French startup Bubblemaps has just raised 3 million euros to further develop on-chain analysis and make it accessible to as many people as possible. Thanks to this injection of capital, Bubblemaps hopes to improve its infrastructure and develop its tools for the general public as well as institutional users.

Bubblemaps raises 3 million euros

The on-chain analysis platform Bubblemaps, which visualizes the largest portfolios of different blockchains in an innovative and simplified way, has just raised 3 million euros to accelerate its development.

The funding round saw the participation of a number of venture capital firms, including INCE Capital, Stake Capital, Momentum 6 and V3ntures. A number of business angels also made financial contributions, including Owen Simonin (Hasheur), Nicolas Bacca (former CTO of Ledger), and Dyma Budorin (CEO of Hacken).

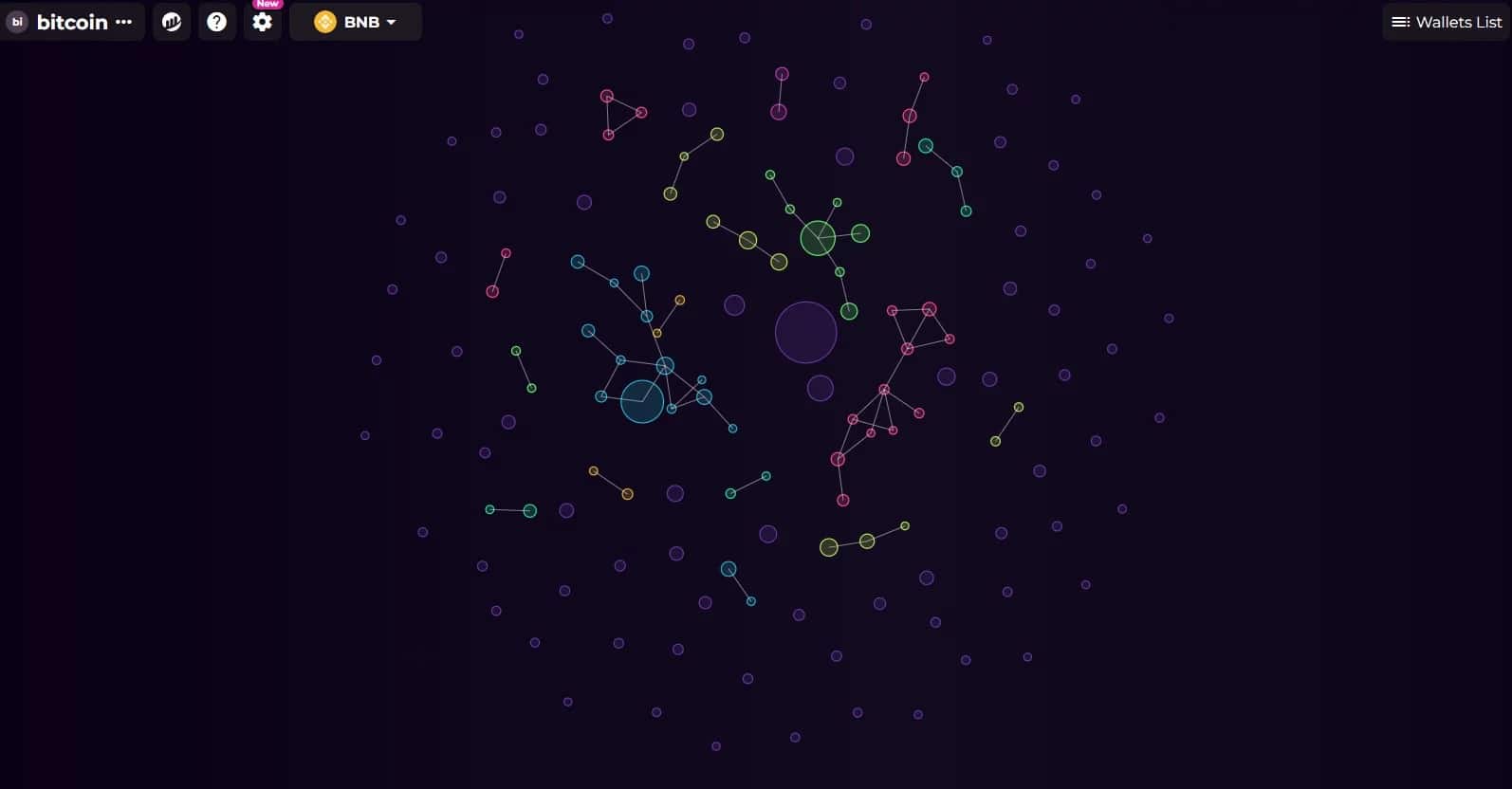

Bubblemaps provides a visual representation of the main holders of numerous cryptocurrencies, making it possible to exploit the most important on-chain data at a glance.

By visualizing portfolios as bubbles, users can uncover hidden relationships between certain entities, detect wash trading activities, expose corrupt DAOs and more broadly bring transparency to the world of on-chain data.

Screenshot of Bubblemaps representing major Bitcoin holders and their interactions

Currently based in Paris, Bubblemaps is a project born at the end of 2022, the fruit of collaboration between Nicolas Vaiman (the CEO), Léo Pons (the CTO), Arnaud Droz (the COO), as well as Cameron McIntosh, the CMO. Although they come from different backgrounds, including CentraleSupélec or ECE Paris, they are all deep cryptocurrency and blockchain enthusiasts.

At the time of writing, Bubblemaps supports the Ethereum (ETH), BNB Chain (BNB), Fantom (FTM), Avalanche (AVAX), Cronos (CRO), Polygon (MATIC) and Arbitrum (ARB) blockchains. The startup plans to add data from Base (Coinbase layer 2), TON and Aurora in the near future.

On-chain transparency, a real challenge

According to Bubblemaps, the money raised will be invested in improving its infrastructure, always with a view to making on-chain data accessible in a user-friendly way, both to the general public and to institutional investors. Bubblemaps’ visuals are available on leading platforms such as OpenSea, CoinGecko, DEX Screener and DEXTools.

Bubblemaps’ tool was notably used to highlight the voting power of crypto investment giant a16z at Uniswap’s decentralized autonomous organization (DAO) last February, where we learned that the company held 4% of the UNI token supply and could therefore manipulate voting proposals to a significant degree.

Nicolas Vaiman, CEO of Bubblemaps, told us that the platform had thus revealed one of the major problems of certain DAOs, namely the illusion of democracy:

” Starting from the good will of giving each token holder voting power, the important governance of DeFi quickly turned into a political battleground. Uniswap was no exception, and we detected that the investment fund a16z held over 4% of the supply [of UNI tokens, editor’s note] via a dozen wallets, just above Uniswap’s quorum.” “

With more than 100,000 users a month, Bubblemaps has gradually established itself as the source of choice for on-chain analysis. As such, the startup was chosen by L’Oréal & HEC last April to join their incubation program at Station F, in the heart of Paris.

Bubblemaps is aiming to become the “Google Analytics” of Web3, and intends to give itself the means to achieve this goal.