Decentralized finance (DeFi) thunderclap. Better known under the pseudonym “0xSifu”, the co-founder of Wonderland (TIME), one of the biggest DeFi protocols of the Avalanche blockchain, is in fact a well-known criminal and scammer in the industry. This revelation has impacted the entire Wonderland ecosystem. We take stock.

What is Wonderland (TIME)

Launched in September 2021 by Daniele Sestagalli and a certain “0xSifu”, Wonderland (TIME) describes itself as the first decentralised reserve protocol based on the Avalanche network. Its ambition is to build an algorithmic stablecoin that is completely uncorrelated with the dollar and backed by a basket of assets held in the protocol’s treasury.

Daniele Sestagalli is a leading figure in the world of decentralised finance (DeFi). He is the founder of the Frog Nation, a community of Wonderland users, but also of Popsicle Finance (ICE) and Abracadabra Money (SPELL), two other major DeFi protocols launched by Sestagalli.

Wonderland is one of the many fork projects of Olympus DAO (OHM) and has established itself as the most important of them. Like its predecessor, the aim is to build a decentralised autonomous organisation (DAO) with full decision-making power over the future of its protocol, including treasury investments.

The staking principle is the most attractive feature for investors interested in the protocol. And for good reason, the Average Percentage Yield (APY) – or compound annual percentage yield – has been stabilising at around 80,000% for several months. These excessive yields are intended to attract as many investors as possible, but they are logically bound to decrease over time.

To put it simply, Wonderland’s returns are ensured by the various investments made with the cash flow, itself made up of user funds. Eventually, the DAO’s aim is to give users the opportunity to vote for the investment strategy that the protocol adopts. For the time being, the co-founder and financial director, “0xSifu”, is in charge of the cash flow. That’s where the problem lies, and you’ll immediately see why.

The Frog Nation sees red

Before we get into the details of the story, some background is in order. Over the past few weeks, Wonderland has been evolving its strategy, disassociating itself a little more from its parent company Olympus DAO. Users were asked to move away from the TIME token to the wMEMO. In this way, they could deposit it on a platform such as Abracadabra as collateral for a leveraged stablecoin loan.

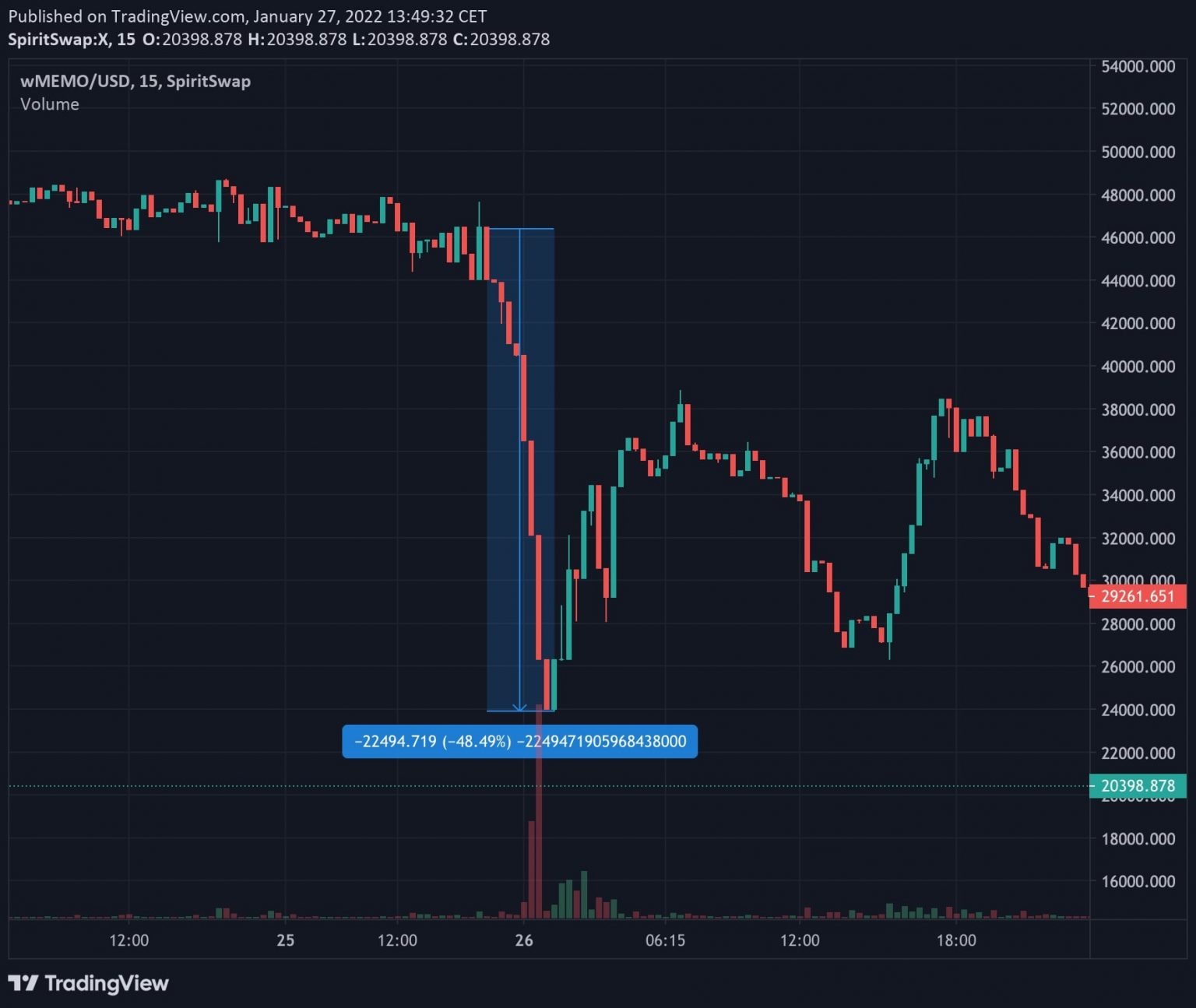

About 48 hours ago, however, the price of wMEMO fell (yet again) dramatically, leading to an unprecedented liquidation cascade. In just a few hours, the price of the token plummeted from $45,000 to nearly $22,000, a drop of about 48%.

Fall in wMEMO/USD price (Source: TradingView)

More surprisingly, this price collapse also led to the liquidation of Daniele Sestagalli’s positions, having himself applied this strategy to the tune of several million dollars. This is a first indication that this attack was premeditated and intended to directly harm the protocol, its founder and its users.

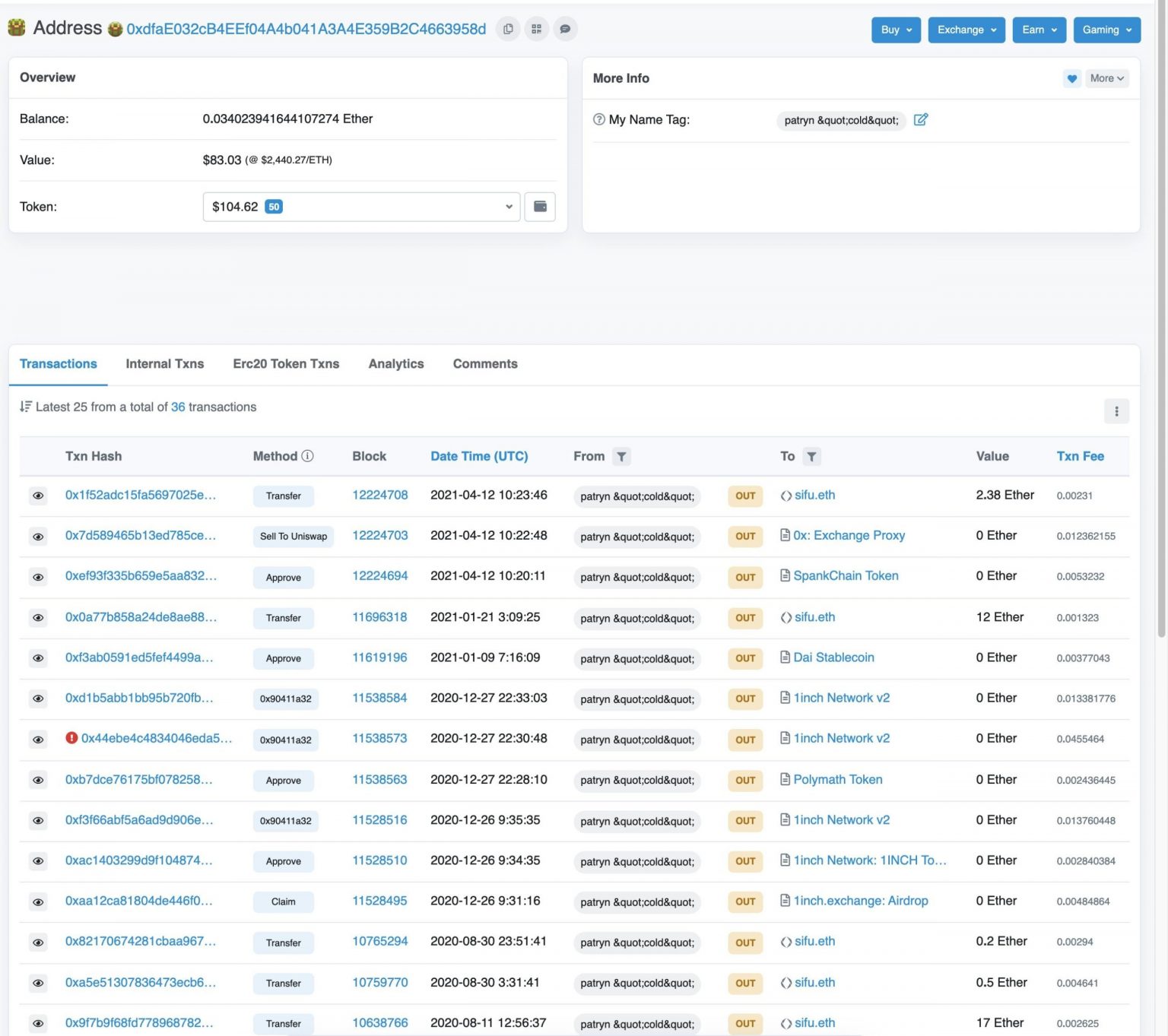

Another intriguing element is that Internet users got their hands on the personal Ethereum address of “0xSifu”. While Wonderland’s investors had been seeing red for several weeks, the CFO’s portfolio went from $45 million to $450 million… Before emptying out, and falling back to around $200 million a few hours later. Strange movements that leave no room for doubt

The masks come off for “0xSifu “

On Thursday 27 January, a user by the name of Zachxbt.eth published a series of tweets in which he revealed private conversations with Sestagalli. Among other things, he explained that he had discovered the true identity of “0xSifu”, who was none other than Michael Patryn, co-founder of the now defunct QuadrigaCX exchange

“Today, allegations about our team member @0xSifu will be circulated. I want everyone to know that I was aware of this and have decided that one’s past does not determine their future. I choose to enjoy our time together without knowing his past more than anything,” Sestagalli said on Twitter.

In other words, Sestagalli confirmed this user’s allegations about 0xSifu, but did not directly admit that he is Patryn, just someone with a sinister past. If you’re not familiar with the story, QuadigaCX was a Canadian exchange platform that disappeared in 2019 after the other co-founder, Gerald Cotten, fled with nearly $170 million.

A little later, Taylor Monahan, founder of MyCrypto, pointed out in a series of tweets that on-chain evidence confirms Zach’s words. In 2019, she identified a wallet as Patryn’s based on a note containing her Ethereum address. She then showed that this wallet remained active and fed several transactions to 0xSifu’s address.

Analysis of Michael Patryn’s Ethereum address, or 0xSifu (Source: Etherscan)

At present, Wonderland’s governance token, TIME, is capitalised at $420 million, a drop of about 50% in less than two days. An evaporation of capitalisation that coincides with the recent rise in value of 0xSifu’s personal portfolio, or rather Michael Patryn. In total, he is accused of stealing over $450 million.

In conclusion, what does the future hold for Wonderland?

In an official statement issued early this afternoon, Daniele Sestagalli finally put an end to the rumors. Indeed, he explains that 0xSifu was indeed “the co-founder of QuadrigaCX, and had other events in the past”. He also admits that he found out about it about 1 month before, but wanted to “give it a second chance”.

Eventually, 0xSifu was removed from his position as Wonderland’s CFO. Danielle Sestagalli also assured that all funds would be returned to the users who had been liquidated by the sharp price drop and that the fundamentals would remain unchanged. It is not certain that these statements will be enough to reassure Frog Nation, which seems to have capitulated definitively.

And for good reason, Wonderland is not the only project of Daniele Sestagalli that has suffered from this affair. Indeed, Popsicle Finance’s ICE token collapsed by 41% in just 24 hours. Far from doing better, Abracadabra’s SPELL posted a sad -25%. More generally, the entire ecosystem of decentralised finance will be bruised by this affair, which should give grist to the mills of detractors and regulators.