The fall in cryptocurrency prices has hit all investors as the summer approaches. Institutions have fuelled liquidation cascades: they’ve reportedly sold more than 230,000 bitcoins in the past two months, according to a new report. We take a look at the trend, which could be on its way to resolution.

Institutions have been selling bitcoins in droves

Last week, it was a surprise to learn that Tesla had sold 75% of its bitcoins (BTC) in the second quarter. And Elon Musk’s company isn’t the only one to have dumped its cryptocurrencies: institutions have been on a tear for the past two months, according to data presented by Arcane Research.

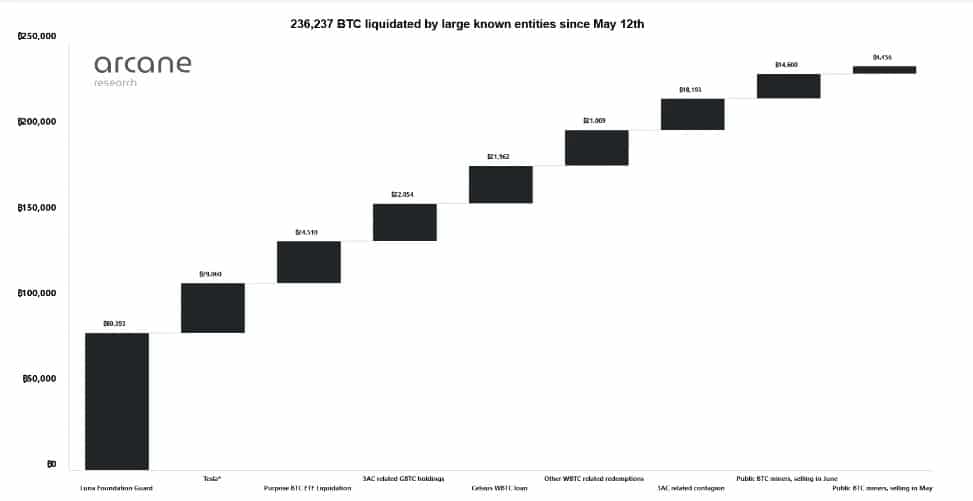

Number of bitcoins sold by major institutions since May 2022

As the report reminds us, it all started with the Terra (LUNA) case. The Luna Foundation Guard’s BTC reserves were wiped out on 9 May, leading to a series of consequences in the ecosystem.

The first to be affected by the selling pressure were the miners. They got rid of 4,456 bitcoins over the month of May. Tesla followed, as Bitcoin approached $30,000. In total, the sale is estimated to have reached $935 million.

FUD then spread through the crypto ecosystem, and major players began to experience difficulties, fuelling the trend. Celsius suspended withdrawals, Three Arrows Capital collapsed, and the Bitcoin price continued to plunge.

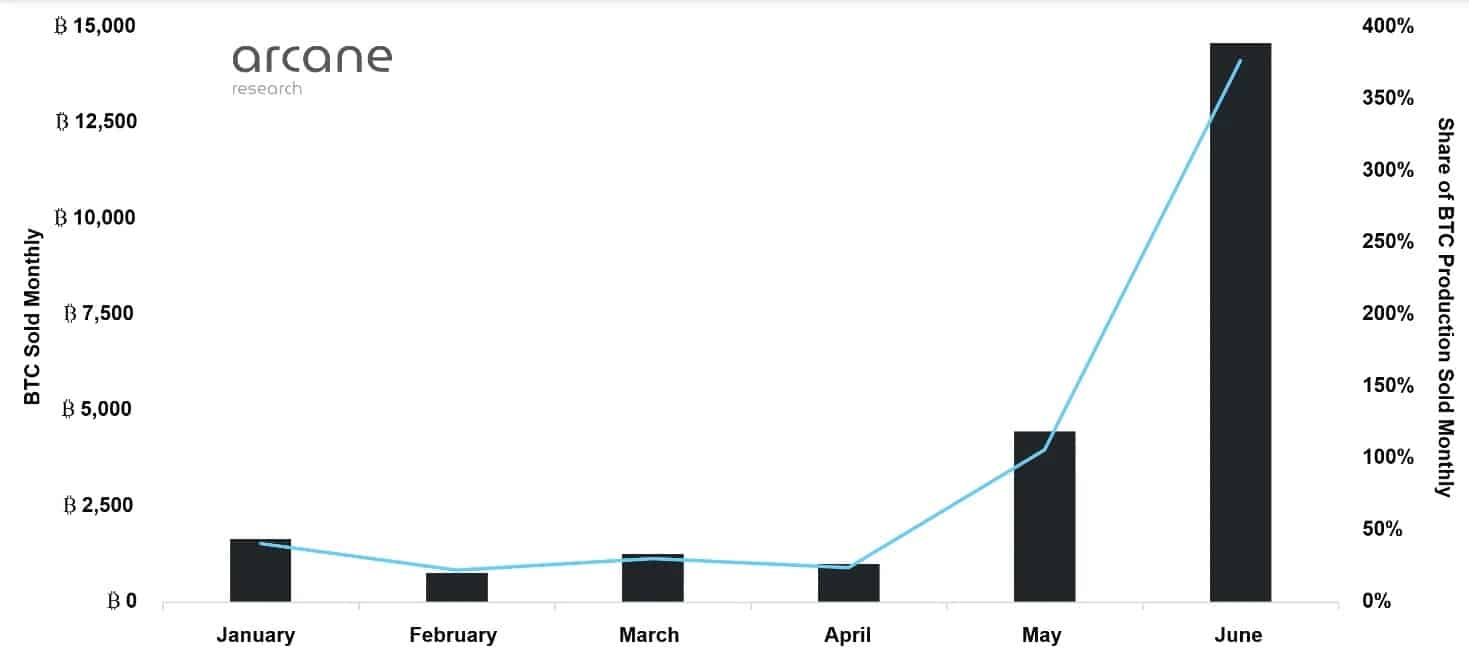

As a result, miners sold an even larger sum in June, amounting to 14,600 bitcoins:

Bitcoin miners’ sales rise

Are we out of the surrender phase?

Arcane Research report notes that all this data is probably just the tip of the iceberg:

“Most of the sales of the 236,237 bitcoins mentioned above were forced, and it was probably worse than this study mentions, with hidden capitulations of private and institutional players. “

So are we out of the worst? That’s the interpretation of this report: the declarations of bankruptcy are in the books, and the last few weeks have finally seen some green closes for cryptocurrencies :

“The contagion is being resolved, we’re moving into less uncertain times. “

Proof of this renewed optimism: BTC came up against $25,000 last week, after struggling to stay above $20,000 until then:

Bitcoin price wakes up last week

So there’s been a bit more optimism in the last few weeks, after the uncertainty and massive capitulations. However, the BTC price has a long way to go before it reaches its all-time high of $69,000 again.