A major player that has grown too big? Part of the crypto community is concerned about the disproportionate place taken by Lido Finance among liquid staking protocols. Does this really represent a risk of centralisation for Ethereum (ETH)? We take stock of the situation.

The rise of Lido’s staking services

As a reminder, Lido Finance is a liquid staking protocol, which allows its users to deposit and immobilise ETH, in exchange for “Lido Staked Eth” (stETH). This allows its users to use stETH in DeFi protocols, while reaping the staking rewards of Ethereum.

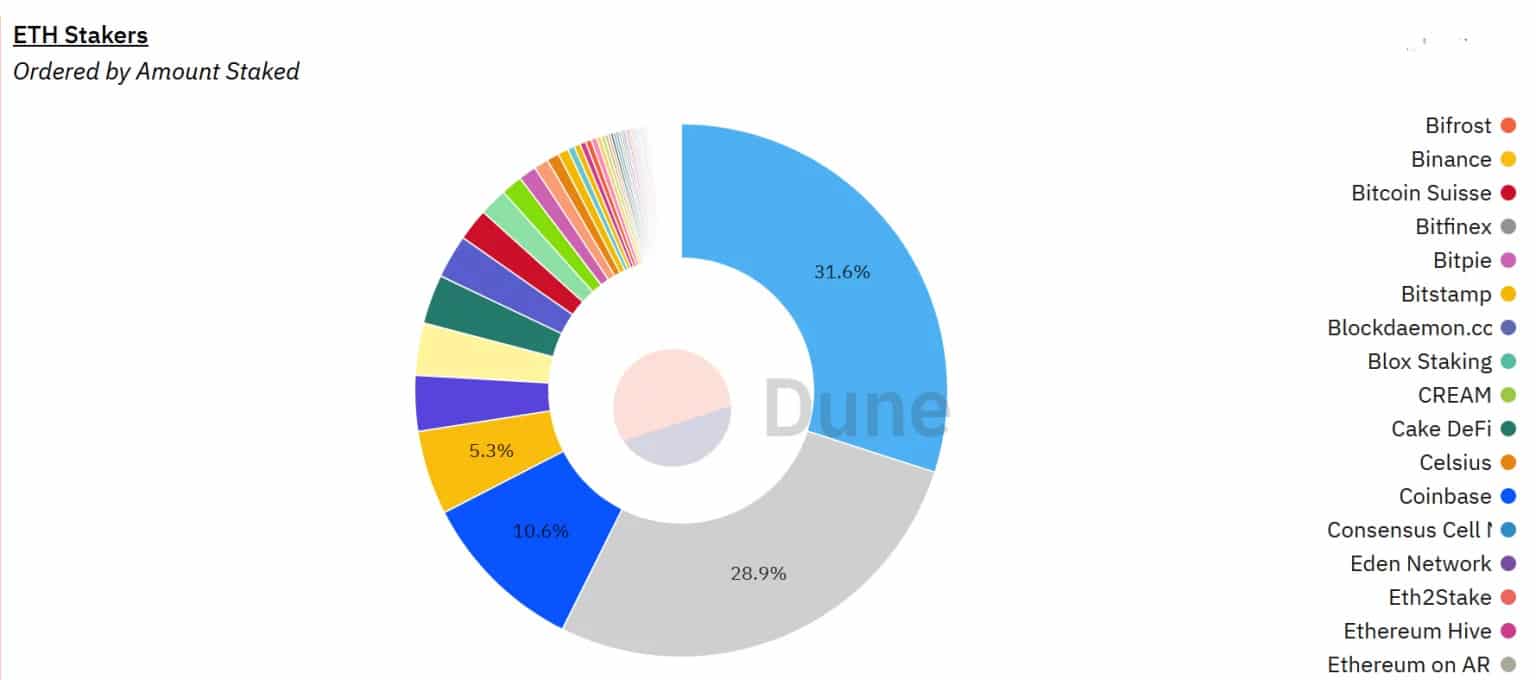

Lido has grown considerably over the past year. The protocol currently accounts for 31% of ETH staked, ahead of larger entities such as Coinbase (10%) and Binance (5%):

Origin of ETH staked on Ethereum

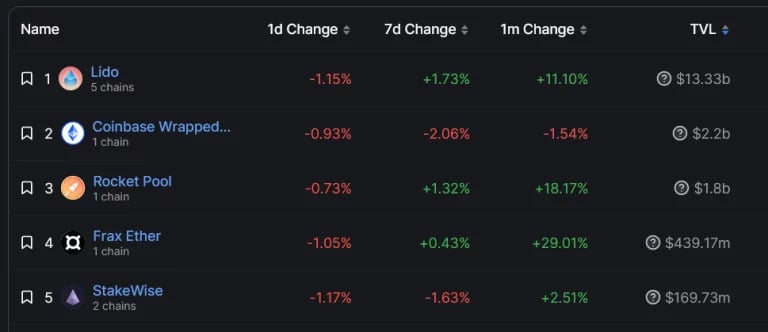

If we look at liquid staking protocols alone, Lido’s dominance is overwhelming. It accounts for 74% of ETH staked in this way:

Lido crushes the competition in terms of total value locked (TVL)

Another sign of this phenomenal success is that Lido became the first decentralised finance protocol (DeFi) in January this year. Hence the questions that have begun to emerge about the centralisation of Ethereum’s staking around this protocol

Is ETH staking too centralised around Lido?

The question is being asked more and more as Lido grows in importance. Several members of the Ethereum community have voiced their concerns on the subject. The founder of The Daily Gwei, sassal0x, said that the risk of centralisation was very real for Ethereum: “

“.

The concerns about the centralisation of LSDs are well-founded. […] If my dear Ethereans want Lido’s dominance to diminish, they will have to create better liquid staking protocols. “

The advantage of Lido is its ease of use. A user wishing to stage ETH without using an ancillary protocol is often faced with several obstacles. The first is financial, since you need to have at least 32 ETH to start with, or nearly $60,000 at the current rate. There are also technical hurdles, as the process can be complex for the uninitiated. Lido’s great strength, therefore, is its ease of access

The scale of Lido could attract the attention of regulators

According to Ari Paul, founder of BlockTower Capital, the other problem with a hegemonic entity is that it can be more easily targeted by regulators and governments:

Call to action on this likely to be when LIDO or big competitor faces gov action and starts censoring to avoid criminal charges. I’ll be very impressed if ethereum community can mitigate the centralizing before that happens.

– Ari Paul ⛓️ (@AriDavidPaul) June 1, 2023

“Calls like this are likely to be relayed when Lido or one of its larger competitors faces government action and starts censoring to avoid legal charges. “

A greater variety of entities is therefore also a guarantee that it is more difficult to attack one of them. While a service provider such as Lido cannot therefore prevent transactions per se, its sheer size can unbalance the blockchain. The risk to Ethereum’s centralisation therefore seems real, and Lido’s rise to power will probably be a key issue in the coming months.