Financial markets have chosen the path of optimism this early 2023, with double-digit bullish performance in equity and crypto markets, although inflation is still undefeated and the 12-month horizon economic framework uncertain. The stock market session next Tuesday, February 14 will be the judge of peace, and Valentine’s Day has nothing to do with it.

A great start to the year

We’ve seen a lot of microeconomic (quarterly corporate earnings) and macroeconomic (broad economic aggregates) data every week, allowing institutional investors to adjust their expectations and positions on the stock market.

At the beginning of 2023, they have chosen an offensive positioning, with a very clear sequence of outperformance by risky assets on the stock market, to the detriment of defensive assets. This is why the European equity market is showing a bullish performance not seen for 15 years for the first 5 weeks of the year. For example, the price of the CAC 40 Global Return (GR), i.e. the price of the Paris stock exchange’s flagship index with dividends reinvested, has just set a new all-time record! Yes, I did say a new market record never seen since the birth of the index in 1987.

So there’s plenty for the cryptocurrency market to dream about, while the Bitcoin (BTC) price, despite a very good start to 2023, is still a long way from its record high set in November 2021.

Tuesday’s trading session promises high volatility

This bullish investor choice is based on a combination of anticipated fundamentals, including the belief that economic recession will be avoided in the coming months, despite the sharp rise in the cost of money, the 16-month firm upward cycle in interest rates.

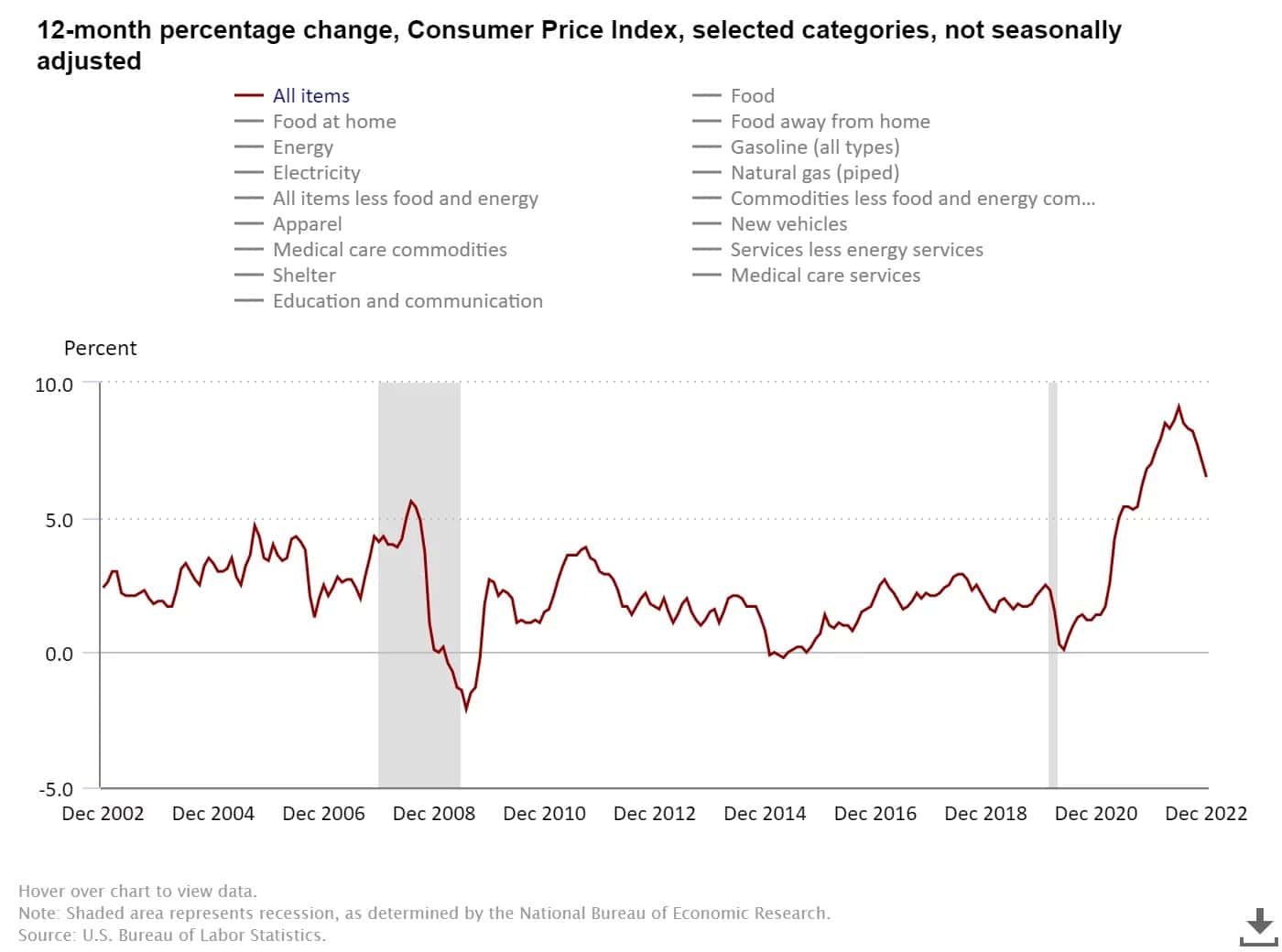

The other major fundamental dimension expected is the decline in inflation rates in the West which would allow Central Banks to adjust their monetary policy by the end of the year. It is on this second fundamental concern that we will have to pay close attention next week.

During the stock market session on Tuesday 14 February, it is not Valentine’s Day that should hold your attention as an investor, but the publication of the US inflation rate for January. With the consensus of economists predicting a continued slowdown in the price regime, it is imperative that the consensus is right so as not to jeopardise the recent bullish rally in the crypto market. In other words: a number to watch on Tuesday at 2:30pm.

Chart that reveals the dynamics of the annual inflation rate in the US according to the Consumer Price Index (CPI)

Bitcoin (BTC) and Ethereum (ETH) offer a Golden Cross on the chart

The technical signals offered by the crypto market have been bullish since January 1, however a sideways transitional phase has started in the short term below the $25,000 resistance. As long as this market pause does not see a break of the $21,000 support, then the bullish construction is not in question. I believe the technical threshold for invalidating the bounce is at $20,000, where a bullish gap in BTC futures has developed. It is this gap that must never be filled to preserve the bounce.

This week, I am picking up a chartist signal that the bullish camp is adding to their argument, it is the Golden Cross moving average pattern. This technical configuration consists of a crossing of the 50-day simple moving average above the 200-day simple moving average, a fact observed on the BTC/USD and ETH/USD rates. To be continued with the release of the US inflation figures on Tuesday at 2:30 pm.

Chart showing the ETH/USD rate in daily Japanese candles