According to Arthur Hayes, former CEO of BitMex, a possible massive success of Bitcoin ETFs run by traditional asset managers could completely destroy BTC in the long term. He points out that Bitcoin is unique in its moving nature, unlike other tangible assets, and predicts that such centralization could lead to the death of BTC by turning it into a mere state-controlled financial asset.

Arthur Hayes delivers his year-end summary article

18 days: that’s how long it will be before Gary Gensler’s Securities and Exchange Commission (SEC) has to rule on Ark Invest’s 21Shares cash Bitcoin ETF application. ETF analysts estimate a 90% chance of approval not only for this spot Bitcoin ETF, but also for a series of others, so as not to favor one player over another.

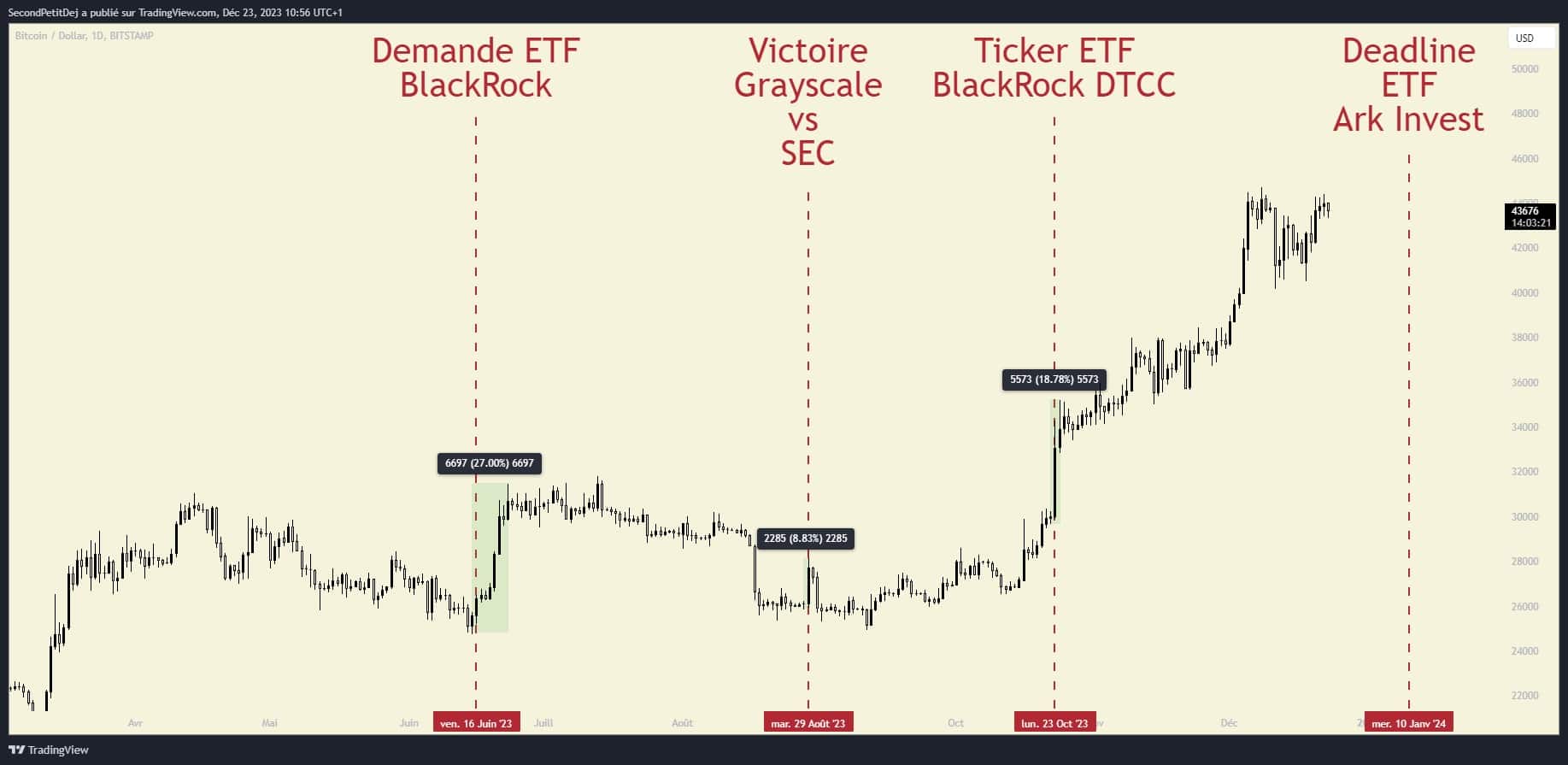

As 2023 has amply demonstrated, since the giant BlackRock entered the Bitcoin spot ETF race in the USA, the market has been extremely sensitive to announcements relating to this sector, although overall we’ve only had to deal with positive news in this regard for the time being.

Bitcoin price evolution over the year 2023

This being the case, the subject of Bitcoin ETFs is far from unanimous within the crypto community. Some are delighted at the idea of the colossal influx of money this could generate, while others see it as an attempt by institutional investors to appropriate an asset which, in its very essence, consists in emancipating themselves from them and, more generally, from the financial world as a whole.

Arthur Hayes belongs in the second category. In his end-of-year blog post, the former CEO of crypto exchange BitMex gave his views on the trends emerging in 2023, from the tokenization of Real-World Assets (RWAs) to the positioning of the US Treasury, inflation, debt, decentralized finance (DeFi) and, of course, Bitcoin ETFs.

“Expression” is my last article of 2024. I offer some thoughts on expressions of the crypto investment theme that will ultimately prove to be worthless.

May the Pump be with you!https://t.co/bG4ZnSjYu5 pic.twitter.com/nbru6yZlJD

– Arthur Hayes (@CryptoHayes) December 23, 2023

And for Arthur Hayes, the conclusion is simple: these Bitcoin ETFs could spell the end of BTC in the long term.

Bitcoin ETFs, the end of BTC?

Already last month, the crypto-billionaire took aim at the narrative of Bitcoin ETFs, arguing that while they were undoubtedly beneficial for BTC’s price, they would probably be less so for its utility, insofar as the entities offering ETFs will hold large quantities of Bitcoin immovable.

“Are we rejoicing today only to create a huge calamity in the future?” he asked.

Arthur Hayes persists in his new article: “Fundamentally, if ETFs run by TradFi asset managers are too successful, they will destroy Bitcoin completely.” The former BitMex CEO explains that Bitcoin is the first asset in human history to exist precisely because it is in motion, unlike fiat currency or gold, which are palpable, tangible.

Hayes points out that, projected to 2040, when Bitcoin miners will only be rewarded through the various transactions carried out on the network, they will have no interest in keeping the network alive if, in an extreme case, the majority of BTC were to be stored in the wallets of financial giants.

“Let’s imagine a future where the largest Western and Chinese asset managers hold all the Bitcoins in circulation. This happens organically, because people confuse a financial asset with a store of value. Because of their confusion and laziness, people buy Bitcoin ETF derivatives rather than buying and accumulating Bitcoins in stand-alone wallets. “

He continues:

“Now that a handful of companies hold all the Bitcoins and have no real use for the Bitcoin blockchain, the coins never move again. In the end, miners shut down their machines because they can no longer afford the energy needed to run them. Bye-bye, Bitcoin! It’s wonderful when you think about it. If Bitcoin becomes a mere state-controlled financial asset, it dies because it’s not used. “

To close his argument, Arthur Hayes explains that in this scenario, another crypto-currency network would naturally take Bitcoin’s place, perhaps in an “improved” way. “Let’s hope that the second time around, we’ll learn not to give our private keys to bats,” he writes.