21 Coins today have a market capitalisation of more than 10 billion dollars. We take a look at them – and find that pure cryptocurrencies have become almost rare. But then what dominates the market?

Hardly anything says as much about the current state of the crypto market as a look at the usual rankings of cryptocurrencies based on their market capitalisation, for example on Coinmarketcap.com.

We all know that Bitcoin recently reached a new all-time high, that Ethereum is currently hovering on the cloud of the all-time high, that SHIBA INU recently ousted Dogecoin from the throne of memecoins.

What we further know is that there are currently 108 “unicorns”. By “currently” I mean yesterday afternoon when I started this text, and by unicorns cryptocurrencies with a market capitalisation of more than a billion dollars. This term comes from the startup world, where it distinguishes those companies that reach a valuation of more than a billion dollars.

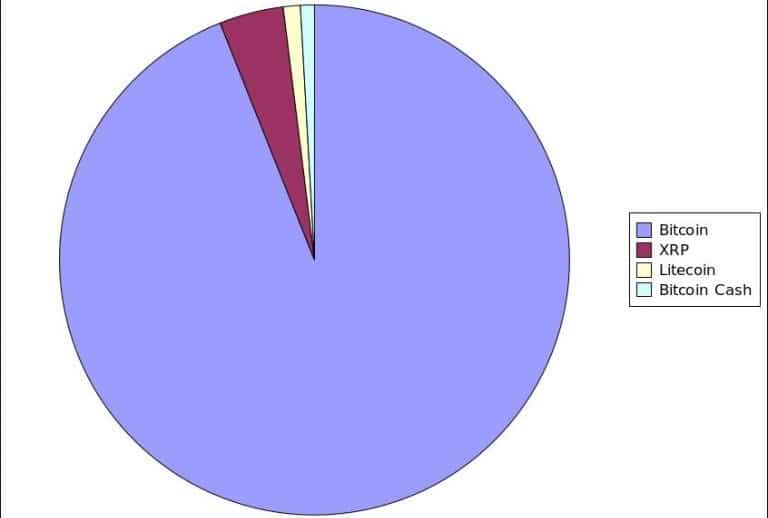

The 21 Super Unicorns on coinmarketcap.com

But today we’re not talking about the unicorns – but the super unicorns: cryptocurrencies with a market capitalisation of more than $10 billion. There are “only” 21 of these left, and we’ll take a closer look at them.

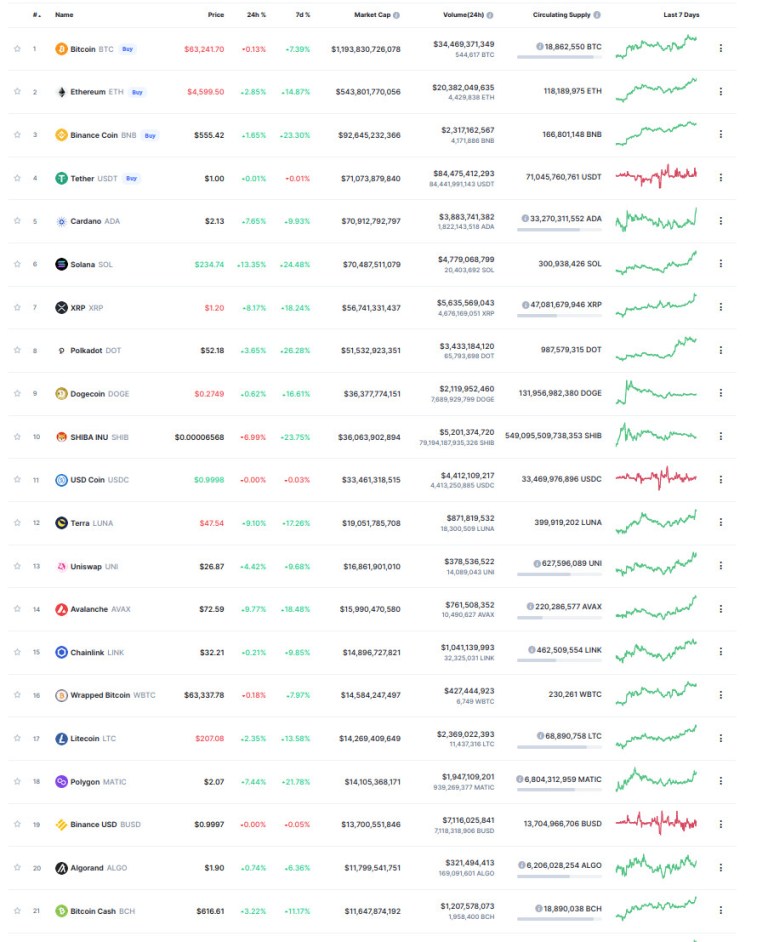

Firstly, which categories do they belong to?

Super unicorns by number

This is where we come across the first surprise: “Real cryptocurrencies” such as Bitcoin, Litecoin or Bitcoin Cash do not even account for a quarter of all super unicorns. In contrast, smart contract platforms make up almost half of these rare creatures. The rest is distributed among stablecoins, memecoins and DeFi tokens. If you consider Stablecoins, DeFi tokens and the Memecoin SHIBA INU to be the product of smart contract platforms – because that is where they run – they would dominate the market by now.

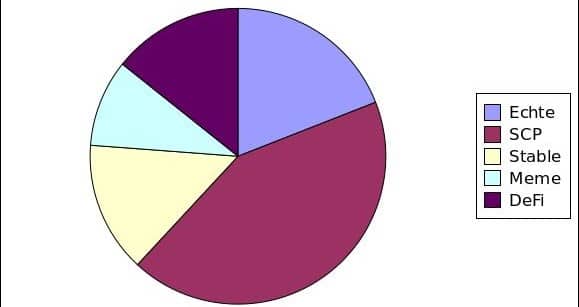

But things look different if we look at market capitalisation rather than pure numbers. In total, all 21 super unicorns weigh in at just under 2.4 trillion dollars. Significantly, the entire crypto market “only” manages 2.74 trillion.

Out of 7001 cryptocurrencies listed by Coinmarketcap, 0.3 per cent – the 21 super unicorns – account for 86 per cent of capitalisation. Pareto’s formula that 20 percent of everything provides 80 percent of everything seems like a socialist delusion by comparison.

But back to our super unicorns. As can be seen, real cryptocurrencies are regaining the top spot in terms of value. More than half of the $2.369 billion market cap of the 21 super unicorns falls to the real cryptocurrencies. They are followed by smart contract platforms, which also take a decent chunk, while the share of stablecoins, memecoins and DeFi tokens shrinks significantly.

In the following, we take a closer look at the individual categories.

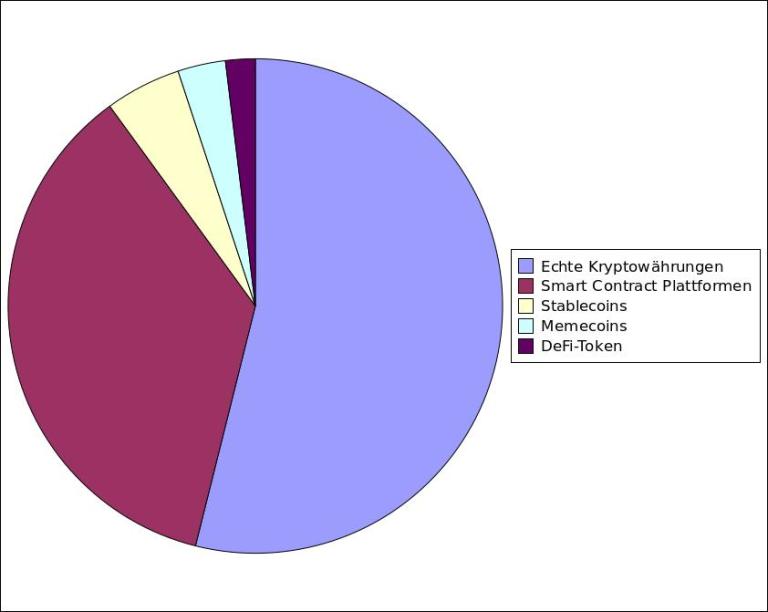

Real cryptocurrencies

Bitcoin is the blueprint for true, decentralised cryptocurrencies. With a market capitalisation of $1.2 trillion, Bitcoin is the undisputed king of its class and tops the charts of all cryptocurrencies. With this enormous value, Bitcoin is no longer a super unicorn, but a mega or monster unicorn. In mythology, Bitcoin would probably be the unicorn that eats the world.

Real cryptocurrencies

After Bitcoin, you have to search for a while until you find the next real cryptocurrency. Under certain circumstances, that would be Ripple or XRP with a market capitalisation of 52 billion dollars. Whether Ripple really belongs in this class, however, is questionable due to its lack of decentralisation. Can something that is considered “security” by the American regulator because it is too closely tied to the fate of Ripple really be a cryptocurrency?

A little deeper, we find Litecoin (LTC) at $13.8 billion and Bitcoin Cash (BCH) at $11.3 billion, two more genuine and decentralised cryptocurrencies.

If we go even deeper, leaving the palace of super unicorns and entering the grove of unicorns, we could possibly add Stellar (XLM) (9 bn. Dollars), Fantom (7 billion), Hedera (5.9 billion), Tezos (5.5 billion), Monero (5 billion), eCash (3.4 billion), Bitcoin SV (3.2 billion), Zcash (2.3 billion), Mina (1.2 billion) and Ravencoin (1.2 billion). However, the boundaries between a real cryptocurrency and a smart contract platform are sometimes rather blurred.

One thing is clear, however: in no category does a coin dominate as strongly as Bitcoin does here. I wonder if this is because a true cryptocurrency claiming to be decentralised hard money relies on network effects more than any other type of coin? Money, after all, is what most people accept as money.

Smart Contract Platforms

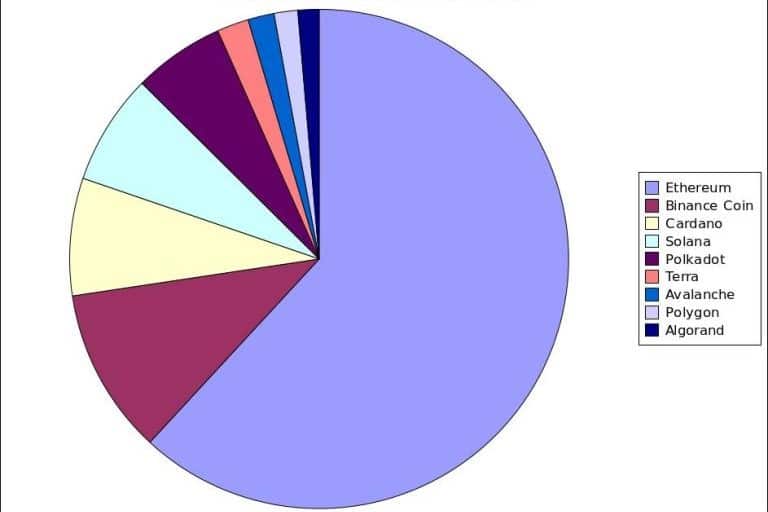

The next category is that of smart contract platforms. Once again, we find the founder of the category at its top: Ethereum (ETH) with a market capitalisation of $529 billion. However, the gap here is shrinking to the competition, which is significantly more richly represented among the super unicorns than in any other category.

Smart Contract Platforms

Ethereum is followed by Binance Coin (BNB), which is stuck in the second largest smart contract platform spot with 92 billion. After that comes Cardano (ADA) with 65, Solana with 61.5 and Polkadot (DOT) with $50.6 billion. Then, far behind, we find Terra (17.6 billion), Avalanche (14.5 billion), the Polygon sidechain (13.1 billion) and Algorand (11.7 billion).

This makes smart contract platforms the busiest category. The chances of making it to the holy land where the super unicorns graze are probably greatest with this type of blockchain, even if, like Cardano, it can’t really do smart contracts yet or, like Polkadot, is still heavily experimental in its construction. However, Ethereum continues to lead by a wide margin – and this is despite the huge pain that the fees on Ethereum cause users.

True, it’s easier to switch platforms if you want to earn dollars in DeFi. But the network effects still take hold.

Stablecoins

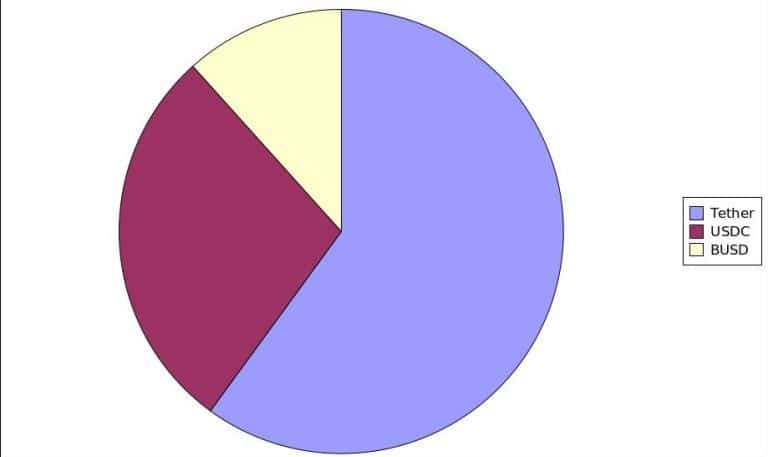

Working down from the top, we now come across the first stablecoin, Tether (USDT). Tether brings up a market capitalisation of 70.6 billion dollars and thus clearly leads in this class, despite all the scandals and uncertainties. However, it is followed not so much further by the centre dollar USDC with 33.3 billion, and then the Binance USD (BUSD) with 13.7 billion dollars.

Stablecoins

If we were to expand this inspection, we would find the first decentralised stablecoin in the form of the 6.5 billion Dai dollars, another slightly smaller decentralised representative in the form of TerraUSD with 2.8 billion dollars, and two centrally managed stablecoins with around one billion units in the form of TrueUSD and Pax Dollar.

Memecoins

The most unlikely category now are the Shiba Inu memecoins Dogecoin and SHIBA INU. We find both head to head as super unicorns, SHIBA at $38 billion, Dogecoin (DOGE) at $36 billion.

What is amazing now is that there are no other successful memecoins far and wide. Neither did coins trying to jump on the Doge bandwagon as well reach the unicorn threshold of one billion dollars, nor other memecoins such as the Cat Token. Why does it only work so well with the Doge?

DeFi Token

Finally, we encounter the first DeFi token with the Uniswap tokens, which have a market cap of $16.1 billion. It is followed by Chainlink, the main oracle for DeFi, with $14.9 billion, and Wrapped Bitcoin with $14.6 billion. For them, I wasn’t sure if they really belonged in this category.

If we scroll a little deeper, we find numerous other tokens for DeFi on Coinmarketcap that have achieved unicorn status after all. For example, PancakeSwap (4.4bn), Thorchain (4.4bn), Aave (4.3bn), Maker (2.6bn), Yearn (1.3bn), Synthetix (1.2bn), Perpetual Protocol (1.2bn), 0x (1.1bn). Many more traditional, centralised startups also make it into the unicorn enclosure with their tokens: FTX with 7.1 billion, Crypto.com (CRO, 6.2 billion) Unus Sed Leo (Bitfinex, 3.2 billion), Huobi token (1.8 billion), Nexo (1.7 billion), OKcoin (1.4 billion) and Ankr (1.1 billion).

In other words, the tokens are a popular way to raise capital for centralised and decentralised projects, bypassing regulation. Whether these tokens can even be called a “cryptocurrency” is questionable. What is clear, however, is that there are so many unicorns in no other category – even if the leap to the Olympus of super unicorns is difficult here. One could conclude from this that the network effects that are so extremely effective with cryptocurrencies hardly play a role here.