It’s a worst-case scenario for the bitcoin price. At a time when the global macro context is seeing inflation on the rise again, the US dollar and interest rates are directly threatening the annual rebound in the bitcoin price. There seems little hope of preserving the $25,000 support level. Here is Vincent Ganne’s technical analysis.

The FED and the price of oil in force of bearish pressure

The macroeconomic scenario of a second wave of inflation no longer has the status of a minority scenario, such is the relative importance of the rebound in oil prices (US WTI and North Sea BRENT) (a rebound of more than 15% since the start of the summer).

It is important to bear in mind that behind this new rise in the price of black gold on the commodities market lies the end, or at least the pause, of the disinflation cycle that has been in place since spring 2022. The price of oil makes a direct contribution to the calculation of inflation indices, amounting to between 15% and 20% depending on whether we are talking about the CPI index, the PCE index (for the United States) or the Truflation application (which, by the way, is based on blockchain technology).

So you might ask, why fear a second wave of inflation (which would be harmful to the BTC rebound) for a direct contribution that isn’t all that great? Because the indirect contribution is just as important. So, if we mix it all up, the price of oil can boost the price regime just as it had the power to bring inflation rates down from 10% to 3% between June 2022 and June 2023.

More generally, the difficulty with this whole affair is that the Federal Reserve (FED) considers that bringing the US inflation rate below 2% (compared with over 4% currently for so-called core inflation) is the top priority, accepting the sacrifice of a global economic slowdown. On the other hand, if this were to provoke an economic recession, then the Central Banks could end up being less rigorous in their monetary policy.

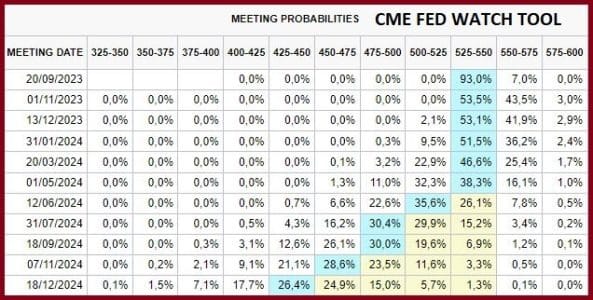

At this stage, as the table below shows, the FED plans to keep interest rates very high, perhaps until the spring of 2024. That famous spring of 2024: halving and the FED’s pivot are a reassuring horizon for the price of bitcoin.

But that horizon is still a long way off, and so will be of no help in the short term.

Chart from the Chicago Stock Exchange’s CME FED WATCH TOOL showing expectations for the FED interest rate cycle

Technically, holding support at $25,000 would be a “minor miracle “

So in the short term, the bitcoin price is still sitting on the $25,000 support, the one we’ve been talking about here for several weeks. It’s quite astonishing that BTC hasn’t yet broken this support to chase liquidity towards $20,000 or $22,000. It has every reason to do so, and it would take very good news from the ecosystem to save it.

Graph created with the TradingView website and displaying the weekly and daily Japanese candlesticks for the BTC future contract on the Chicago Stock Exchange (CME)