It’s not just cryptocurrencies that are in trouble. Credit Suisse proves that the traditional financial system is not spared too. Faced with the risk of bankruptcy, the latter could cause a systemic risk of a magnitude far greater than what the blockchain ecosystem experienced with Celsius Network.

Credit Suisse in trouble

Credit Suisse, a major commercial bank, has been in the news since the weekend due to rumors of a potential bankruptcy.

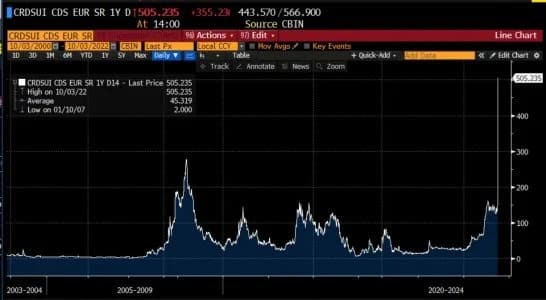

One of the things fueling these concerns is the surge in credit default swaps (CDS). To put it simply, CDS can be seen as credit insurance.

For example, let’s say that A lends money to B, but also wants to hedge its risk. He will then turn to C, from whom he will pay a premium, in exchange for which C agrees to cover A if B defaults on his credit. Thus, A will not be put at risk in case of bankruptcy, and C, on his side, will have to manage with B to recover the amount borrowed.

A rising CDS can therefore be a sign that the actor, to whom money has been lent, is subject to doubts about his creditworthiness, and therefore the premium to be paid by the creditor to cover his risk increases.

Credit Suisse’s Credit Default Swap (CDS) is said to have risen to over 500 today, almost fivefold since the beginning of 2022.

Source: Randy Woodward (Twitter)

Whatever these difficulties are, they are not new. Indeed, Credit Suisse’s share price has been in free fall since April 2007 with a performance of -95% :

Credit Suisse share price

In response to the rumours, Ulrich Koerner, the group’s CEO, announced this weekend that he would keep his employees regularly informed of the company’s situation until the announcement of a “new strategic plan” on 27 October.

Other sources of the bank’s difficulties include the failure of the hedge fund Archegos in 2021, which would have cost the bank USD 4.8 billion in losses. In addition, Credit Suisse has also been fined in recent years for several cases, such as aiding tax evasion.

A significant amount of assets under management

Last week, at a conference on the tokenisation of finance, Banque de France governor François Villeroy de Galhau stressed the need for regulation of the cryptocurrency ecosystem, to prevent certain dangers for investors. This referred to crashes such as Terra, Three Arrows Capital and Celsius Network.

Credit Suisse shows here that regulation does not make all problems go away. Moreover, the sums at stake in this case are on a completely different scale to what we have seen in cryptos. Indeed, at its peak, Celsius had up to $3 billion in assets under management, for Credit Suisse, it would be over $1.5 trillion, more than the entire crypto market.

With such a large money supply, the bank is considered “to big to fail”, which means that different financial authorities could come to its rescue in case of failure, in order to prevent systemic risks.

In addition, a financial document of the company, dating from the last quarter of 2021, mentions a significant leverage among the different branches of the group. For example, the company would have been exposed to leverage of 895.81 billion Swiss francs.

Bitcoin philosophy criticized by Bitcoin (BTC)

While the bankruptcy of Credit Suisse is not certain, these difficulties are a reminder of why Bitcoin came into being. Indeed, the excesses of the traditional financial system usually end up falling on individuals.

We can point to the Cyprus crisis of 2013, for example, which saw some taxpayers’ bank accounts being drained to keep the financial system afloat. It may therefore be worth considering moving some of your savings from your bank accounts into BTC.

It is similar mismanagement that has caused the ruin of some players in our ecosystem such as Celsius.

While it’s not possible to prevent bankruptcies from happening, these episodes do make the case once again for self-guarding one’s finances, made possible by cryptocurrencies, including buying a little bitcoin.

It is also worth remembering that other financial institutions are in trouble. For example, Deutsche Bank has been in trouble for several years now, and Lehman Brothers was in trouble at the beginning of the subprime crisis.

All these events can create a systemic risk, capable of spreading to all financial actors with links to the institutions in difficulty.

Indeed, as long as an individual investor is dealing with a centralised actor, he or she can never be sure of what is done with these funds. This applies to traditional finance as well as to Web3.

projects.