After officially confirming the application of the MiCA and TFR regulations from 2024, the European Union will shortly be looking at new laws, this time applying to decentralised finance (DeFi). To prepare the ground for the forthcoming debates within the European institutions, the Association pour le Développement des Actifs Numériques (Adan) has published a study in which it sets out its recommendations for regulation tailored to this very special field

Europe seeks to regulate the Web3

While the United States struggles to create legislation specific to the cryptocurrency sector, as a result of a president who recently discredited these assets at the G7, Europe is focusing on creating a legal framework to foster innovation on its territory.

After last week’s final vote on the MiCA (Market in Crypto-Assets) regulation, a piece of legislation regulating companies across the continent, the European Union hopes to continue this trend by now focusing on decentralised finance (DeFi).

Against this backdrop, the European Commission is currently preparing to publish a report with the aim of assessing the growth of decentralised finance (DeFi) in the cryptocurrency market.

This study will also examine the issue of regulation of decentralised systems, which do not involve any cryptocurrency issuer or service provider, in order to assess the need for and feasibility of specific regulation for DeFi.

In one of its reports, the Association pour le Développement des Actifs Numériques (Adan) proposes a number of approaches to guide the work of European regulators. Let’s take a closer look at the solutions proposed by Adan

The state of play on DeFi

First of all, we need to take stock. In just a few years, the decentralised finance sector has become a central component of Web3. Beginning with lending and borrowing platforms such as Maker and decentralised exchanges (DEX), the number of users has grown exponentially since mid-2020.

Between July 2020 and November 2021, the total value blocked (TVL) on the various protocols rose from $2 billion to $180 billion. At the time of writing, TVL stands at $48 billion, the same level as in March 2021.

Figure 1 – TVL of all protocols, in billions of dollars

As a reminder, the total value blocked is an indicator used to quantify the amount of cryptocurrency allocated to a specific protocol, platform or smart contract. This measure is essential for assessing investors’ financial commitment to decentralised entities.

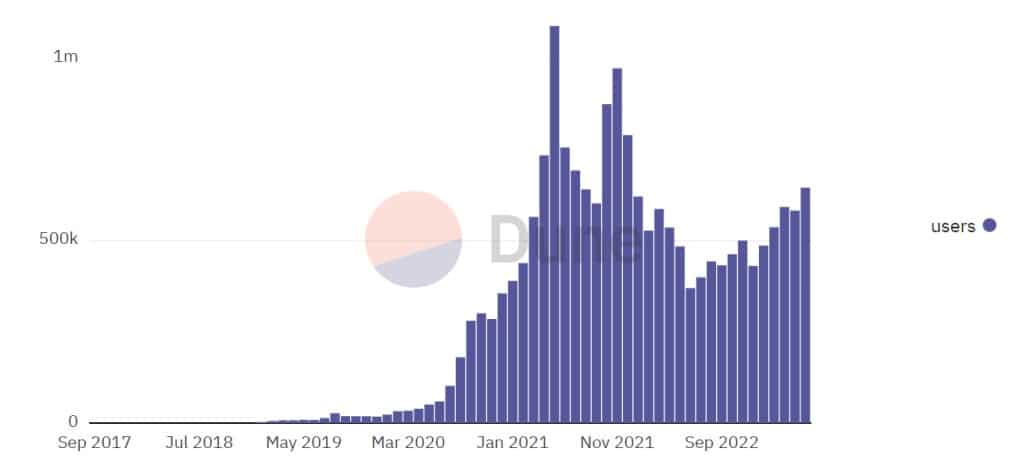

Although the TVL of the protocols saw a sharp drop, relative to the bear market, the number of users on these applications saw a moderate decrease with a much smaller differential between the data for November 2021 and that for May 2023.

For example, the number of DeFi users “only” fell by 33% between November 2021 and May 2023, while the figure for TVL was 73%, a fall 2.5 times greater.

Figure 2 – Monthly unique users on DeFi applications

Moreover, since June 2022, the number of users has been rising steadily, from 369,000 to 645,000 at the time of writing. This demonstrates the growing interest of cryptocurrency holders in decentralised finance applications, despite the fall in the price of Bitcoin.

However, we should point out that these figures are still extremely low compared with traditional finance. As Adan points out in its report, DeFi is still a niche sector with few institutional entities:

“Although the adoption of DeFi is growing, it is not yet fully institutionalised and remains an innovative but niche market compared to traditional finance “

Furthermore, without the arrival of institutional players, the development of DeFi could experience slower growth. Regulation of these applications is therefore envisaged to encourage the entry of these entities into decentralised applications.

Adan’s 9 recommendations for regulating this field

The European Union will soon begin to study the various ways of regulating DeFi. As with the MiCA and TFR regulations, Adan has an important role to play with elected representatives in order to achieve legislation that will benefit both the Member States and the structures and professionals concerned.

The association, which works for the democratisation and regulation of crypto-assets, has put forward 9 recommendations to guide future EU regulatory approaches.

These include the desire to create a specific framework for DeFi, decentralised autonomous organisations (DAOs) and decentralised stablecoins.

Adan is also considering the creation of an observatory dedicated to decentralised finance. Its objective would be to promote innovation by creating fair regulation, combining innovation by developers and the reduction of illicit activities.

On the same subject, it should be noted that the transparency of protocols, user interfaces and integrated industry solutions could be mobilised to reduce money laundering and the financing of terrorism through DeFi.

In addition, one of the recommendations suggests that elected representatives should get together with players in the sector to consider solutions for reducing the risks associated with decentralised finance.

Finally, Adan suggests avoiding any regulation of the protocols and their developers, who are seen as the pioneers building Europe’s financial future.