According to a study conducted by brokerage Charles Schwab, young Americans are very attracted to cryptocurrencies. In addition, 45% of those under 25 believe they want to include cryptocurrencies in their retirement savings plan, compared to only 11% of those over 60.

Cryptocurrencies in vogue among young Americans

What’s better than a long-term view for successful investing? That’s the rhetorical question many Americans are asking themselves as they prepare for retirement. For a large portion of young people, the answer lies in cryptocurrencies.

According to an April 2022 survey, 45% of those under 25 want to be able to invest in cryptocurrencies through the 401(k) plan, the most widely used retirement savings plan in the US.

In parallel, let’s note that millenials, people born between 1980 and 1997, have results substantially similar to generation Z: 46% of them hope for the integration of cryptocurrencies in the 401(k). On the contrary, only 11% of those over 60 years old have a similar discourse.

For their retirement, older people are more adept at traditional investments: 47% of them have an individual retirement account (IRA), compared to 29% of millenials.

The gap between young and old is the result of many variables. The low cost of entry into the cryptocurrency market, the popularity of the topic, and the recent emergence of the industry are all factors that are driving young people to be more interested in this type of investment.

Generation Z and millennials are multiplying their ways of investing

As technology evolves, so do the ways of investing: generational differences are not specific to cryptocurrencies. In addition, people under 40 tend to diversify the platforms they use and the assets they invest in.

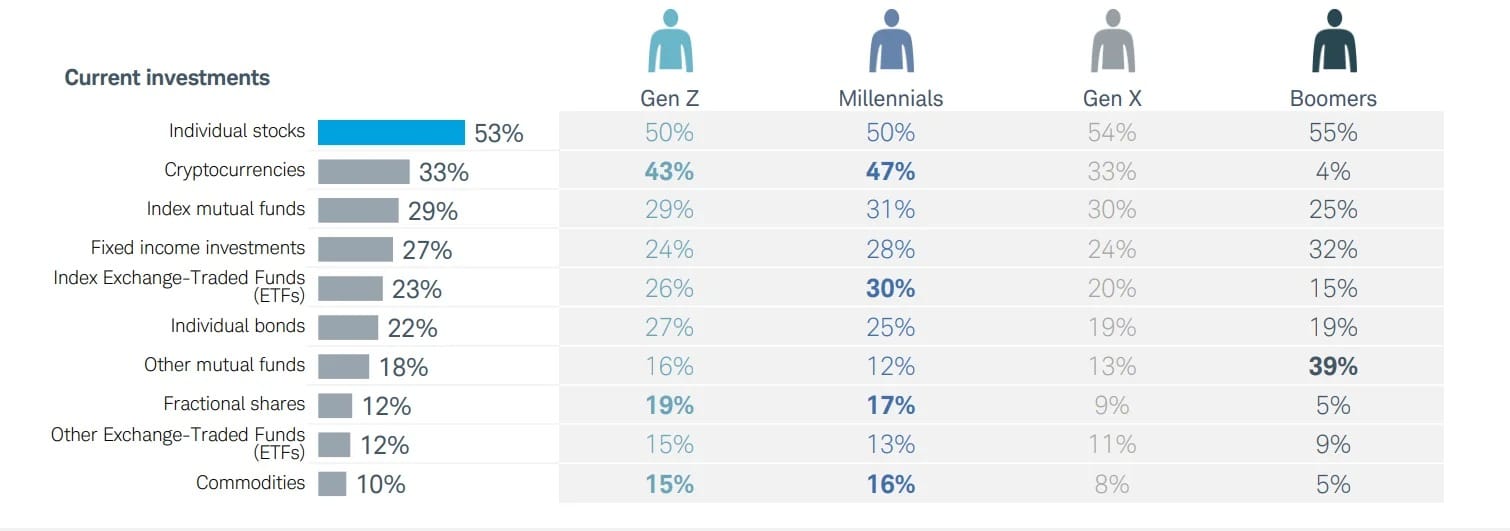

Figure 1: Current investments by different generations

While equities remain the majority investment for the entire sample studied, the gap widens when looking at other asset classes.

On the subject of cryptocurrencies, while 43% of Generation Z and 47% of millennials own them, only 4% of the over 60s have taken the plunge. Moreover, many asset classes are dominated by the under-40s, such as ETFs and commodities.

As a result, in a time of economic crisis like the present, the under-40s are concerned about their financial capital to improve their future.

Many of them have a long-term view on cryptocurrencies, where the annual economic growth of the sector is no longer in question.