As the Bitcoin (BTC) price struggles to climb back above the $30,000 mark, transactions executed on its network are hitting a new record. As a result, the king of cryptocurrencies is seeing its number of transactions explode upwards in May 2023. This phenomenon is mainly caused by the popularisation of Ordinals registrations.

A new record in the middle of a bear market

With the appearance of Ordinals at the beginning of the year, followed by their popularisation from April onwards, the Bitcoin blockchain (BTC) has experienced a major resurgence of interest, to the point where it has spectacularly surpassed its previous record for monthly transactions.

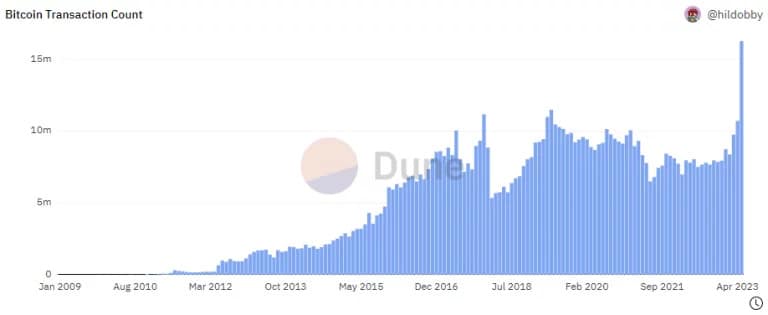

Between April and May 2023, the number of monthly transactions on the Bitcoin network rose from 10.7 million to 16.3 million, an increase of 52%.

Figure 1 – Number of monthly transactions on the Bitcoin network (BTC) since its creation in January 2009

Note that the previous record was set 4 years ago. In May 2019, the Bitcoin blockchain counted no fewer than 11.5 million transactions. Today, the record for May 2023 far surpasses its predecessor, with 41.7% more transactions.

This spike in transactions is mainly linked to the peak reached by Ordinals. Indeed, more than 70% of the Ordinals subscriptions made between January and May 2023 came into being during the latter month, when their number rose from 3 million to 10 million.

Moreover, according to the data in the chart, transactions on the Bitcoin blockchain appear to have been decoupled from price rises for several years. Prior to the arrival of Ordinals, the number of transactions carried out had been declining since the peak in May 2019.

One reason for this could be the gradual arrival of investors who are not interested in the uses of Bitcoin. To put it simply, the number of people acquiring BTC for investment purposes has increased over time. They would be storing their cryptocurrencies for hoarding purposes, instead of using the network for its primary function, i.e. to send value without intermediaries.

As a result, the supply of Bitcoin is gradually shrinking. Today, according to Chainalysis, more than 75% of Bitcoin’s supply is illiquid. So it remains to be seen whether the impressive rise in transactions is temporary or not, as is the interest shown in Ordinals.

Network fees far from breaking records

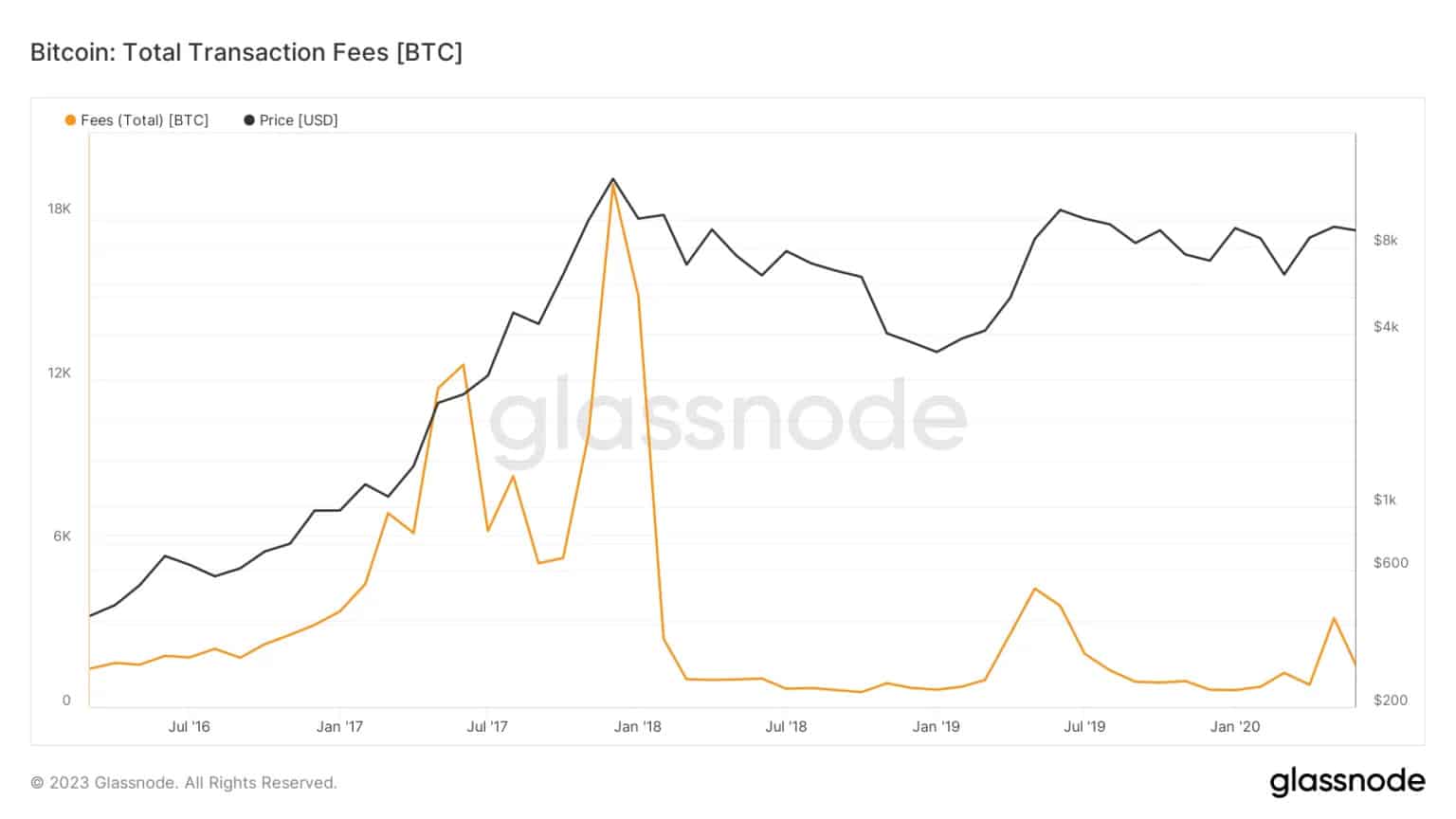

With this new record for the number of transactions, shouldn’t network fees be higher than their previous peaks? Although the costs involved in executing a transaction have risen sharply compared with previous months, they have failed to catch up with the heights reached during the bullrun of 2017.

While bitcoins paid to miners amounted to 19,120 BTC in December 2017, they “only” reached 3,250 BTC in May 2023.

Figure 2 – BTC paid to miners on the Bitcoin network, in months

The fact that the number of transactions can break records without network fees soaring is mainly due to the many improvements made to the Bitcoin network in recent years.

For example, the Taproot update rolled out in November 2021 helped increase the number of transactions in a single block, while also reducing transaction fees on the Bitcoin blockchain.

In this case, if the engineers behind the world’s leading cryptocurrency continue to innovate, the downward trend in transaction fees could continue in the long term.