With nearly 3.37 million ETH burned for $9.8 billion, it’s time to take stock of Ethereum’s burn functions. Who is contributing the most to reducing emissions on the network?

More than 3 million ETH have already been burned

Since EIP-1559 came into effect on Ethereum in August 2021, the number of ETH burned has continued to rise. This trend has been accentuated by the success of The Merge, which sometimes even tends to make the asset deflationary, depending on the activity present on the network.

Nearly 3.37 million units have been burnt since EIP-1559, including just over 745,000 destroyed since The Merge in September, equivalent to 2.8% of the total quantity of ETH. At the current price of the asset, this represents almost $9.8 billion.

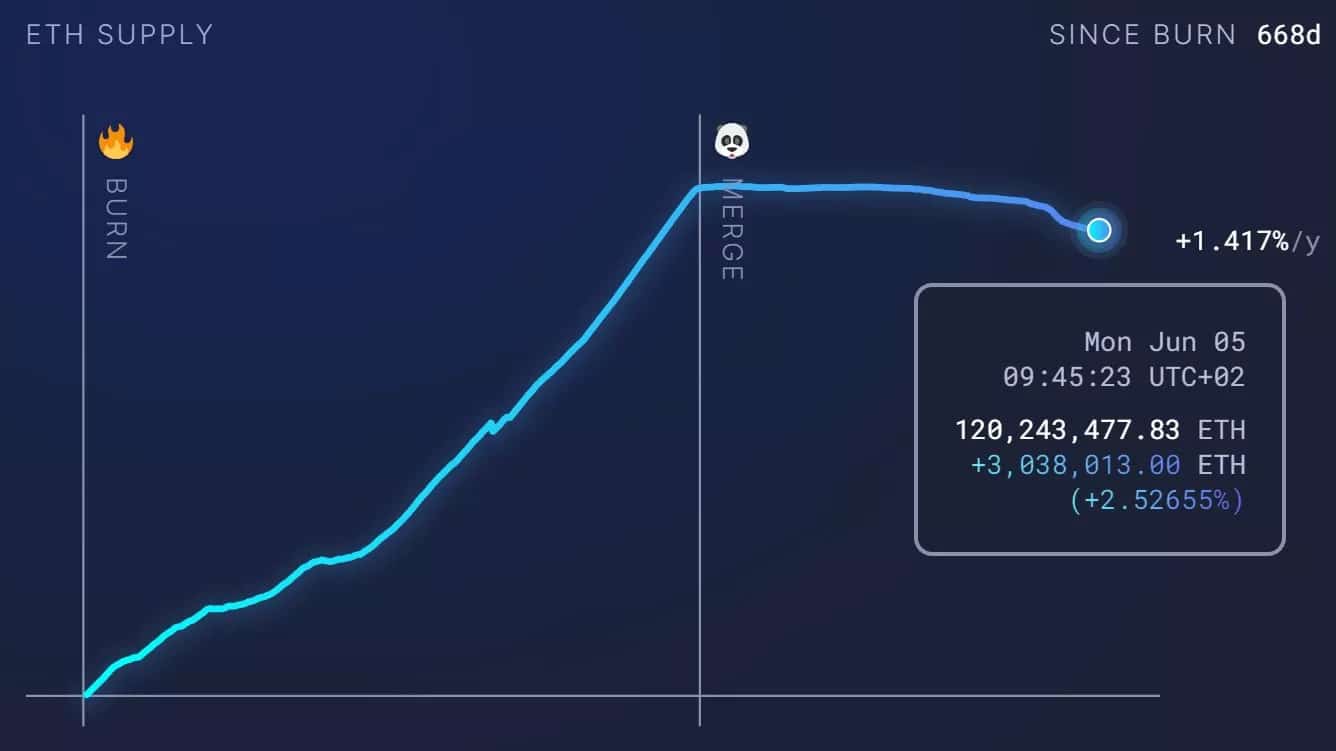

Since 6 August 2021, ETH distribution has therefore increased by only 3 million units, representing inflation of 1.42%. At the current rate, smoothing the average since that date, 3.5 ETH are being destroyed every minute.

Taking The Merge as a benchmark, the said distribution has even seen deflation of 0.32%:

Figure 1 – Evolution of ETH issuance since EIP-1559

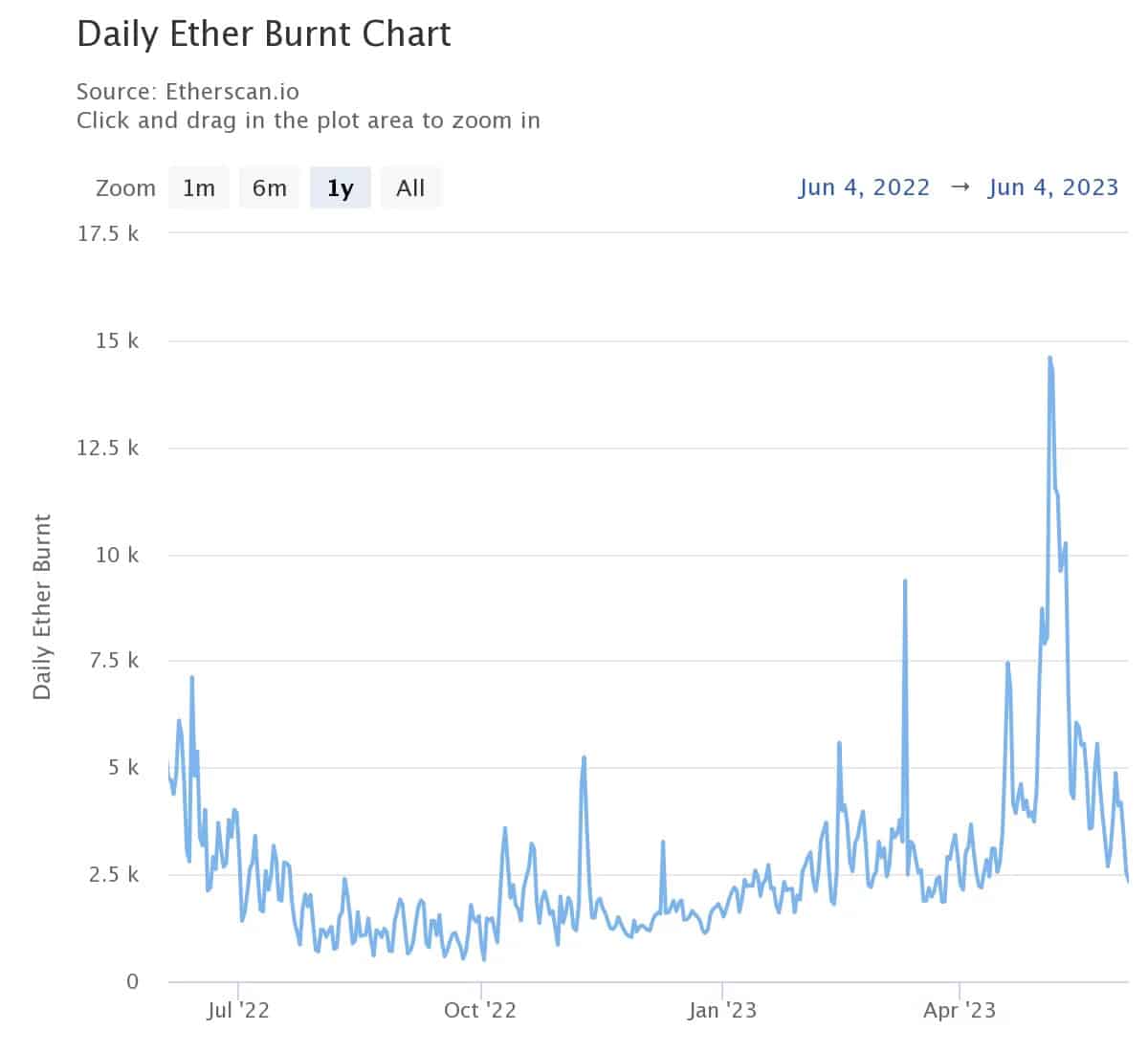

After a dip between late summer and early autumn last year, the amount of ETH destroyed each day has been back above 2,500 daily units since the beginning of January. The chart below even shows a peak of almost 14,600 at the beginning of May, when the euphoria surrounding PEPE led to an explosion in transaction fees on the network:

Figure 2 – Amount of ETH burnt each day

Who generates the most burn on ETH?

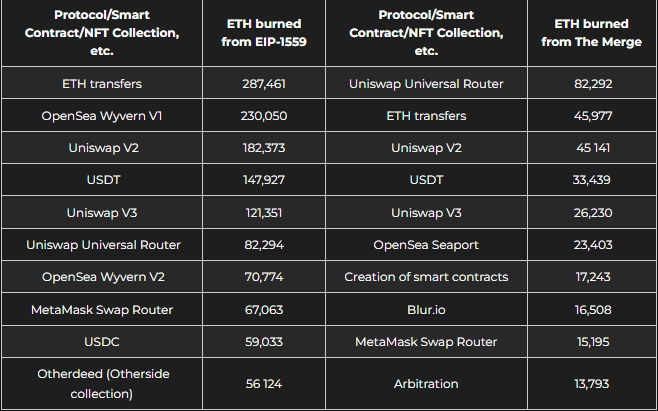

In order to get a better idea of the players most involved in the destruction of ETH, here is a table showing a snapshot of the burns carried out since EIP-1559 and since The Merge. For each event, the table lists the top 10 protocols, smart contracts or decentralised finance applications (DeFi), for example:

Figure 3 – Players most involved in ETH burn since EIP-1559 and The Merge

A comparison of the two rankings reveals a number of new trends. For example, Arbitrum is becoming increasingly important, and Blur is making its mark on the non-fungible token (NFT) market.

What’s more, some smart contracts are taking over from others, as in the case of OpenSea, which has moved from Wyvern to Seaport. And others, such as Uniswap, which dominates the rankings by a wide margin, whatever the period.

While we are still technically in a bear market, it will be interesting to take stock of these data when the market re-enters sustained bull phases.