It’s been a month since the FTX affair rocked the crypto market, a fundamental black swan that spread its wingspan to create a black hole in confidence in the ecosystem. 30 days later, calm has returned but beware, Bitcoin’s (BTC) historical volatility is near a long-term low.

Institutional participation remains stable during platform audit phase

D+30! It’s now been 30 days and 20 trading sessions since the last bearish shock in the cryptocurrency market, and over that time, prices have stabilized surprisingly well. The bearish shock took place over 2 sessions before giving way to the new theme of fundamental concern, the financial audit of the major crypto players.

So investors are still giving the ecosystem a chance to demonstrate its ability to align with the auditing standards of traditional finance. Cryptos have been considered an asset class in their own right since the 2018/2020s, but they have never been considered the equal of other markets (stocks, bonds, credit, forex) due to a lack of regulation/transparency.

The crypto market has entered a new fundamental sequence in its young existence and this starts with proof of reserves, the first step before considering a thorough accounting audit by the global industry giants in the coming months.

Binance seems to be doing well in terms of volume of reserves and diversification, but in any case, this forces all platforms to play the game of this new transparency requirement demanded by institutional investors.

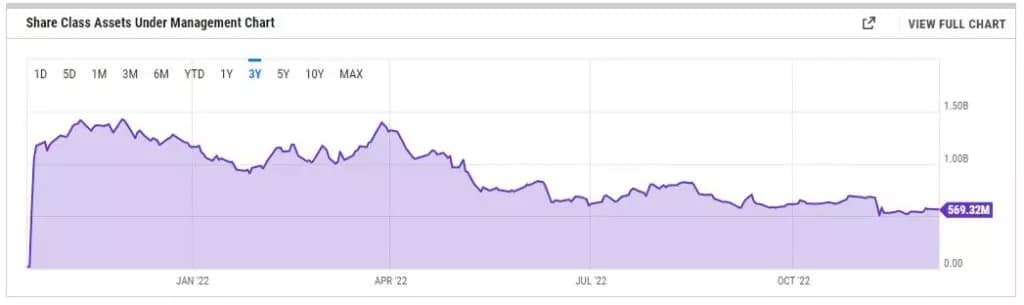

Moreover, institutional investors have been patient for the past month, with a stabilisation or even a (very) slight increase in their exposure. To follow the overall participation of institutional investors in the crypto market, I recommend the asset under management (AUM) barometer of the world’s largest Bitcoin ETF, that of the issuer Proshares and its famous BITO (this is the mnemonic code of the product).

The AUM peaked at nearly $1.5 billion and is now stable at around $570 million. The end of the bear market will first be indicated by a bullish reversal in institutional participation, at this stage they are waiting to see.

Figure 1: Chart exposing the AUM of the Proshares BITO ETF

Beware, Bitcoin’s historical volatility measure is coming into extreme support

A near technical certainty has appeared in my mind this week: the next crypto market shift will occur before Christmas.

This shift will have a magnitude of several thousand dollars and will either be the final purge at $10,000 or the signal for the end of the bear market with a powerful breach of chartist resistance.

This belief comes from the chartist analysis applied to the 7-day historical volatility curve of the Bitcoin price (see chart below). Bitcoin’s volatility has indeed just broken its support from the end of last October, which is a signal that the downtrend in volatility, which has been completely crushed since the bearish shock of early November, is continuing.

BTC’s historical volatility floor is now in sight, a level that will create a powerful flying bounce, with some past occurrences such as falling from $6,000 to $3,000 in 2018, rising from $4,000 to $10,000 in 2019 or rising from $10,000 to $70,000 in 2020.

So the Bitcoin price will make its technical choice over the next two weeks and the move will be very impulsive.

Figure 2: Historical 7-day volatility in weekly Bitcoin price data