Despite the bear market, fundraising in decentralised finance (DeFi) rose from $0.9 billion to $2.7 billion between 2021 and 2022. However, it’s worth taking a closer look at these numbers.

$2.7 billion raised in DeFi in 2022

The year 2022 will have been particularly marked by the bear market, with prices falling and players in the ecosystem going bankrupt one after the other. However, one sector seems to have come out on top in terms of fundraising: decentralised finance (DeFi).

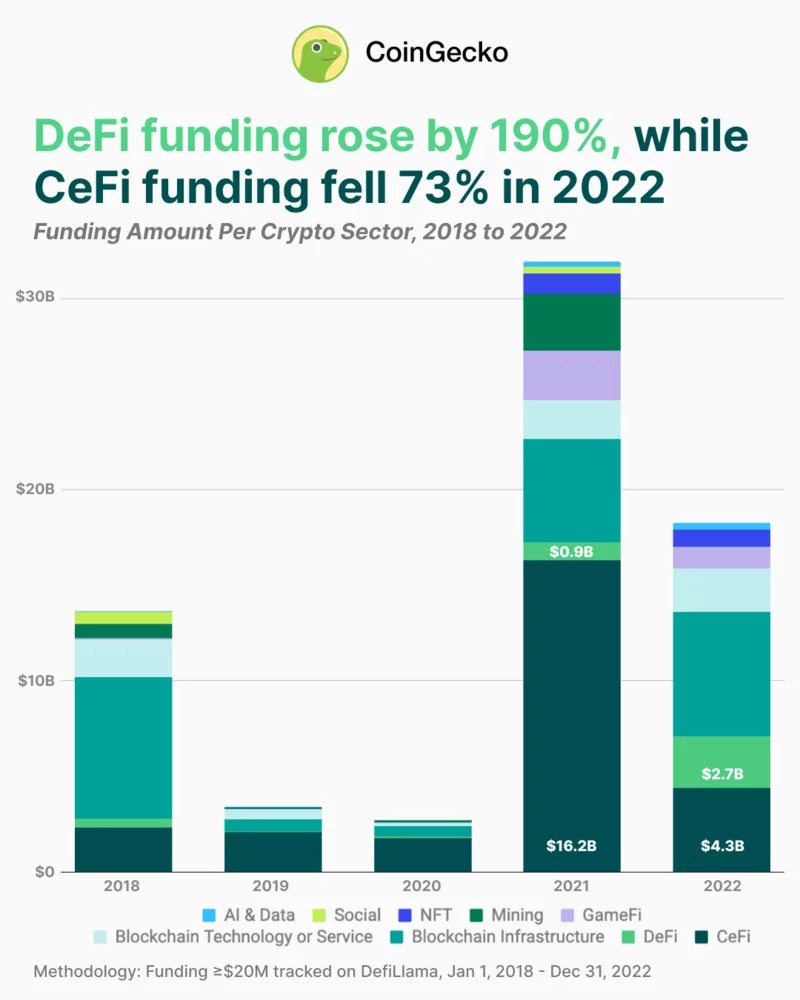

Indeed, according to CoinGecko’s latest study, the total amount of such funding has risen from $0.93 billion in 2021, to $2.7 billion last year, as shown in the chart below by illustrating each sector between 2018 and 2022:

Figure 1 – Summary of fundraising in the crypto ecosystem between 2018 and 2022

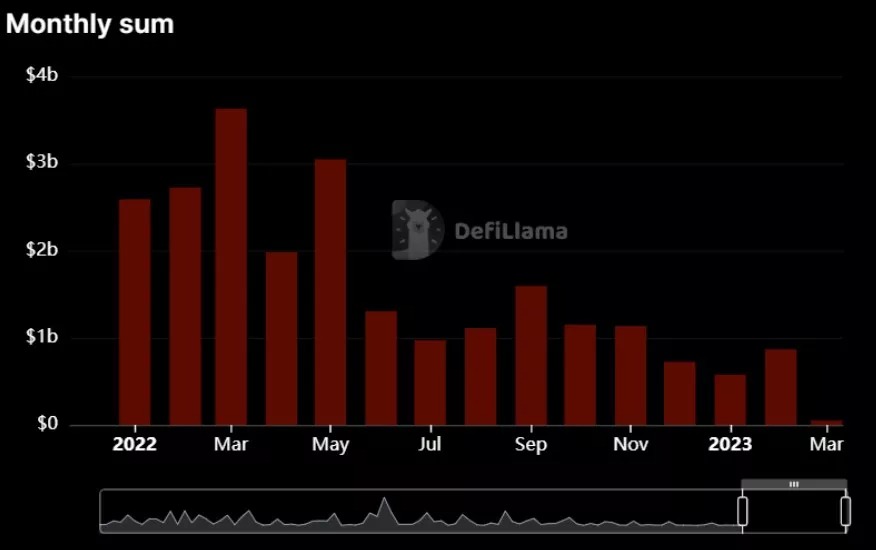

If we look at these numbers more closely, we actually need to take a step back. Firstly, across all sectors, the majority of fundraising in 2022 took place in January and May, before Bitcoin (BTC) fell below $30,000 according to DefiLlama data. The trend is struggling to rise again at the start of the year:

Figure 2 – Overall fundraising since January 2022

Returning to the DeFi sector, it is also important to note that CoinGecko’s data includes a $1 billion sale of LUNA tokens in February 2022 by Luna Foundation Guard (LFG). This fundraising alone accounts for 37% of the industry’s funding this year. We know what happened next with the collapse of UST a few months later.

Nevertheless, even removing this statistical outlier, we still see an 82.8% increase in the amount of fundraising in DeFi between 2021 and 2022: from $0.93 to $1.9 billion.

The state of play in other sectors

While DeFi can claim to have made its mark on fundraising in 2022, there is one sector that has clearly suffered from the fall in prices: centralized exchanges (CEX). And for good reason, CEXs have seen their total funding rounds fall from $16.2 billion in 2021 to $4.3 billion last year, a more than 3.76-fold decline.

For this figure, FTX and FTX.US together accounted for 18.6% of total funding.

However, another sector that saw a year-on-year increase in investment was blockchain infrastructure with $6.10 billion representing a 40.2% increase.

In addition, the explosion of the non-fungible token (NTF) ecosystem is reflected in the $1.4 billion and $883 million in funding over the past two years respectively. At the same time, mining has seen a decline from $1.69 billion to $965 million.

Overall, all of these investments remain much higher than in 2019 and 2020, which tends to suggest some resilience in the industry. Although the end of the beau market is not in sight, fundraising continues, allowing projects to continue to develop their solutions.