The first study on banks’ exposure to cryptocurrencies has just been published by the Basel Committee, revealing the prominent areas of activity in the institutional environment. We find that custody services currently make up the largest share of business with the banks surveyed.

The first study on banks’ crypto exposure

The Basel Committee on Banking Supervision, which consists of representatives of central banks and prudential authorities from 28 different countries, has just revealed the first study to assess banks’ exposure to cryptocurrencies.

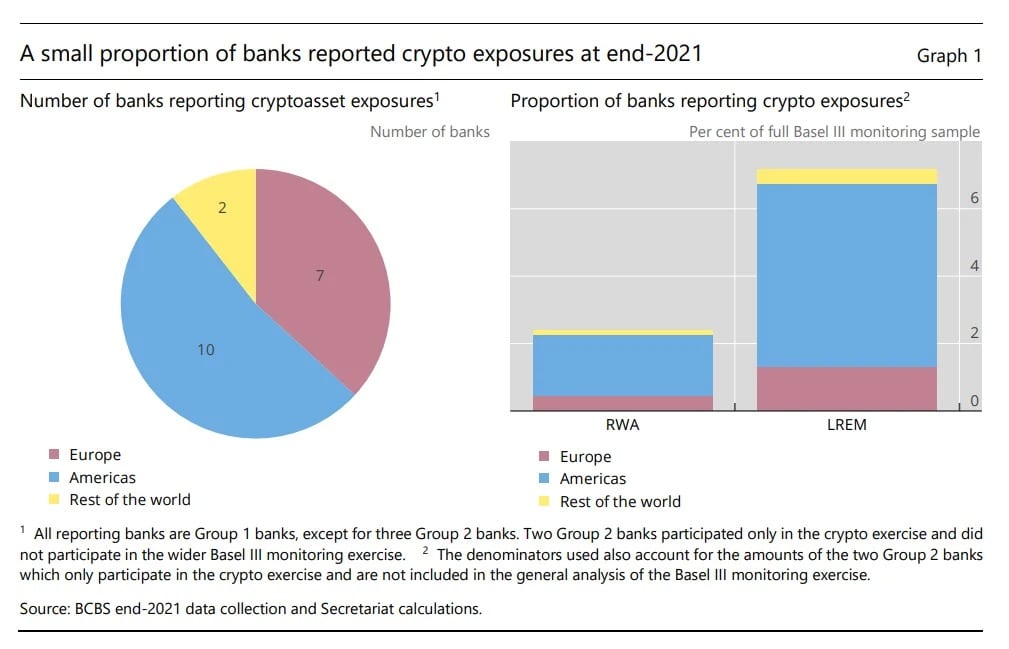

According to data compiled from 19 of the world’s largest banks, including 10 in the Americas, 7 in Europe and 2 in the rest of the world, banks’ overall exposure to cryptocurrencies is around 0.01%. The 19 banks surveyed held €9.4 billion in cryptocurrencies, an exposure of 0.14%.

Geographical distribution of banks holding cryptocurrencies

Furthermore, the paper reveals that assets are held in a very disparate manner, with 2 banks out of the 19 surveyed alone owning more than half of the total cryptocurrencies involved. The next 4 share 40% of that total, and the remaining 10% is shared between the remaining 13 banks.

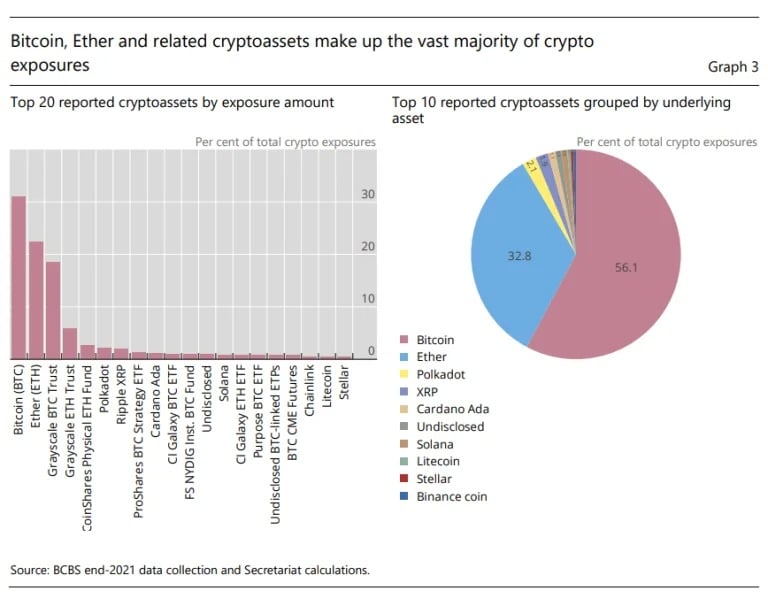

Bitcoin (BTC) and Ethereum (ETH) largely dominant

Assets held are, not too surprisingly, predominantly Bitcoin (31%), and Ether (22%). These are followed by Polkadot’s DOT at 2%, Ripple’s XRP also at 2%, then Cardano (ADA), Solana (SOL), Litecoin (LTC) and Stellar (XLM), in that order. Banks also reported holding a minimal amount of USDC stablecoin as well as tokenised assets.

Breakdown of cryptocurrencies held by surveyed banks

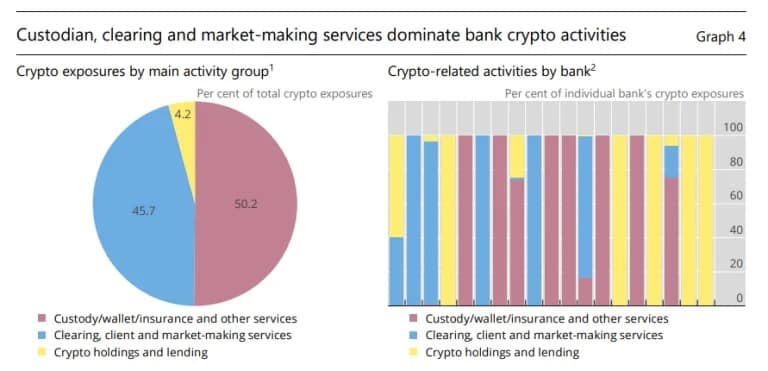

The exposures of the banks surveyed are divided into 3 different sectors: actual asset holding, market making services and custody and insurance services.

We can quickly see that banks’ holding of crypto-currencies only accounts for 4.2% of their activity in this sector, which is very marginal. Custodial services form the majority fringe of the 3 activities, with 50.2% of the shares. As we can see on the right hand side of the graph (4) below, a significant part of the banks reveal that they only offer this service.

Finally, market making services, similar to brokerage, represent 45.7% of the activity of these banks. This includes both trading, securities borrowing involving crypto-currencies or participation in crypto-currency fundraising (ICO).

Breakdown of business sectors on surveyed banks

However, this study should be treated with caution as it only covers a small sample of banks. However, given the growing adoption of cryptocurrencies among institutions, it would be natural for more in-depth studies to emerge in the near future.