A tidal wave: that was the effect of the flash collapse of FTX, which had previously been considered a flagship of the ecosystem. And the collapse of the giant has forced its competitors to try to prove that they have no liquidity problems. Which platforms have played the transparency card

The trading platforms that publish their reserves

Several platforms have communicated on the eventual arrival of proofs of reserves, with audit. These are supposed to show transparently what funds the exchange has, as well as its liabilities. According to the data collected on BlockchainCenter, 11 exchange platforms will now be subject to this obligation, following the FTX case.

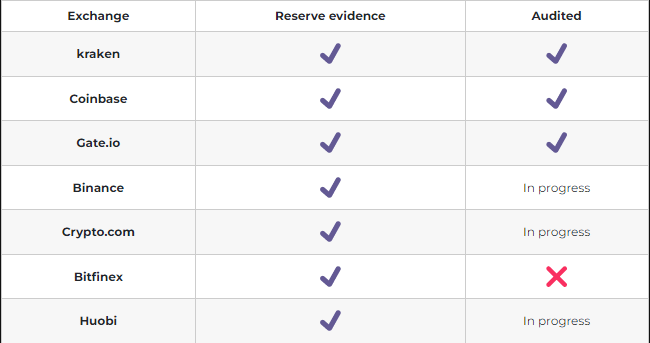

Of these, three had already been audited before the case broke and were forerunners in the field: Kraken, Coinbase, and Gate.io. The giant Binance published last week the status of its addresses and confirmed that an audit would be published soon. Crypto.com is in the same situation, suffering from a lack of credibility after rumours of financial difficulties.

Bitfinex and Huobi finish the list of 7 exchange platforms that have published a proof of reserves. OKX, Kucoin, ByBit and MEXCGlobal have also confirmed that they will also be submitting to the exercise soon. Here is a summary table for the main global exchanges:

A major challenge for the ecosystem

It is difficult to overestimate the importance of the approach for these platforms. They are facing a considerable and undoubtedly unprecedented lack of trust, just as they have been trying to prove their seriousness in recent years. For clients, institutions and regulators, being able to consult the financial health of these major players will therefore be absolutely necessary for them to regain confidence.

As we recall, regulators were already rumbling in recent months, and recent events have only fuelled their distrust. The fall of the giant FTX will therefore certainly become a milestone around which the policies of the next few years will be articulated… For better or for worse.