Fifteen years ago today, the US bank Lehman Brothers collapsed, revealing once again the vices of the traditional financial system. Symbolically, the same year saw the birth of Bitcoin (BTC). A look back at fifteen years of history: the legacy of a crisis, the emergence of an alternative.

September 15, 2008: Lehman Brothers goes bankrupt

Fifteen years ago today, on 15 September 2008, what seemed unthinkable happened: the American bank Lehman Brothers declared bankruptcy. More than a century old, this institution, thought to be eternal, was abandoned to its fate by the US central bank, triggering the worst financial and economic crisis since the 1930s.

After several months of financial woes, the fourth-largest investment bank in the United States filed for bankruptcy, leaving a $691 billion debt and 27,000 unemployed employees. After surviving the 1929 crash, it was the subprime crisis that finally got the better of Lehman Brothers.

In the early 2000s, the property speculation bubble was enormous in the United States. Banks were issuing more and more “subprime” mortgages, i.e. property loans granted to customers at risk, i.e. with a high risk of default.

As the US Federal Reserve tried to take action in 2005, interest rates on bank loans rose drastically and sub-prime customers could no longer afford their monthly repayments. This was the beginning of the end for the property bubble, which rapidly collapsed, causing an earthquake on the world’s financial markets.

A few weeks after the collapse of Lehman Brothers, on 31 October of the same year, Satoshi Nakamoto published a now-famous paper: the Bitcoin White Paper.

As a sign that Bitcoin was on the right track, this mysterious individual set out to offer a sound alternative to the traditional financial system, which was infected from within and whose speculative vices plunged the world into one of the worst crises of our era.

15 September 2023: where are we now?

Fifteen years on, the ghost of Lehman Brothers is still very much with us. An ominous barometer of the new financial crises affecting us, it now embodies the deep-rooted flaws in the financial system and its institutions.

So, yes, the storm of 2008 brought about changes in the system. The “Basel III” reform, presented in 2010 by the Basel Committee, increased the resilience of banks, theoretically reinforcing their robustness and security.

The famous “banking union”, introduced in 2014 within the eurozone, led to the creation of the Single Supervisory Mechanism (SSM), which oversees the management of potential bankruptcies of around a hundred banking institutions in Europe.

However, today more than ever, the fate of the world seems to rest in the hands of the few most powerful central banks. The financial system reveals its flaws with each new monetary issue – saving in the short term, destroying in the long term – without which it would have collapsed a long time ago.

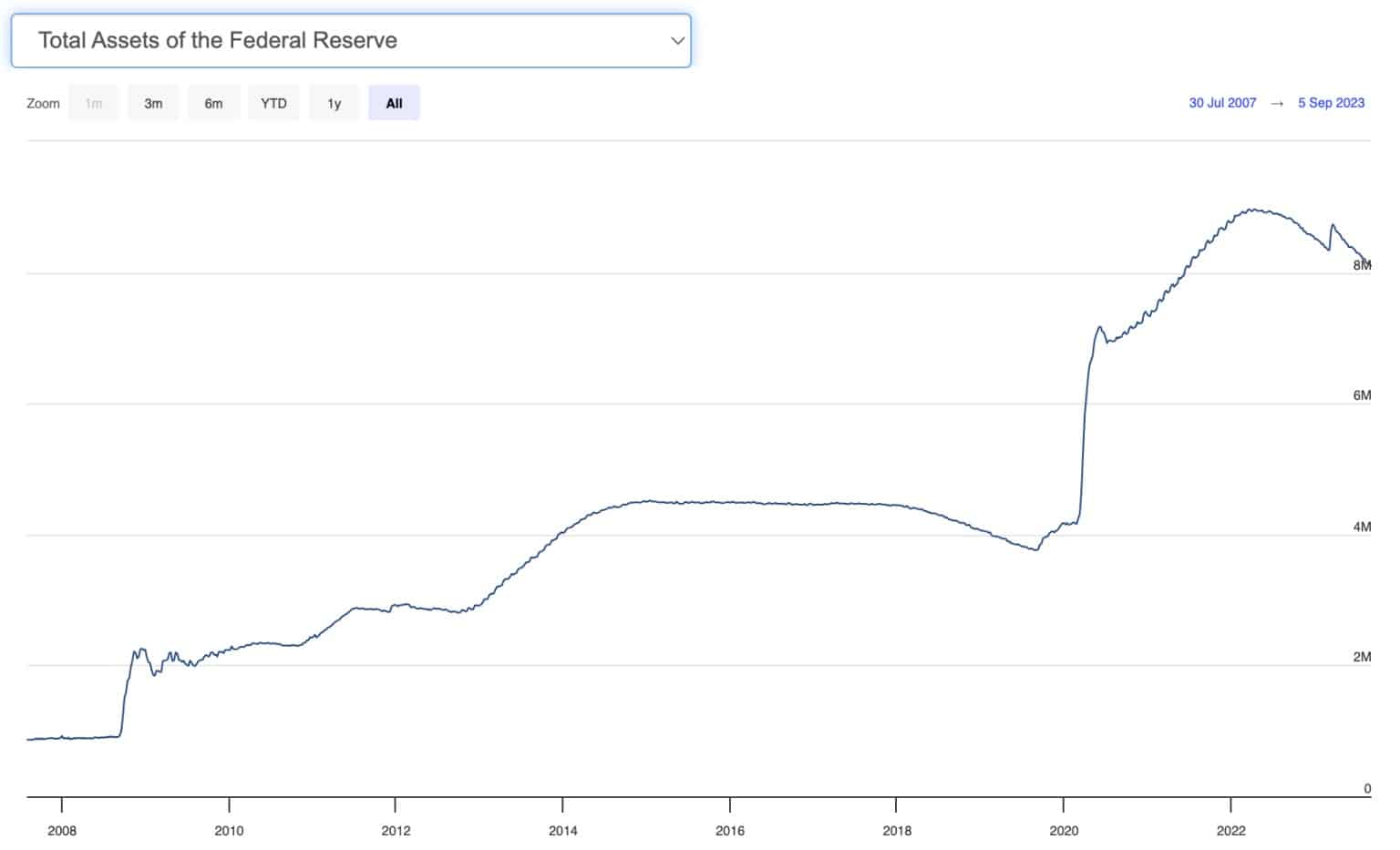

Evolution of FED reserves in US dollars

9 March 2023 saw the collapse of Silicon Valley Bank, a crisis reminiscent of Lehman Brothers. Specialising in start-ups and considered to be one of America’s biggest banks, the SVB once again sent shockwaves through the world’s banks.

Had it not been for the FED’s new stimulus plan, namely the reopening of the printing press and the printing of more than $300 billion in the space of a week, the repercussions would have been far more profound. This headlong rush shows that, fifteen years after the collapse of Lehman Brothers, global finance has not given up its vices.

Meanwhile, Bitcoin’s fundamentals are looking stronger and stronger. While its price on the markets may have soared to $69,000, then fallen back to around $25,000 today, its real (value proposition) continues to rise.