The use of cryptocurrency mixers reached a record high in 2022, according to a report by Chainalysis. And there is a shift in the majority addresses sending their funds to them. Zoom in on this little-known sector of the ecosystem, and the entities that use it.

The use of cryptocurrency mixers on the rise in 2022

The Chainalysis report is unsurprisingly very pro-regulation, with the company otherwise attempting to “unmix” transactions through its services. But it gives a good overview of the evolution of cryptocurrency blenders, and their actual uses.

As a reminder, blenders (or “tumblers”) are platforms for anonymising transactions in Bitcoin (BTC) or other cryptocurrencies. They take their name from the original process of mixing coins together.

Blenders are of course useful for people who want to discreetly move funds in cryptocurrencies, but as Chainalysis points out, it’s not always funds from criminal acts. The platforms can indeed be used by people living in totalitarian countries or countries that have not authorised cryptocurrencies. The desire to leave no trace can also be seen as an end in itself, especially for users close to the initial ideals of cypherpunks.

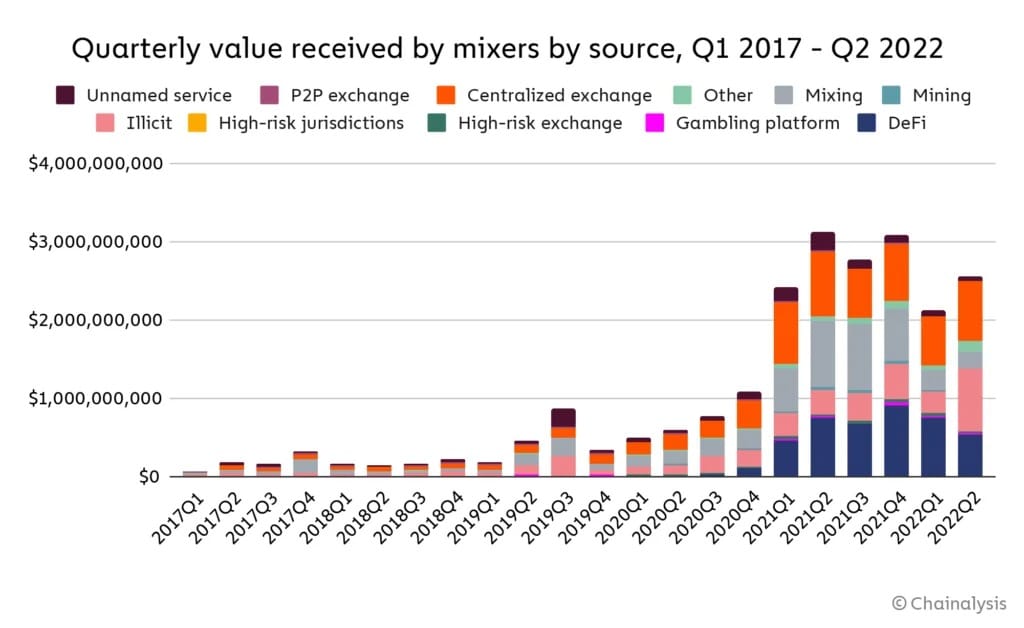

With this context in mind, it can still be pointed out that 10% of the funds sent to the mixers come from illicit sources. Less than 1% comes from high-risk exchange platforms, betting platforms, peer-to-peer exchanges, DeFi and centralised exchange platforms. Note, however, that Chainalysis does not report the remaining share, which is probably not analysable.

Volumes also up

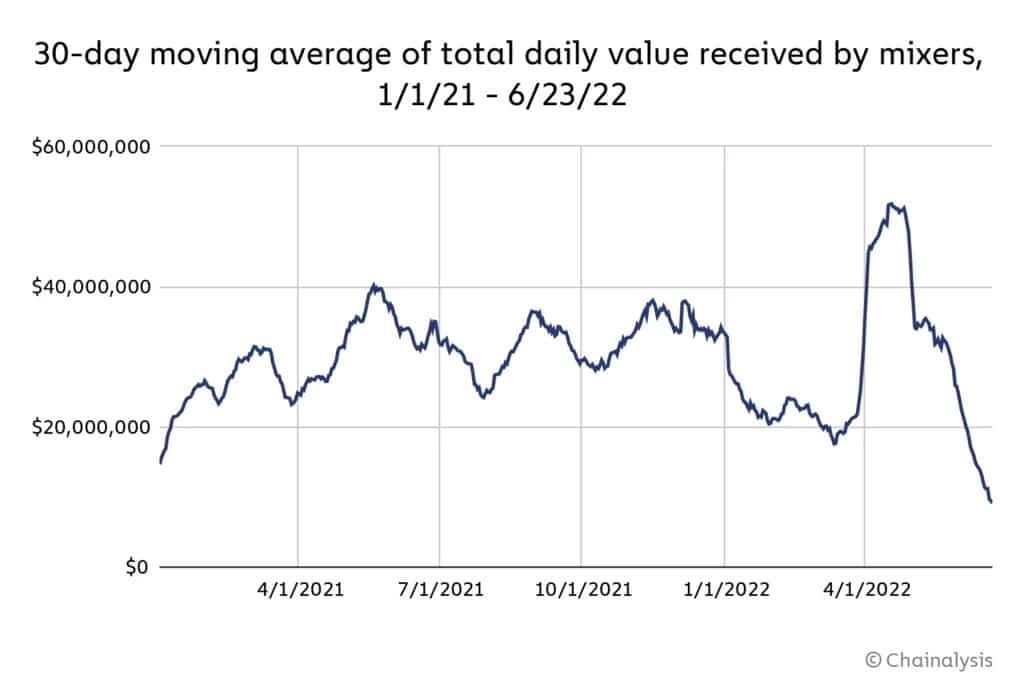

Value received by mixers had peaked in early 2022, before plunging following the fall in cryptocurrency prices. On April 19, the average funds sent to the mixers reached an all-time high of $51.8 million:

Figure 1: Evolution of value sent to cryptocurrency mixers

If we look at the origin of the funds received, we can see that usage has changed in recent years. Since 2021, decentralised finance (DeFi) is now an important channel, and there is also a breakthrough of centralised exchange platforms:

Figure 2: Origin of funds sent to cryptocurrency mixers

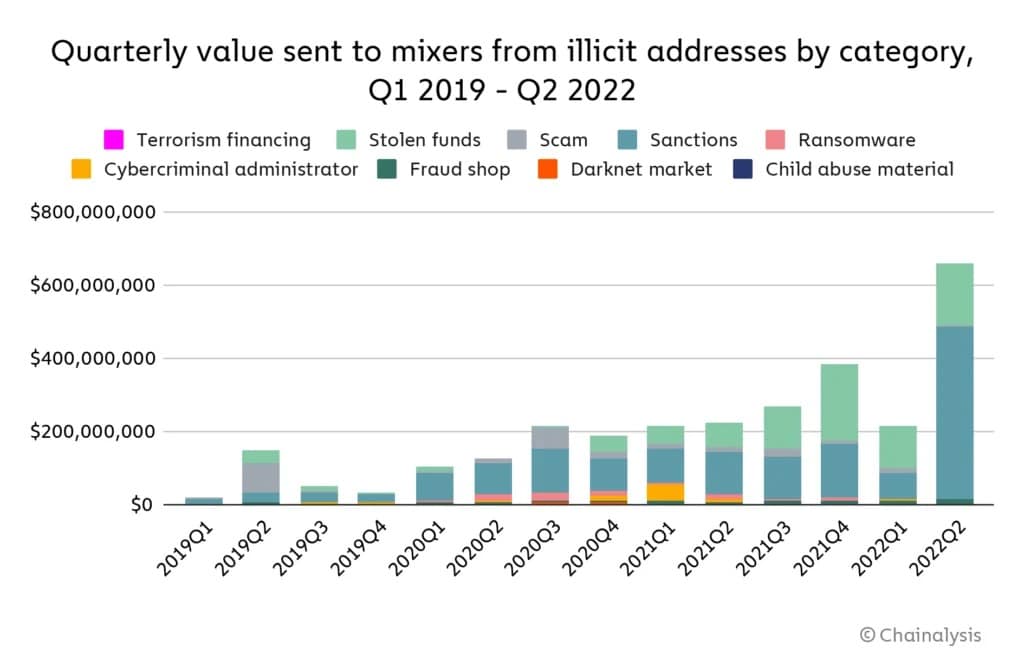

There has also been a surge in illicit addresses, with funds doubling since last year according to Chainalysis:

“Illegal addresses account for 23% of funds sent to mixers in 2022, up from 12% last year. “

What criminals are using cryptocurrency mixers?

The report also looks at the types of criminal activity that led to these transactions. In recent years, the majority of the volume has come from sanctioned platforms, such as darknet marketplaces like Hydra Market. The second largest sector in terms of volume is represented by stolen funds:

Figure 3: Category of addresses that sent funds to mixers

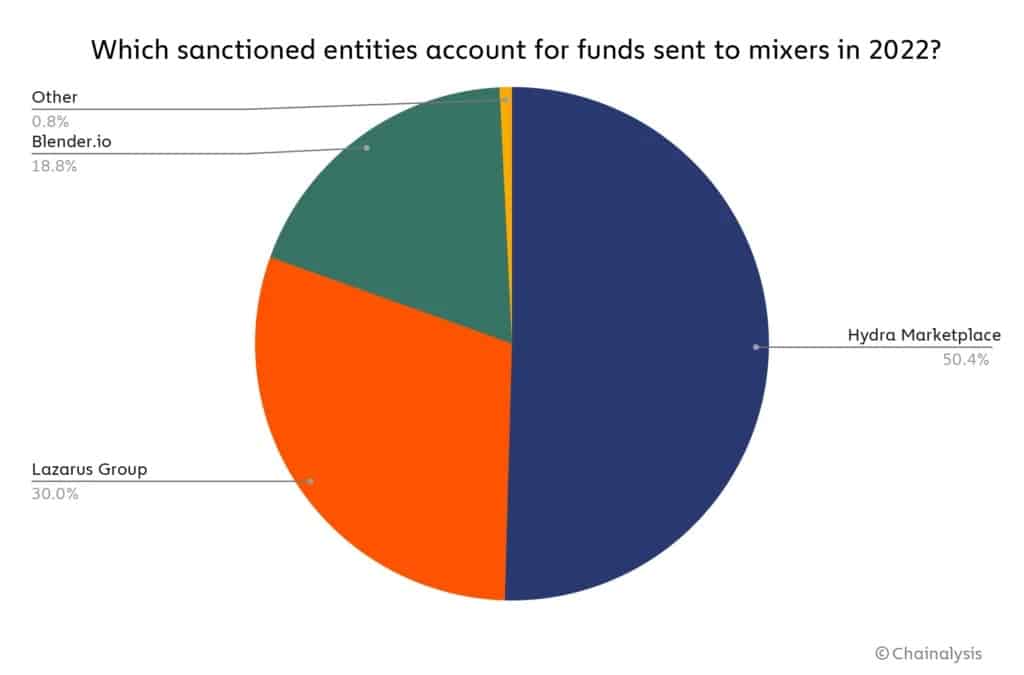

Other interesting data: in the category “entities subject to sanctions”, large criminal groups account for a very large share of the volume for 2022, which is less heterogeneous than one might think. For example, Hydra Marketplace accounts for more than 50% of the funds from sanctioned entities sent to mixers in 2022. The North Korean group Lazarus, often associated with large-scale hacks, accounts for 30%.

Figure 4: Sanctioned entities that used blenders in 2022

Chainalysis also notes a breakthrough by North Korean entities. This is not really a surprise, as North Korea’s use of cryptocurrencies has been observed for years, with attacks targeting centralized exchange platforms.

The place of mixers in the ecosystem

Having the means to preserve one’s privacy is globally a given, especially in the cryptocurrency industry, which was built with this ideal in mind. So blenders have their role to play, and even if they are used by criminals. This data also reminds us of something that is worth repeating: the majority of cryptocurrencies are not truly anonymous, and you will have to go through side services to avoid leaving a trail.

It’s also worth noting that criminal activity now only accounts for 0.15% of cryptocurrency transactions. A figure that should be kept in mind when regulators and analysts emphasize the alleged danger of the sector.