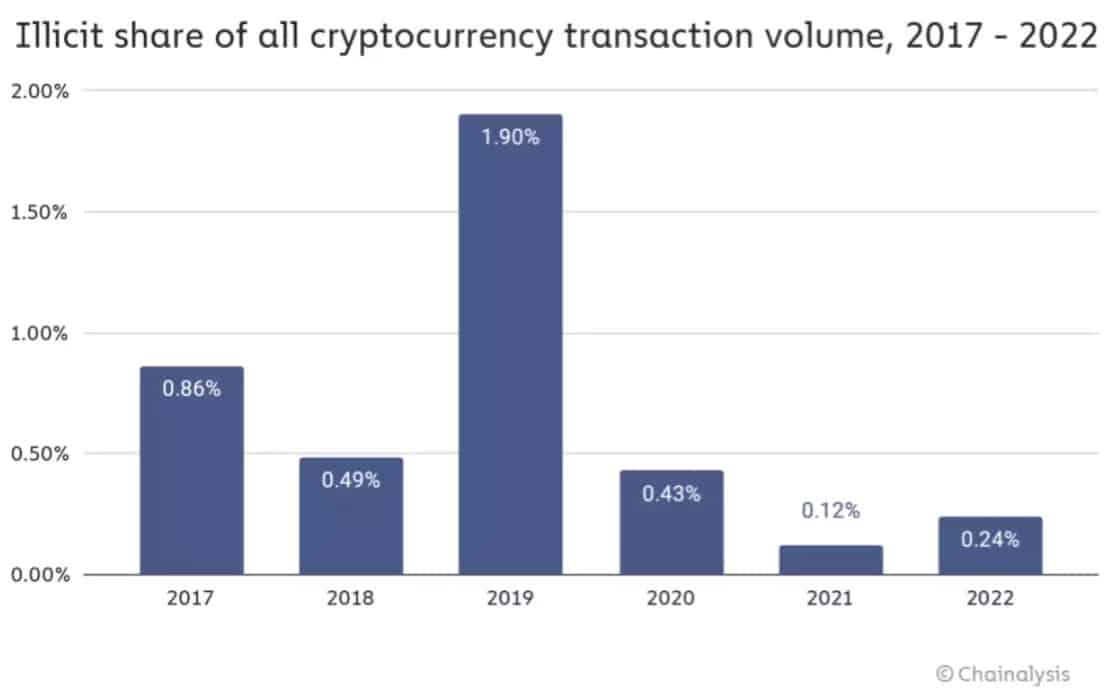

While these have unfortunately increased since 2021, they remain marginal at 0.24% of total volume or the equivalent of one in 416 transactions:

Figure 1 – Illicit trading volume in 2022 on cryptocurrencies

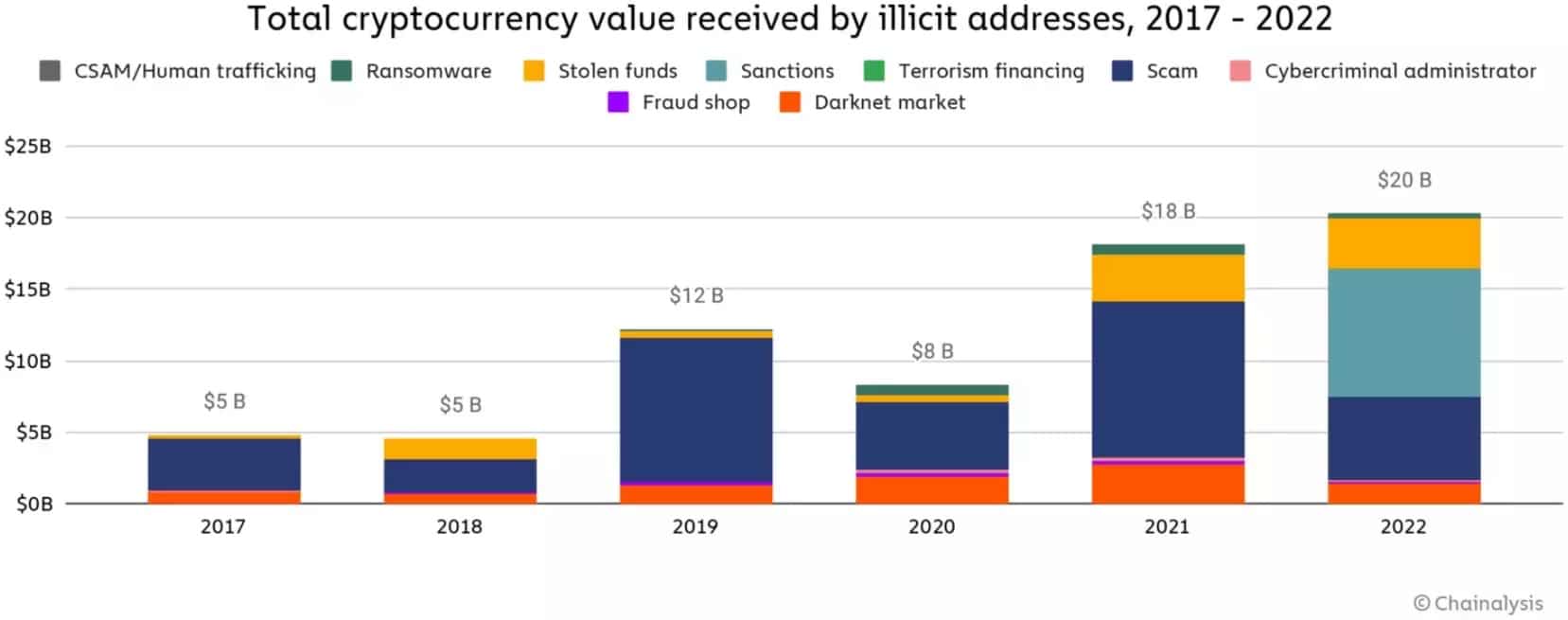

In terms of value, that’s $20.1 billion. While this figure is indeed substantial, it should be put into perspective, remembering for example that over the last 24 hours, Binance generated over $31 billion in spot trading volume.

Looking more closely at the activities that make up this study, 44% of the volume was traded on addresses sanctioned by the US Treasury’s Office of Foreign Assets Control (OFAC):

Figure 2 – Detail of illicit transaction types

This data on OFAC sanctions is interesting, as it turns out that a large part of this 44% relates to the Russian exchange Garantex, sanctioned in April 2022. As these OFAC sanctions only apply, in theory, to US citizens, there is nothing to prevent Russians from using this local platform legally in their own jurisdiction, which will however feed into the data found by Chainalysis.

The nuances to consider in this data

Apart from the Garantex case, the Chainalysis analysis has some subtleties that qualify the data presented. Firstly, this study only concerns on-chain data, which is the only data that can be verified with certainty.

This implies that the internal transactions of an exchange, which are recorded on a ledger outside the blockchain, cannot be taken into account. This opens up the debate about the activities of FTX, Celsius or other companies that committed fraud in 2022, but whose activities are not reflected in the analysis.

It is also worth noting that some activities are difficult to quantify, such as drug payments in cryptocurrencies, which may look like a simple transaction from an on-chain perspective.

Even so, the numbers are evolving as Chainalysis finds new ways to monitor the full range of illicit activity in the ecosystem. So, for example, while the value of $14 billion was initially put forward for 2021, an update with new calculations has raised this figure to $18 billion.

On the other hand, it would be a simple shortcut to say that “illicit activity has doubled in 2022”, as we have gone from 0.12 to 0.24% of transactions. However, such reasoning would be fallacious. Indeed, while the criminal industry has not seen a respite, the cryptocurrency market did see a decline in activity in 2022. From this observation, this mechanically drives up the share of illicit transactions in the total volume.