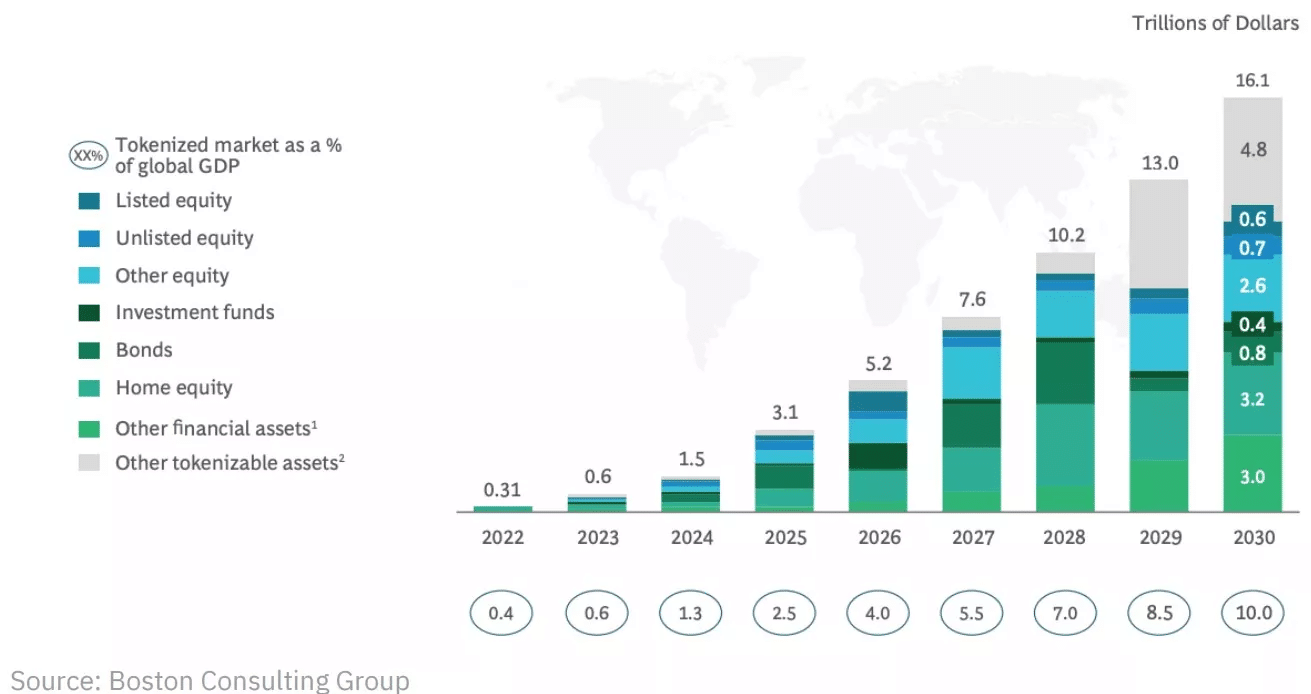

Real-world asset tokenization (RWA) is gaining momentum, and the latest study from Binance Research suggests that the sector could reach $16,000 billion by 2030. Last year, this already represented $310 billion, or 0.4% of global GDP.

The tokenization of real-world assets is gaining momentum

The tokenization of real-world assets (RWAs) is an increasingly important topic in the blockchain ecosystem, so much so that Binance Research’s latest study puts the sector at $16,000 billion by 2030.

The figure seems large, and every study goes into overdrive, but the fact is that in 2022, this value already stood at $310 billion, and that would be on track to double this year. While RWA tokenization accounted for 0.4% of global gross domestic product (GDP) last year, this share could rise to 10% by 2030, again according to the same forecasts:

Figure 1 – Forecast evolution of RWA tokenization

Asset tokenization vehicles are varied, and can include real estate, commodities such as gold, corporate shares or bonds.

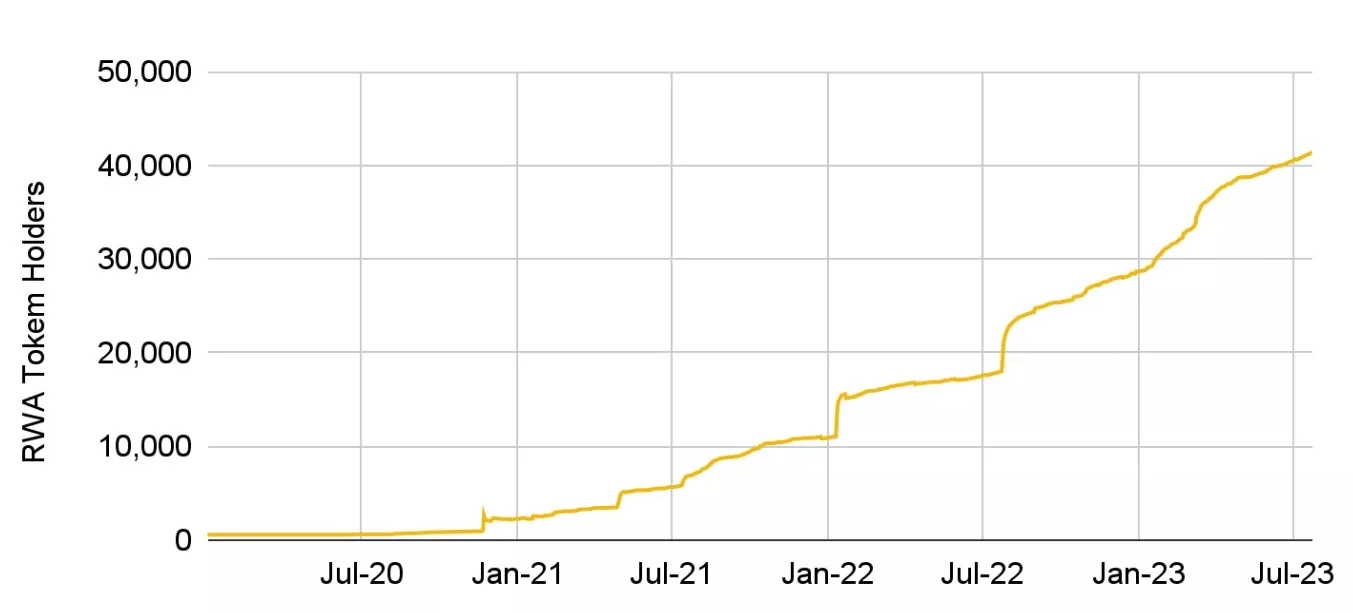

In the space of a year, the number of addresses holding so-called RWA tokens on the Ethereum blockchain (ETH) has more than doubled, from 17,900 to over 43,000 :

Figure 2 – Evolution of addresses holding RWA tokens on Ethereum

The players in RWA tokenization

Within the cryptocurrency ecosystem, several players are active in the RWA tokenization sector.

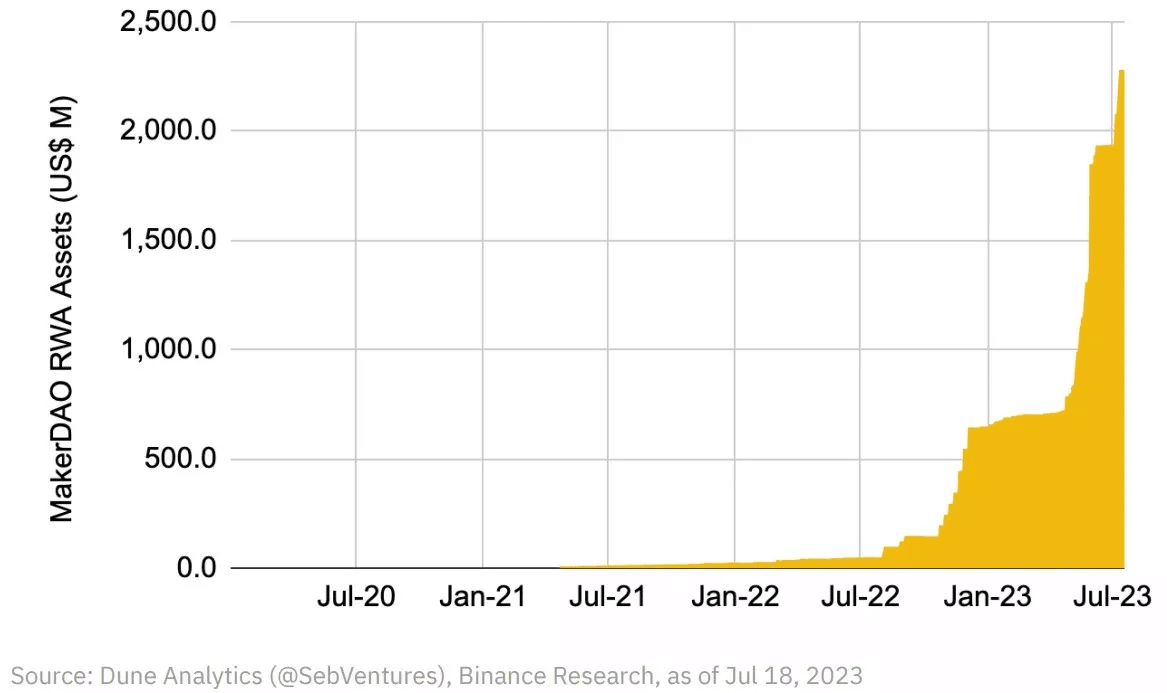

The Binance study cites Maple Finance, for example, with $332 million in institutional loans outstanding. One of the most telling examples, however, is MakerDAO, with countless IAD loans collateralized with real-world assets by various institutional players.

According to the study, this exposure now stands at $2.3 billion, representing a vertical increase in the space of a year:

Figure 3 – Evolution of MakerDAO’s exposure to real-world assets

Yesterday, we learned that the Avalanche Foundation was allocating $50 million to the tokenization of assets, and more and more players in traditional finance are working in this direction. While it’s still too early to estimate reliable forecasts, there’s no doubt that we’re facing one of the revolutionary aspects of blockchain, which is gaining in maturity every day.