The release of PYUSD caused quite a stir at the beginning of August, as it showed the giant PayPal’s commitment to the cryptocurrency sector. A month and a half on, where does stablecoin stand? A new report from the company gives us the lowdown on its evolution.

How is the stablecoin PYUSD guaranteed by PayPal?

PayPal has published its very first report on the PYUSD stablecoin. Now a must in the stablecoin world after the Terra fiasco, this type of report shows how many tokens are being issued, and how they are backed. The document ends on August 31, and at that date PayPal had issued 44.3 million PYUSD.

Notably, the PYUSD is backed by only $1.5 million in cash. The remaining $44 million came from US Treasury securities, known as Collateralized Reverse Repurchase Agreements. These are securities sold by one institution to another, with the expectation of repurchase at a fixed date, usually for a higher price.

Backing stablecoins with securities linked to government debt is no exception. The majority of centralized stablecoins are partially backed by fiat currency equivalents, such as US Treasury bills and bonds. At Tether (USDT), cash and cash equivalents account for 85% of reserves… But of these, only 0.12% are actual cash deposits. At Circle’s USDC, the $26.1 billion in reserves are divided into two categories. 24.3 billion correspond to a varied reserve fund managed by BlackRock. The “real” cash only corresponds to 1.8 billion dollars.

This of course raises the question of the links between assets that claim to be independent and highly centralized institutions. We have to look to decentralized stablecoins for other models. But these are no longer in the odor of sanctity since the disaster that was the fall of Terra’s UST.

Measured success for PYUSD?

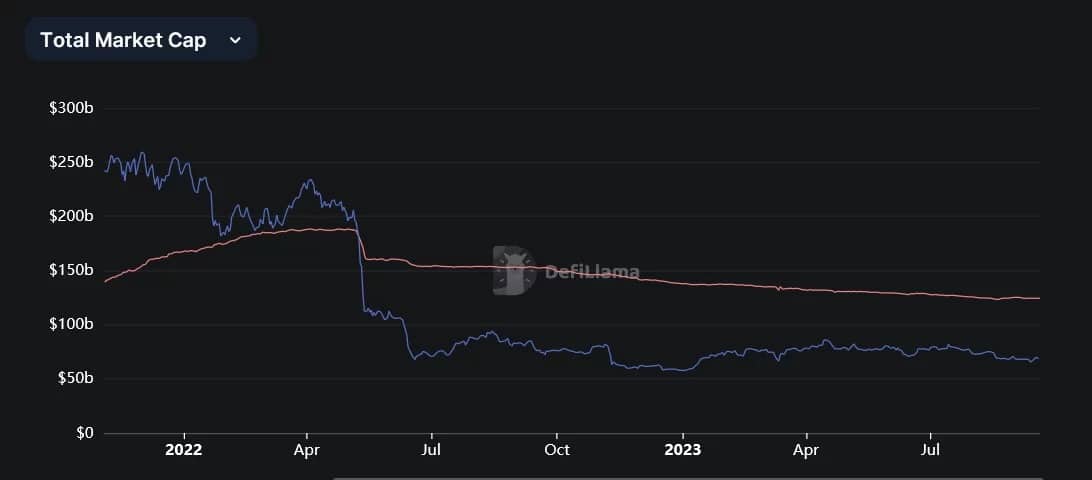

It’s still too early to draw any conclusions, but PYUSD’s capitalization suggests that stablecoin is enjoying moderate success for the time being. It’s worth remembering, however, that stablecoins have been attracting less attention in recent months, with total capitalization down sharply since last year:

The fall in stablecoin capitalization since last year

It was also one of the notable points of the PYUSD launch: PayPal chose a very distinctly bearish context for the release of its stablecoin. This shows the company’s confidence in its ability to promote this new cryptocurrency.