The co-founder and head of new technology investment fund Cathay Innovation, Denis Barrier, talks to TCN about the $50 million investment in Flowdesk, the French market maker. The latter is at the heart of the news, as it is one of the liquidity providers for Grayscale’s Bitcoin spot ETF. Let’s take this opportunity to find out how the major players in the ecosystem are positioning themselves following the arrival of spot Bitcoin ETFs.

Cathay Innovation, a cutting-edge fund

The announcement came barely a week after another highly anticipated one. On January 10, 2024, Cathay Innovation announced that it had invested $50 million in French market maker Flowdesk, following the approval of 11 Bitcoin spot ETFs by the Securities and Exchange Commission (SEC).

With this investment, the fund dedicated to new technologies positions itself a little more as a major player in the crypto ecosystem. But Cathay Innovation, founded 8 years ago, is no newcomer. The fund, which claims $2.5 billion under management, was one of Ledger’s first investors, back in 2017, before becoming one of its largest.

A trial run transformed by a partnership with the French unicorn to create, in June 2022, a fund dedicated specifically to blockchain backed by Bpifrance. The fund has also invested in Starton and Syndicate, 2 Web3 infrastructures.

Flowdesk, liquidity provider for Grayscale’s ETF

An investment that should pay off, since Flowdesk is one of the liquidity providers for the Grayscale Bitcoin Trust (GBTC), one of the 11 spot Bitcoin ETFs validated by the SEC. The French company is also a market maker for EUR Coinvertible (EURCV), the stablecoin launched by Societe Generale, whose value is based on the euro.

With the approval of Bitcoin spot ETFs, Flowdesk sees a colossal market opening up with all the funds offering to invest in BTC, and perhaps Ethereum in a few months’ time.

“ETFs, for Flowdesk, are a huge opportunity,” Denis Barrier, co-founder and CEO of Cathay Innovation, tells TCN. “Players offering ETFs need market makers. And if we estimate that within a year products will become more sophisticated, we’ll need them even more.”

Cathay Innovation’s decision to invest in Flowdesk is not, however, directly linked to the SEC’s approval of ETFs. Discussions had already begun in May 2022. The context was radically different then: the FTX affair had just erupted, and Binance seemed to be facing trouble with the US justice system. It was therefore time for pessimism

Mingpo Cai, founder and chairman of Cathay Innovation (left), and Denis Barrier (right)

“We put forward a thesis at a time when it wasn’t obvious, when no one wanted to invest. We felt we were entering a period of rationalization and rule-setting. Flowdesk started out as a market maker, emphasizing compliance and security from the outset, and we were won over by the hyper-dynamic management.”

Denis Barrier, co-founder and CEO of Cathay Innovation

The executive compares this period with that experienced by the financial markets in the 1980s, when a wave of regulation brought order to a sector that was then sorely lacking in it.

For Cathay Innovation, the investment in Flowdesk quickly paid off. In the months that followed, the company grew by almost 300%. And Bitcoin spot ETFs now enable investors to think even bigger. “It can add very significant volumes of business that we weren’t even counting on, since we hadn’t made the plans with the idea that the ETF would be approved so soon,” Denis Barrier points out.

“Cryptos go mainstream “

The executive is convinced that we are at the dawn of a revolution in finance, with the advent of tokenization, which will affect all sectors. “BlackRock and the world’s biggest asset managers are now giving their clients access to Bitcoin,” explains Denis Barrier. “This opens up a huge market enabling the general public to invest. Cryptos are becoming mainstream.”

The co-founder of Cathay Innovation is also confident that managers from traditional finance backgrounds will realize that blockchain can enable them to modernize their processes. “Asset managers can use blockchain technologies to enter the 21st century, doing away with paper for good by reducing errors,” says Denis Barrier.

The executive sees a particularly interesting period ahead, with an acceleration in the number of innovations on the financial markets over the next 5 to 10 years. And, he is certain, Flowdesk is well positioned to benefit from this development.

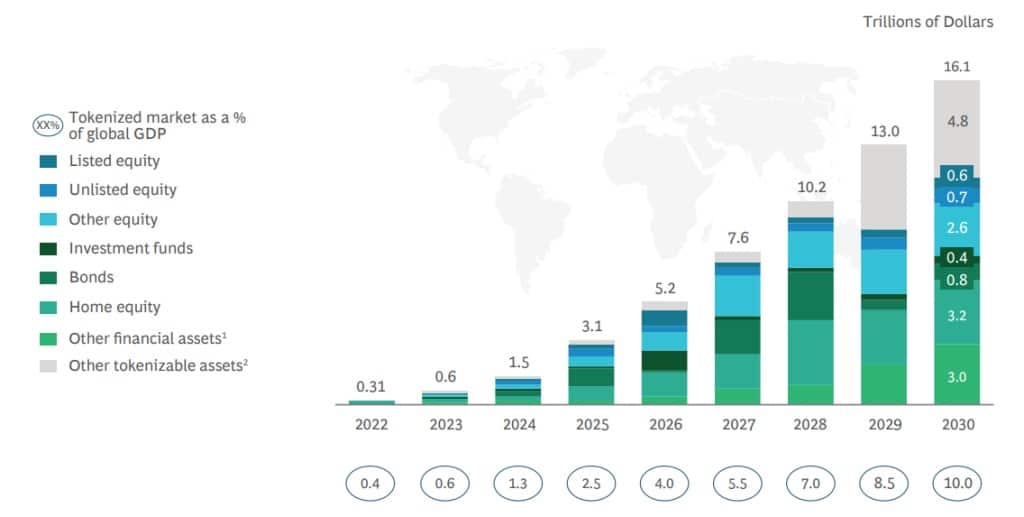

Flowdesk could benefit from the huge Real World Assets (RWA) market, which is growing exponentially. According to a recent report by global consultancy BCG and digital exchange for private markets ADDX, tokenized assets are expected to grow to represent a $16 trillion business opportunity by 2030 – constituting 10% of global GDP by the end of the decade – up from $310 billion in 2022.

Hypothesis of the evolving volume of tokenization by 2030, according to ADDX

A potential paradigm shift for the economy, for which the crypto market has to some extent been paving the way for the past decade or so. “This tokenization movement is starting with the financial markets,” explains Denis Barrier.

“We have assets like Solana, Bitcoin, Ethereum with huge values. They’re designed to exchange and create value, but behind them there’s an economy that’s developing, which is ultimately a service economy. We can see that the service economy is changing today, particularly with automation linked to AI. Entire sectors are going to be radically transformed. And this new economy can find the right support in blockchain. “

In this context, the approval of Bitcoin spot ETFs can thus be seen as a decisive step towards the advent of the tokenization of the economy.

However, Denis Barrier believes it’s still too early to draw conclusions, only ten days after the first ETFs were launched on the market, at the time of this interview. “This symbolically signals the start for all tokens that have a real utility value, which can be analyzed financially and legally,” he explains. “Part of the value of the economy will be in tokens, many of which can be valued with cash flow models. “

“[ETFs] are just steps toward tokenization, and I really believe that’s where we’re headed.”

Larry Fink, CEO of BlackRock (January 2024)

Cathay Innovation is expected to announce further investments in blockchain-related start-ups in the near future, and also intends to focus on artificial intelligence, the other current big narrative in tech.

Web3 and artificial intelligence (AI) are on the verge of converging,” says Denis Barrier. “AI, capable of automating and anticipating tasks traditionally carried out by humans, raises an important question: at the moment of pressing the button, is human supervision required, or can processes take place automatically but with a need for traceability and monitoring? That’s where blockchain comes in.”

In his view, “blockchains will act as the highways for AI”, providing a framework to monitor and guide its actions and thus enable the development of “ethical” AI. “Without blockchain, AI is missing something,” concludes Denis Barrier.