The gap between the two largest stablecoins in the market, Tether’s USDT and Circle’s USDC, continues to widen since the beginning of March, largely to the benefit of the former. The USDC has recently lost its peg to the dollar, causing some investors to lose confidence, despite Circle’s CEO reassuring them of the company’s reserves.

USDC not recovering from loss of dollar peg

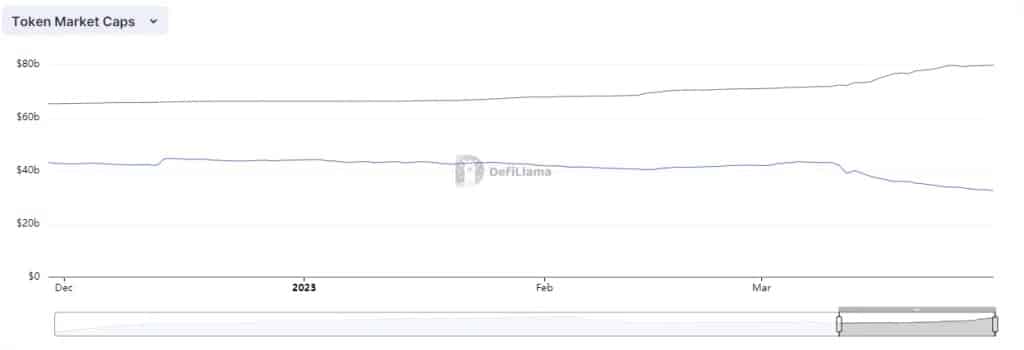

The gap between Tether’s USDT and Circle’s USDC, the 2 most capitalized stablecoins in the market, has been steadily widening since the beginning of this March. So much so that the market share of USDT has returned to its May 2021 level of over 60%, and this through a capitalization now exceeding $80 billion.

As a result, a value shift corresponding to the weekend when the USDC lost its peg to the dollar. A rare event for a stablecoin of this magnitude, but one that was enough to lose the confidence of a number of investors.

Fortunately, the USDC regained its natural peg shortly after the event, but the damage had been done. This was despite an intervention by Circle’s CEO Jeremy Allaire, who personally intervened to remind people of how stablecoin was secured.

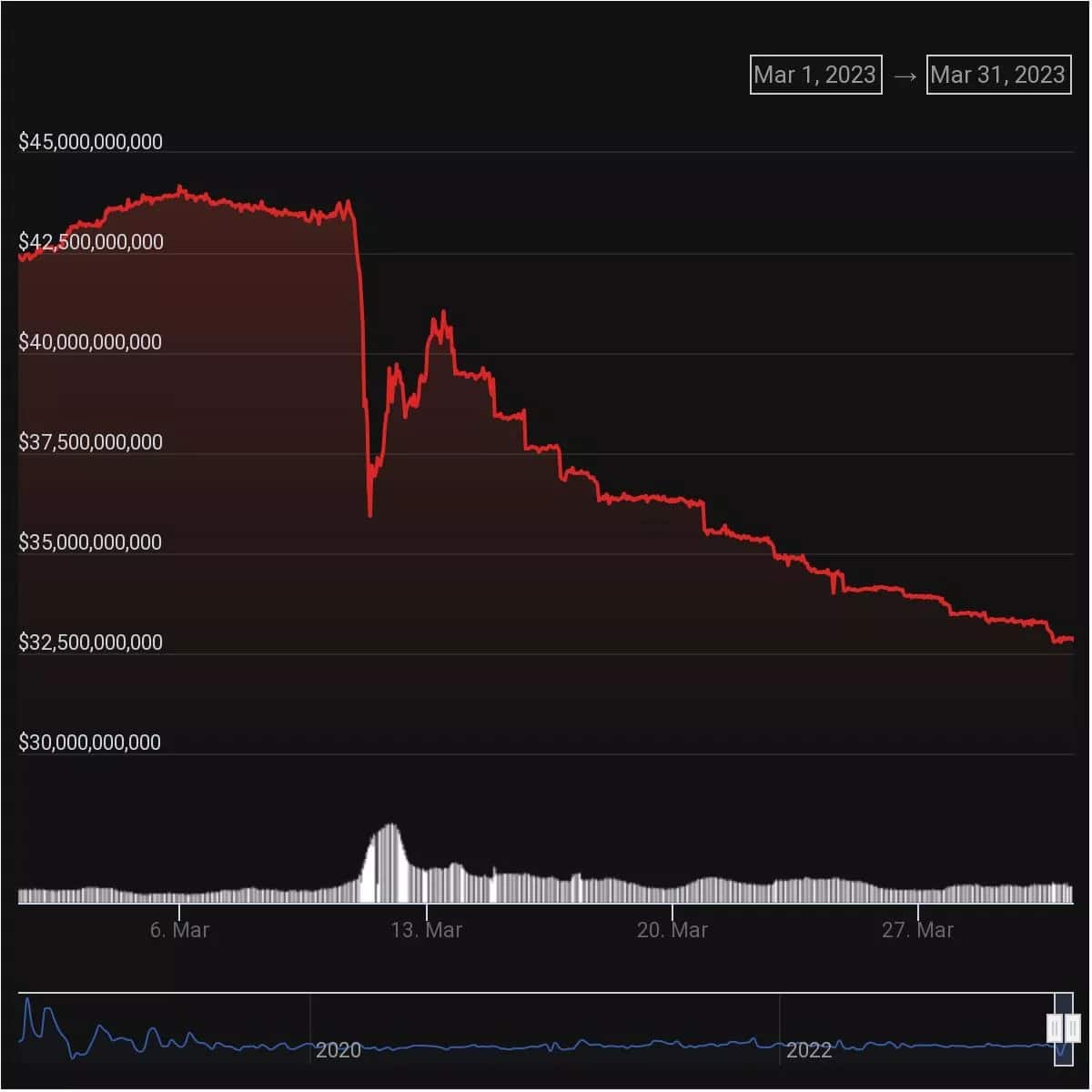

Figure 1 – USDC Market Capitalization Evolution over a Month

In other words, USDC’s market capitalization has lost $10 billion in just 2 weeks. As an example, over the last 24 hours, the equivalent of over $460 million of USDC has been sold for another asset.

USDT is the big winner in the stablecoin debacle

And, as we said in the introduction of this article, it is Tether that comes out the big winner of the problems currently faced by Circle. As such, Paolo Ardoino, Tether’s CTO, recently stated that he expects $700 million in profits for the company for this first quarter. A staggering sum, which brings the USDT issuer’s surplus reserves to over $1.6 billion.

The transfer of value from the USDC to the USDT is clearly visible in the chart below:

Figure 2 – Comparison of the market capitalization of the USDT (black) and the USDC (blue)

Note that a significant number of holders of BUSD, Binance’s stablecoin, have also exchanged their tokens for other stablecoins following the setbacks experienced by its issuer Paxos.

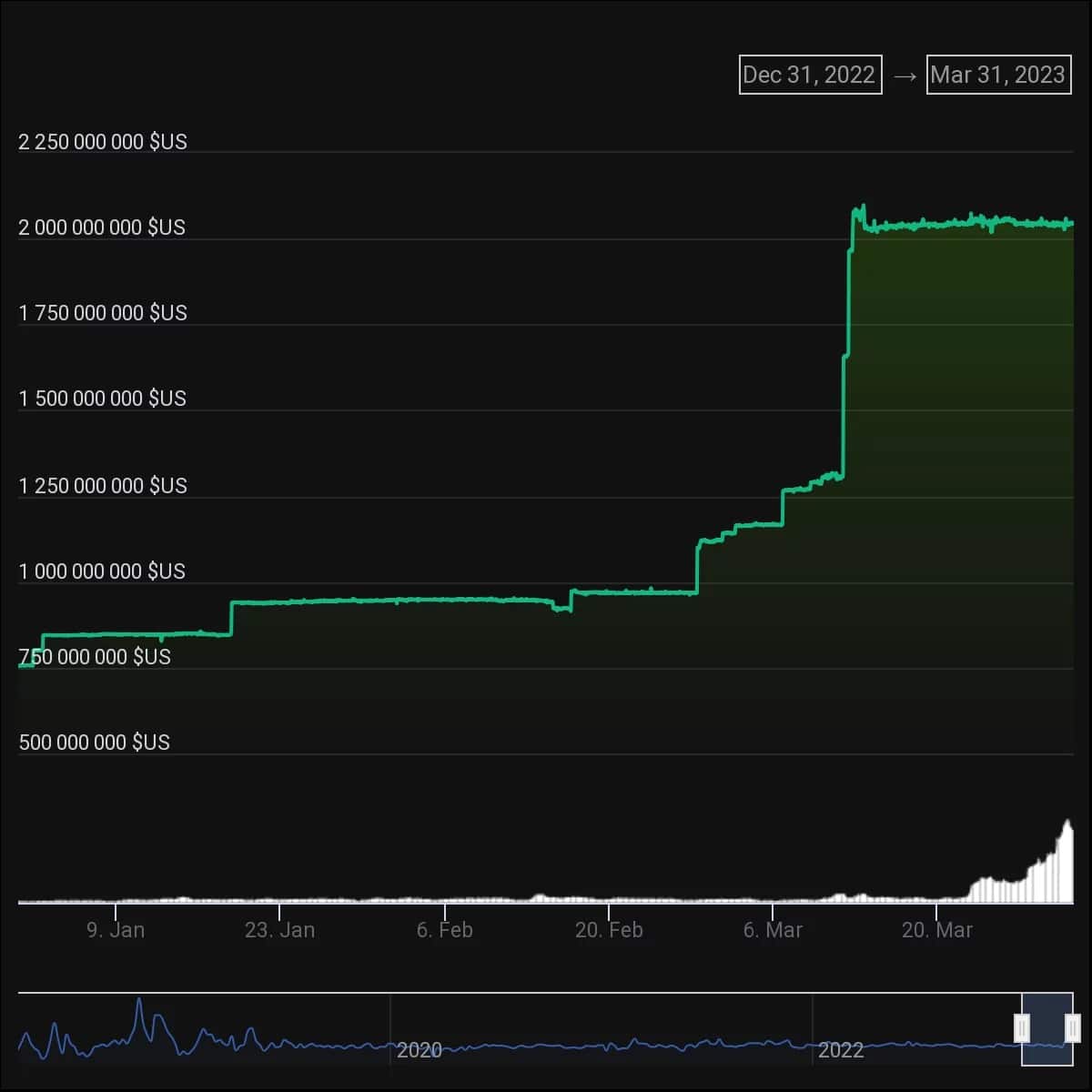

However, we can see that another big winner of Circle’s troubles is the TUSD (TrueUSD), which has seen its capitalization literally multiply by 2:

Figure 3 – TUSD market capitalization evolution since January 1, 2023

Jeremy Allaire, Circle’s CEO, recently tweeted, not without irony, that it was the players who were the most compliant with US regulations that were now perceived as the least safe.