Dogecoin demonstrated what happens when you combine a meme with cryptocurrencies. SHIBA INU goes one better and combines a meme with DeFi. The result is a vertitable rocket fuel that reveals much about the hidden relationships of memes, value and decentralisation.

Several millennia ago, King Croesus had some 10 tonnes of gold brought to Delphi. In return, the oracle’s high priestess, the Pythia, sent him a divination of how his reign would go. This short, strangely self-fulfilling prophecy remained the most expensively traded meme in world history for a very long time.

Croesus and the Pythia had instinctively grasped what the technology-obsessed crypto scene likes to overlook: Memes are more powerful than technology.

Cryptocurrencies are, it is sometimes said, only one per cent technology and 99 per cent memes. That may be an exaggeration if you look at Bitcoin or Ethereum – but it may be even more understated if you look at Dogecoin and SHIBA INU. The coins, both a homage to the “Doge”, that Shiba Inu that has become a cult on the internet, are more like 99.99 percent memes and 0.01 percent technology. If at all.

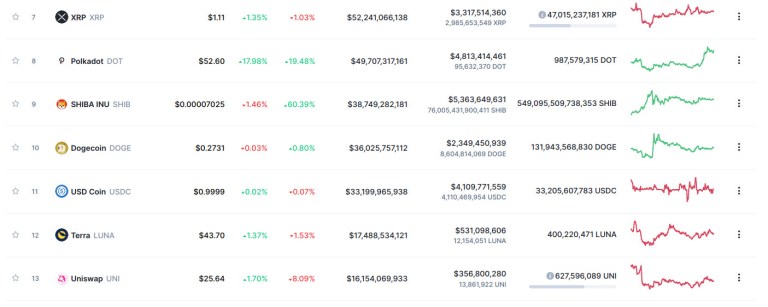

And yet Dogecoin is one of the longest-lived altcoins on the market, having worked its way up into the top 10 cryptocurrencies in this bull market and reached a market capitalisation of a good 36 billion dollars. Memes are powerful. Just how powerful is now demonstrated by SHIBA INU.

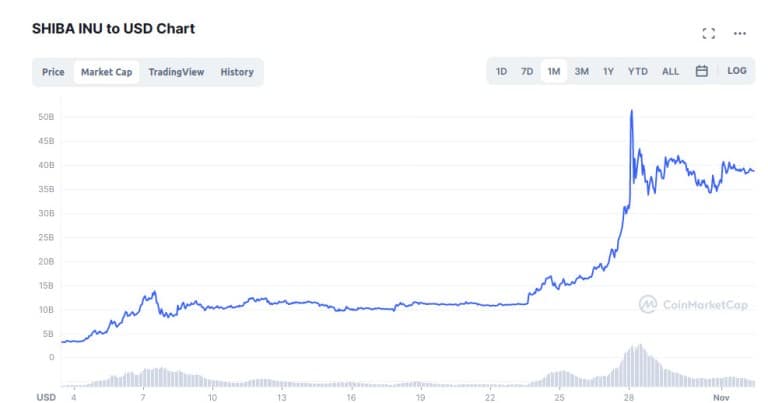

Market capitalisation of Shiba Inu (SHIBA) in the last 30 days according to Coinmarketcap.com

SHIBA INU was launched in August 2020, as another coin capitalising on the Doge meme. It was quite amazing that it worked once. That the move will pull off another time is almost laughably unlikely.

But it did. SHIBA rose rapidly at the beginning of the year, then collapsed again from a peak in May, and in recent weeks began an astonishing second rally, compared to which the first one is shrinking into dwarfism. In the past week SHIBA has doubled in price, and in the past 30 days it has increased about tenfold. In the meantime, with a market capitalisation of more than 38 billion dollars, the coin is in ninth place in the ranking of cryptocurrencies, ahead of Dogecoin.

38 billion dollars – for a copy of a joke and meme coin?

Shiba Inu ranked 9th among cryptocurrencies on coinmarketcap.com.

Twitter is thrilled or outraged simply because it was so unlikely to happen, and because the improbable, when it comes true, is a nice kick in the butt to the snooty, boring rationality of everyday life. Particularly in focus is a wallet that had bought SHIBA tokens for $8,000 in August 2020 and held them ever since. How much do you think those SHIBA tokens are worth now?

That’s right: $5,700,000,000. The SHIBA tokens probably became the most successful investment in the history of mankind. (Almost) anyone can become a millionaire with a few thousand dollars. Real alpha comes from becoming a multi-billionaire with it.

Want to see the best trade of all time?

This wallet bought $8,000 of $SHIB last August.

It’s now worth $5.7 billion.

I repeat – 5.7 billion dollars in 400 days.

He owns 16% of marketcap. pic.twitter.com/A164lQyBfX

– unusual_whales (@unusual_whales) October 27, 2021

What the heck is going on? Memes are powerful – but that powerful? Is SHIBA INU mainly marking how much the crypto markets are in a bubble? How absurd values are in themselves? Or is SHIBA simply putting the Doge meme on a better technical footing than Dogecoin ever could?

Everything hinges on memes and distribution

To learn a little more about SHIBA INU, one can head to the website, study the whitepaper and read the blog posts by Ryoshi, the founder. None of the sources waste too many words on the technology – most not a word – simply because there is not much to say about it. SHIBA is mostly memes and a bit of economics. The technology is boring and plays almost no role. That SHIBA doesn’t pretend to be about technology makes Memecoin one of the most honest cryptocurrencies on the market right now.

The Woof Paper explains that SHIBA INU is an “experiment in decentralised, spontaneous community building”. The cryptocurrency should be “100 per cent community-led.” Founder Ryoshi also emphasises this on his blog: He had “always been fascinated by the decentralised genesis of communities”. To be more precise: To what degree they are seeded and guided by invisible hands, or whether they really grow into something permanent and 100 percent owned by the community from the start, the way BTC or DOGE did without central figures or organisations. ”

Don’t be discouraged just because Shiba is not yet listed in robinhood.

For those who are new in the ShibArmy you can read the Woofpaper, It will be better than watching youtube vids that predicts the outcome of Shiba Inu.

Never doubt, HODL and keep calm.SHIB pic.twitter.com/Z63SCEp45y– JJK Crypto (@jjk_crypto) October 30, 2021

These decentralised communities are playing an increasingly important role, both in cryptocurrencies and in traditional finance. It was an “eye-opener”, it said, when the WallStreetBets community drove up the share prices of GameStop and AMC, giving hedge funds a thrashing. They were, the white paper said, “testing how to distribute control to consumers and inexperienced investors.” WallStreetBets demonstrated the power of memes and became a meme itself.

But memes don’t float in free air. When you put the meme of decentralisation in front of you, like the ShibArmy (that’s what the community calls itself) then you have to mean it. A centralised coin that advertises decentralisation is not capitalising on a meme, it is deceiving investors. Therefore, Ryoshi has indeed honestly ensured that SHIBA becomes the haven of the most decentralised community possible. And he has done so in a way that demonstrates a keen sense of memes.

“Since crypto is always about tokens, I think, quite honestly, decentralisation is a matter of incentives and distribution of tokens. If a mysterious admin holds 30 per cent of all tokens in a supposedly ‘locked wallet’, then the admin is still 30 per cent responsible for the community. That happens a lot.” Therefore, Ryoshi and his team aim to “ensure fair distribution from day one in a very altruistic way.”

As a result, Ryoshi has not spent any Satoshi on the project, nor has he reserved a single SHIB token for himself. “Every token I own, I buy on the market, just like everyone else. ”

Through total centralisation to decentralisation

SHIBA Inu are typical ERC20 tokens on Ethereum. There is, technically, almost nothing special about them. What is special, however, is the distribution of the tokens. The team put half of them into a Uniswap pool to be available as liquidity and then threw away the key. They transferred the other half to Ethereum co-founder Vitalik Buterin.

This is surprising: why does a cryptocurrency that wants to form decentralised, leaderless communities give half of the tokens to someone like Vitalik Buterin, who is not only rich but insanely rich through Ethereum? The move sounds absurd, but shows a certain wisdom and sociological curiosity. “Without weakness,” Ryoshi explains, “there is no greatness. As long as Vitalik doesn’t stab us in the back, SHIBA will grow and survive.” That’s why, as it later came out, Ryoshi not only transferred the tokens to Vitalik, but also the LP tokens, which managed liquidity on Uniswap.

So Vitalik Buterin owned not just 50, but 100 per cent of the SHIBA INU tokens. The project, which is supposed to be 100 per cent decentralised, was 100 per cent centralised. There is, again, some wisdom in that.

While a Shiba can be completely calm and relaxed inside the house, outside the primal dog comes out. He hears only in the radius of 10 meters. If he is further away, one has his dear trouble to penetrate to him”, so shibaclub.de about the nature of the Shiba Inu. Image by Yuya Tamai via flickr.com. License: Creative Commons

Furthermore, this highlights the meme aspect of SHIBA INU. Vitalik Buterin, this nail-biting Canadian-Russian genius, has been the face of Ethereum since day one, and his influence on the project has always been vastly overrated by the public. Vitalik is, in other words, a meme, and SHIBA-INU founder Ryoshi put all his cards on him.

And Vitalik did not disappoint him. He created much bigger memes: first, he transferred a massive amount of SHIBA tokens – around 5 per cent of the total – to an Indian charity that fights COVID and its consequences. Worth more than a billion dollars, this was the largest donation in cryptocurrencies ever. Meme number one was thus accomplished.

But it went even further. About a week later, Vitalik burned 40 percent of all SHIBA tokens – just over 410 trillion SHIBA – that is, transferred them to an address for which no one holds the keys. This address is publicly known as the “black hole”. The 410 trillion SHIBA were worth around 7 billion dollars at the time of the transaction. Today they are equivalent to 28 billion dollars. This made it the biggest token burn ever – probably the biggest destruction of wealth ever – and SHIBA INU killed two birds with one stone: the coin actually became more decentralised – and it achieved meme numbero two with the record burn.

The bet that decentralisation comes from one thing being fully centralised to begin with went on.

Capitalising on memes better with DeFi

But that – the distribution, the memes – can that really be enough to justify an ecosystem being worth more than a billion dollars? Let alone 36 billion? Decentralisation may be important. But it alone cannot be sufficient to make an ecosystem permanently valuable. Even the greatest degree of decentralisation remains an empty shell – a hollow meme – if it is not countered by a real economy.

But where is this in SHIBA INU? One can only guess. The ShibArmy, for instance, tries to promote art – art that, as expected, centres on the Doge – and also to donate to the rescue of lost Shiba Inus via Amazon.Smile. But this is ridiculously small.

The only things SHIBA INU has to show for it so far are ShibaSwap and two other tokens. ShibaSwap is a decentralised exchange, something like Uniswap or Sushiswap, where you can trade three tokens: SHIBA, LEASH and BONE. On ShibaSwap, you can of course also put these three tokens into a pool to provide liquidity. This is a standard in Decentralised Finance (DeFi) that sets SHIBA INU apart from Dogecoin, where there is no such thing.

In doing so, ShibArmy has also been relatively creative. When you “bury” the SHIBA tokens, they become xSHIB. These xSHIB receive a share of the BONE tokens generated with new blocks as well as a share of the transaction fees on ShibaSwap. Similarly with LEASH tokens. These run as “Dogecoin killers” – Leash means leash – and were actually supposed to be linked to the price of Dogecoin. However, this has since been abandoned and they are a simple ERC20 token, albeit with the very scarce circulation of just over 100,000 copies. LEASH tokens can also be buried to make them xLeash, which also earn a share of the newly created BONE tokens as well as trading fees on ShibaSwap.

ShibaInu is a community driven Defi Ecosystem $ShibWoofPaper

– ShibaMyInu (@ShibaMyInu) November 1, 2021

Thus, SHIBA INU not only capitalises, like Dogecoin, on the scarcity created technologically by the Blockchain. SHIBA INU also harnesses the power of DeFI. By allowing tokens to be withdrawn from circulation at interest, they reinforce scarcity and prevent too many tokens from flowing into the market, being sold and depressing the price.

And from the looks of it, it seems to be working. SHIBA INU has taken meme capitalisation to a new level. The whole thing is as ridiculous as it looks – but the market validates the project. And abundantly so.