Is the Worldcoin token (WLD) too concentrated? An analysis of the addresses of the largest holders shows that Sam Altman’s new token is mostly held by a single address. What are we to make of this, given that the project promotes a wider distribution of financial opportunities?

The distribution of Worldcoin (WLD) tokens in question

The Worldcoin project has just been launched: the new initiative from the founder of OpenAI is under particular scrutiny… And often controversial. The status of WLD, in particular its actual usefulness, is often questioned. Since cryptocurrency began to be distributed, we can see a few trends emerging. And for the time being, WLD seems particularly concentrated.

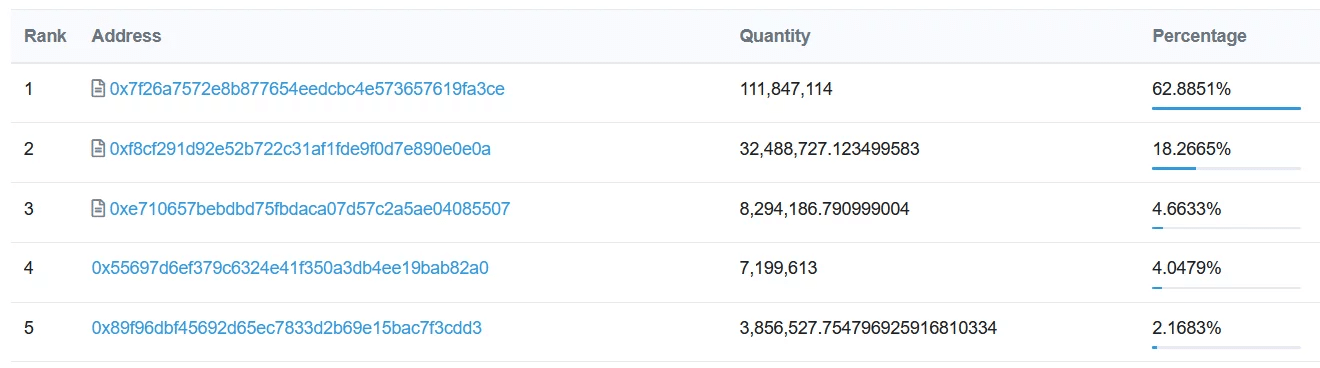

Looking at the data collected by Optimism, the scaling protocol used by Worldcoin, we can see that WLD tokens are currently held mainly by three addresses linked to contracts:

WLD tokens are concentrated on the three largest addresses

Of the 177 million tokens currently available, 62% are stored on a single address. This is the contract for distributing WLD tokens to those who choose to scan their irises to obtain a WorldID. The second address holds 18% of the supply, and 4% for the third. What this means is that 84% of the WLD supply exists on these three addresses.

Financial emancipation and token concentration

Worldcoin wants to offer financial solutions to everyone, and democratize access to financial services. Such concentration therefore seems de facto at odds with the philosophy behind the project. Beyond contracts, it is not surprising that market makers and major exchange platforms hold large quantities of WLD. So the question is: will tokens find their way into retail portfolios?

Ultimately, the project aims to return 75% of tokens to the community. One of the stumbling blocks, however, is the way in which WLDs are distributed. At this stage, we know that a user can earn around $60 by scanning his or her iris. Releasing WLDs in this way will therefore take time, and the address holding 62% of the tokens will not suddenly release them. In the meantime, this means that exchange platforms and market makers will have control over the token.

Will Worldcoin be the revolution announced by Sam Altman? For the time being, the crypto ecosystem is wary of this project at the crossroads of blockchain, artificial intelligence and biometrics. WLD’s token price is still very volatile, just a few days after its launch. We’ll have to keep a close eye on how the project develops over the coming months.