Will the metaverse be the most profitable bet for Mark Zuckerberg’s company? For now, its financial results are unanimous: losses linked to its search unit are steadily increasing, reaching $3.7 billion between April and June 2023. Nevertheless, the company is holding its ground and has managed to win the confidence of investors in recent months, not least thanks to its rising profits.

Meta’s metaverse subsidiary continues to make losses

Meta’s metaverse subsidiary continues to make losses

Meta’s metaverse subsidiary continues to make losses

Is the metaverse at half-mast? Through its financial results, Meta reveals that Reality Labs, its research unit dedicated to virtual reality and immersive worlds, is once again in financial difficulty in the second quarter.

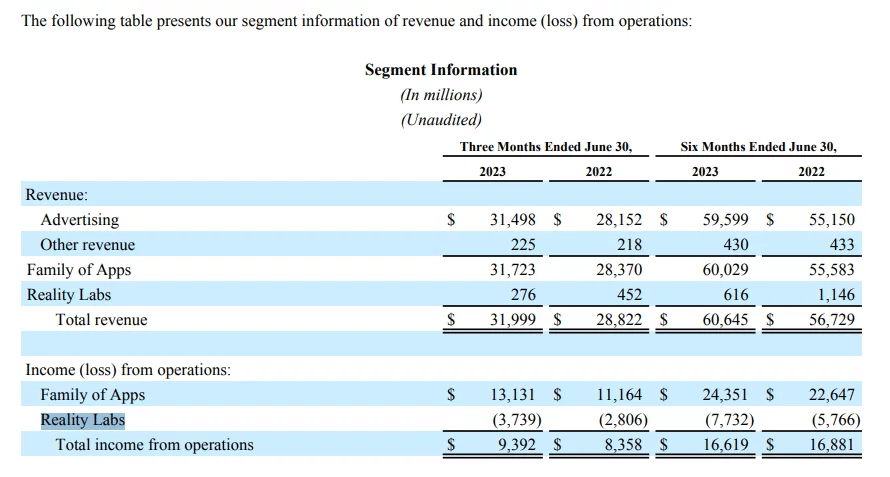

According to the latest figures published by the company, Reality Labs is in deficit by $3.7 billion between April and June 2023. Worse still, its losses exceed $7.7 billion since the start of the year.

Meta’s profits and losses, in millions of dollars

Since Facebook renamed itself Meta, the company’s mission has been to create a suite of products related to the metaverse. However, two years after taking this turn, its department dedicated to this field has not been profitable once.

Today, its financial losses accumulate and swell with each quarter, gradually eroding the American firm’s profits. But Susan Li, the group’s CFO, doesn’t seem worried by the situation:

“For Reality Labs, we expect operating losses to increase significantly year-on-year due to our ongoing efforts and development of our augmented reality/virtual reality products, as well as investments to further evolve our ecosystem. “

Since October 2021, Meta has invested over $15 billion in its metaverse-related services and products, with no return on investment.

The financial health of the American group

While Meta’s metaverse division is running deficits, the positive results of its other services give it comfortable financial security. Between the second quarter of 2022 and 2023, net income rose by 16% to $7.7 billion.

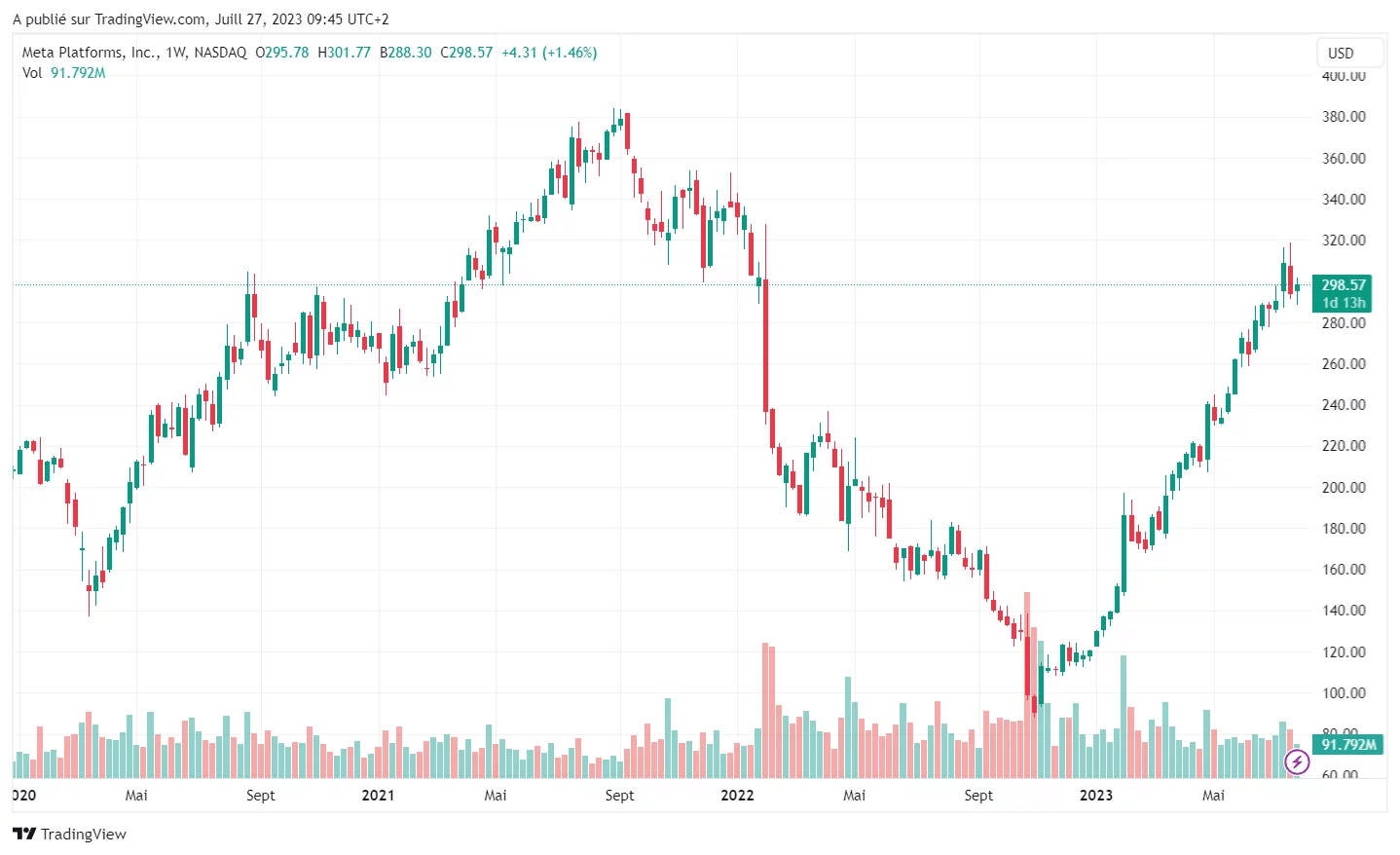

The company’s share price has rebounded sharply since dropping to $90 in November 2022. Currently at $298 a share, Meta has recorded growth of over 300% in just 8 months.

META share price from 2020 to today

One of the few groups to have achieved such performance is Nvidia, whose company valuation has increased 4-fold since October 2022, thanks in particular to the rise of artificial intelligence.

For his part, Mark Zuckerberg is confident about his company’s future financial performance. While revenues from his family of applications (Facebook, Instagram, WhatsApp, etc.) totaled $31 billion in the last quarter, the group is betting heavily on artificial intelligence, video content and its new Thread application:

“We had a good quarter. We continue to strengthen our commitment to our applications and we have the most exciting roadmap I’ve seen in a while with Llama 2, Threads, Reels, new AI products in the pipeline and the launch of Quest 3 this fall. “

In addition, the Californian company is demonstrating that its shift towards the metaverse is not preventing it from generating profits, nor from diversifying into other technology sectors. In the world rankings of financial capitalizations, Meta is in 8th position, just behind Elon Musk’s company, Tesla