Is Bitcoin (BTC) gearing up for an uptrend? If on-chain data are to be believed, the number of BTC immobilized for more than 6 months has never been so high. Today, they account for almost 75% of bitcoin supply in circulation. Based on previous market cycles, this could be a good time to buy BTC. We take stock of the situation.

A new record for Bitcoin (BTC)

After a painful bear market, the end of which was signed a few months ago, the cryptocurrency market has entered a phase known as “accumulation”: despite a few rises, prices remain relatively stable and the general public’s interest in this asset class is at an all-time low.

Investors are taking advantage of this lull to accumulate as many assets as possible, in preparation for the next bull market. For example, according to bitcoin holder data, around 74.6% of BTC in circulation has not been moved once in the last 6 months.

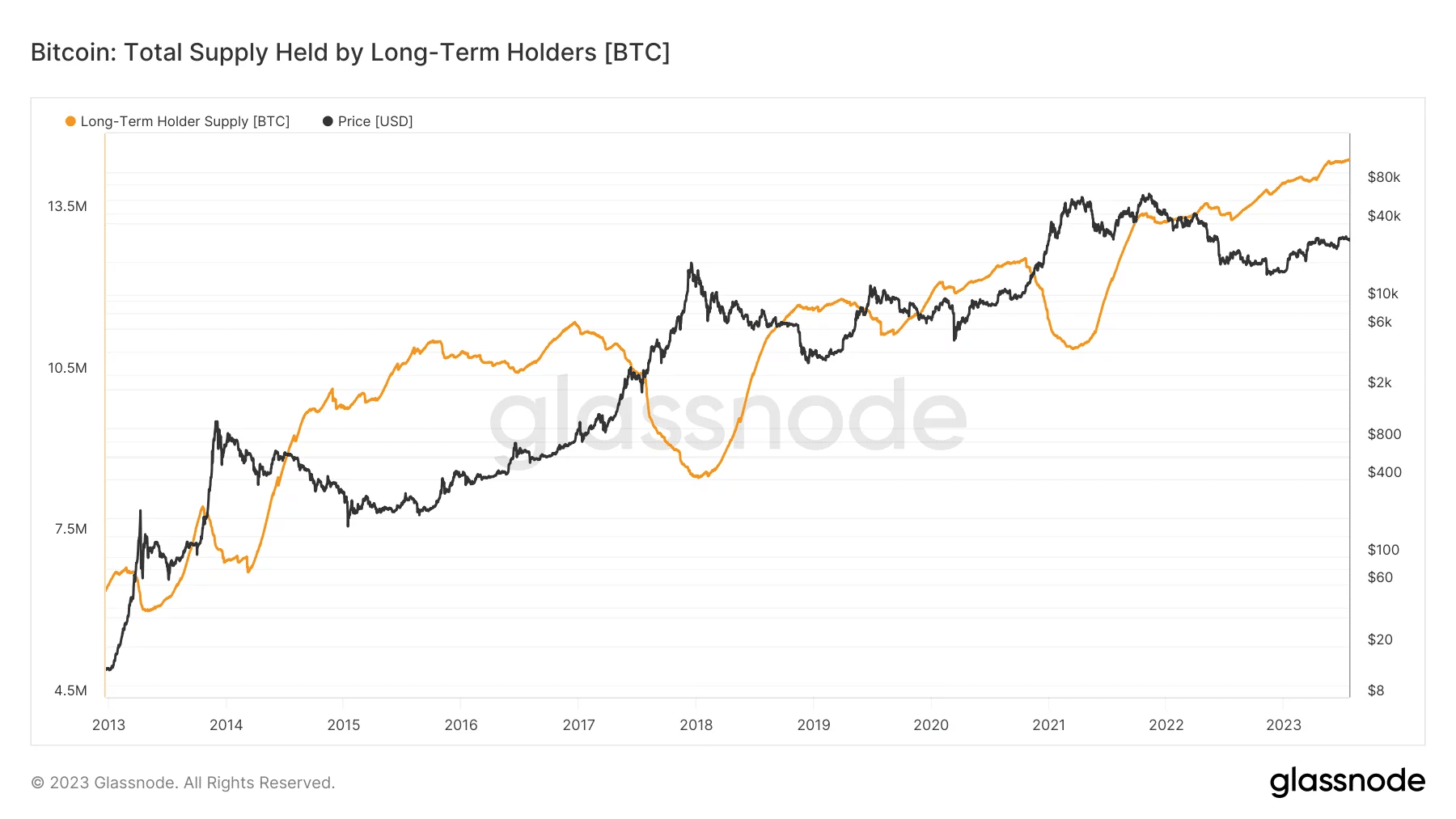

Bitcoin price since 2013, accompanied by the number of BTC held for more than 6 months

At the time of writing, a record 14,527,000 BTC have been immobile since January. This figure takes into account assets that have been held for several years as well as those obtained more recently, in January 2023.

Likewise, it includes Bitcoins that have been lost over time, as well as those of Bitcoin creator Satoshi Nakamoto, estimated at over a million.

Why is this a positive sign for the BTC price?

It’s unusual to observe such a large quantity of bitcoins standing still. Typically, this phenomenon appears ahead of a strong uptrend. For example, in November 2016 and 2020, the percentage of BTC held over the long term stood at 71% and 68% respectively.

These two periods were followed by a strong rise in Bitcoin, during which the world’s largest cryptocurrency recorded new ATH. Moreover, when its percentage is high, this indicator can be seen as a useful tool for detecting buying and selling opportunities.

Conversely, when the number of long-term holders is at its lowest, BTC is usually at the peak of its popularity. In December 2017, when its price touched the $20,000 mark with its finger, the number of bitcoins held for 6 months was 8.7 million, barely 50% of the quantity of bitcoins in circulation.

As for the 2021 bull market, the case is different: in just 6 months, it has recorded 2 strong rises, interspersed with a 50% fall.

As in 2017, the ATH recorded in March 2021 by Bitcoin is marked by a decrease in the number of long-term holders, whose number was estimated at 59%. Conversely, this figure climbed to 71% when the king of cryptocurrencies was approaching $69,000 in November of the same year.

More than a tool for revealing slack periods in the cryptocurrency market, this indicator demonstrates Bitcoin’s role as a store of value. Often dubbed “digital gold”, the increase in the number of Bitcoin holders over the long term is a strong indication of the confidence that investors place in Bitcoin.