A rumour that turned into a fall? Following false claims by a podcaster, the Lido LDO saw its share price fall by 11% over the weekend. We look back at this FUD, and the consequences for the leading DeFi project of the moment.

Rumor spread about Lido (LDO)

Podcast creator David Hoffman shared a rumour about the decentralised finance protocol (DeFi) Lido over the weekend. He claimed that it was the subject of a “Wells Notice”, i.e. an intention to sue, from the Securities and Exchange Commission (SEC). He has since retracted the statement, citing a miscommunication with his source.

But Lido’s LDO price had already been affected by the rumour. It fell -11% in a matter of minutes as the FUD spread:

Lido’s LDO price devolves over the weekend

Although David Hoffman later explained that the rumour was unfounded, it triggered a series of discussions on the future of Lido. As a reminder, the protocol allows ETH to be staked, by offering users tokens in return, in order to bypass the asset lock. However, it is known that US regulators (and the SEC in particular) have been particularly hostile to staking in recent weeks.

Lido in the crosshairs of regulators

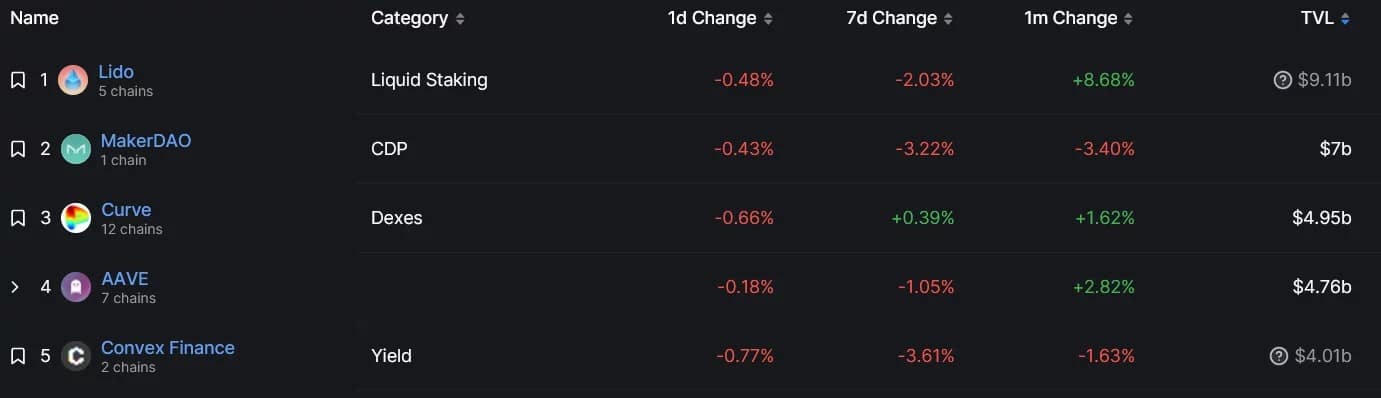

It’s not entirely a surprise to see Lido so scrutinized by the ecosystem. It is currently the leading DeFi protocol in terms of total locked value (TVL). It alone accounts for over 30% of ETH staked on Ethereum, worth over $9 billion currently:

Ranking of the biggest DeFi protocols

If the rumour affecting Lido is – for now – unfounded, the SEC’s tendency to show its teeth is well established. The exchange platform Kraken was forced to end its staking services a few weeks ago, following action by the American financial regulator. It also had to pay a 30 million dollar fine. And Binance is also likely to have to cough up a few dollars to appease the regulators. It is therefore likely that other staking services will incur the wrath of the regulator.