Against a backdrop of growing technological and geopolitical tensions, leading Bitcoin (BTC) miners Antpool and Foundry USA are quietly materializing the friction between the USA and China. Their rivalry crystallizes in a competition for control of the Bitcoin hashrate.

A cold war is being waged through Bitcoin

In the frantic race for Bitcoin hashrate domination, Antpool and Foundry USA are positioning themselves as leaders, indirectly reflecting the geopolitical tensions between the USA and China. This rivalry, although primarily technological and economic, finds parallels in the current climate marked by international friction. These elements underline the growing technological rivalry between these 2 powers that influence our world.

This rivalry is even expressed in the mining of Bitcoin by 2 of the industry’s largest companies, namely:

- Antpool, established in 2013 by Bitmain Technologies, creator of the Antminer ASICs, and based in Beijing, stands out as the most important Bitcoin mining pool, holding 28.71% of the world’s hashrate. Over the past year, Antpool has seen its hash rate jump by 133%;

Antpool hash rate

- And Foundry USA, a Digital Currency Group subsidiary founded in 2019, is positioned as the 2nd most influential Bitcoin mining pool in the US, with 27.93% of the global hashrate. This pool has seen impressive growth of around 70% on its hashrate during 2023.

Foundry USA pool hash rate

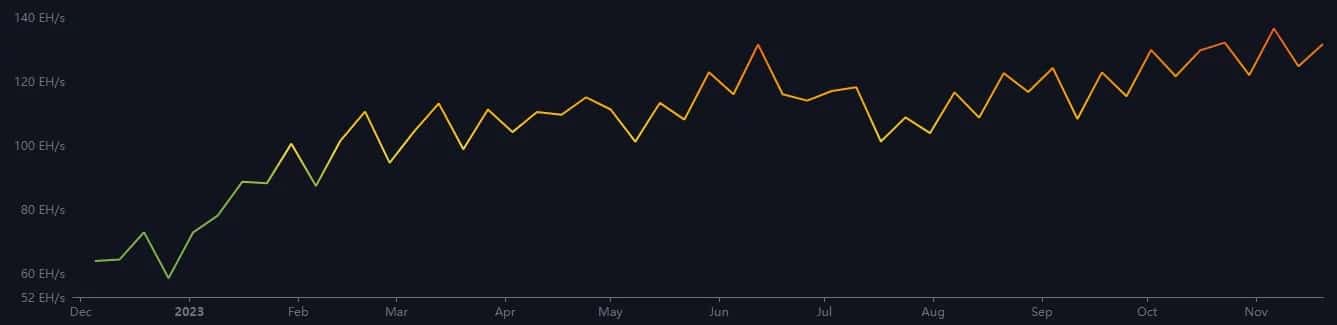

This intense competition between the 2 pools, while considerably strengthening the robustness of the Bitcoin network – whose total hash rate increased by 77% in 2023 – raises questions about the future of Bitcoin’s decentralization and the implications of this hashrate race.

Bitcoin’s hash rate and difficulty

Towards an uncertain future

Currently, although mining pools are profitable, their financial future is uncertain as halving approaches, which will halve miners’ revenues. In such a context, some mining farms could become unprofitable and cease operations, causing a significant drop in hashrate and a potential weakening of the Bitcoin network.

This rivalry between the USA and China in the field of Bitcoin mining can be interpreted in 2 ways. On the one hand, in a positive sense, this confrontation could be seen as an engine for strengthening the Bitcoin network, thanks to the increase in the number of computers involved in block validation.

On the other hand, a more pessimistic view would worry about the possibility of certain mining players becoming too influential, controlling too large a share of Bitcoin’s hashrate.

In an extreme scenario, a mining pool could acquire over 51% of the network’s computing power and start censoring transactions, jeopardizing Bitcoin’s integrity and decentralization.

As this new technological “cold war” takes shape across Bitcoin mining, only time will tell whether this competition will lead to consolidation or, on the contrary, weaken the decentralization on which Bitcoin is based.