The cryptocurrency market soared on 25 October, with Bitcoin (BTC) back above the symbolic $20,000 mark and Ether (ETH) surpassing the $1,500 mark. What are the reasons for this rise, and can we expect it to continue in this direction?

Cryptocurrency market soars without warning

It’s the first time in weeks that Bitcoin (BTC) has broken through the $20,000 barrier, sending the entire market on a surprisingly strong run. So, we can look forward to a green crypto market this morning:

Img – State of the cryptocurrency market on the morning of October 26

So, currently, Bitcoin is showing a proud price of $20,250, but its rise is still lower than that of the perennial runner-up, Ether (ETH). In fact, over the past 24 hours, the BTC price has seen a rise of around 5%, while the ETH has outperformed and literally climbed almost 14% in just over 8 hours.

ETH performance over the last 24 hours

At the time of writing, the ETH is sitting above the $1,500 mark, something it hasn’t done since mid-September, after the implementation of The Merge update. Indeed, following the Merge update, which moved the Ethereum blockchain to proof of stake (PoS), ETH languished between $1,200 and $1,400 for a long time.

Overall, almost all of the top 100 cryptocurrencies in terms of market capitalisation saw a rise of at least a few percent. Some stood out and saw a larger price increase, such as ADA (11%), SOL (10%), or FLOW (11.5%). ETH-related crypto-currencies, such as Lido’s stETH or Ethereum Classic (ETC), naturally saw a significant increase as well.

Why has the cryptocurrency market regained its confidence?

While Bitcoin seemed to have a tendency to decouple from the financial market lately, it would seem that the – some – good news from traditional finance has instilled confidence in crypto investors.

Indeed, over the past 24 hours, major stock indices have seen a significant rise. The Dow Jones Industrial Average (DJI) was up 1.07%, the S&P500 (SPX) was up 1.63%, and the Nasdaq Composite (IXIC) was up 2.25%.

In addition, according to FactSet, 72% of S&P500 companies that reported third quarter earnings beat Wall Street expectations. Thus, the indices based on the results of the largest companies seem to be able to provide some relief to investors.

However, the main concern for investors remains the rise in central bank rates, coupled with expectations that the US Federal Reserve (FED) will do its best to control runaway inflation.

According to some observers, the FED may ease up by the end of the year in order not to totally suffocate the US economy, especially in the housing market. The future remains impossible to predict, and we will have to wait until November 1st for the next FED meeting to hope to see a little more clearly.

An explosion of liquidations

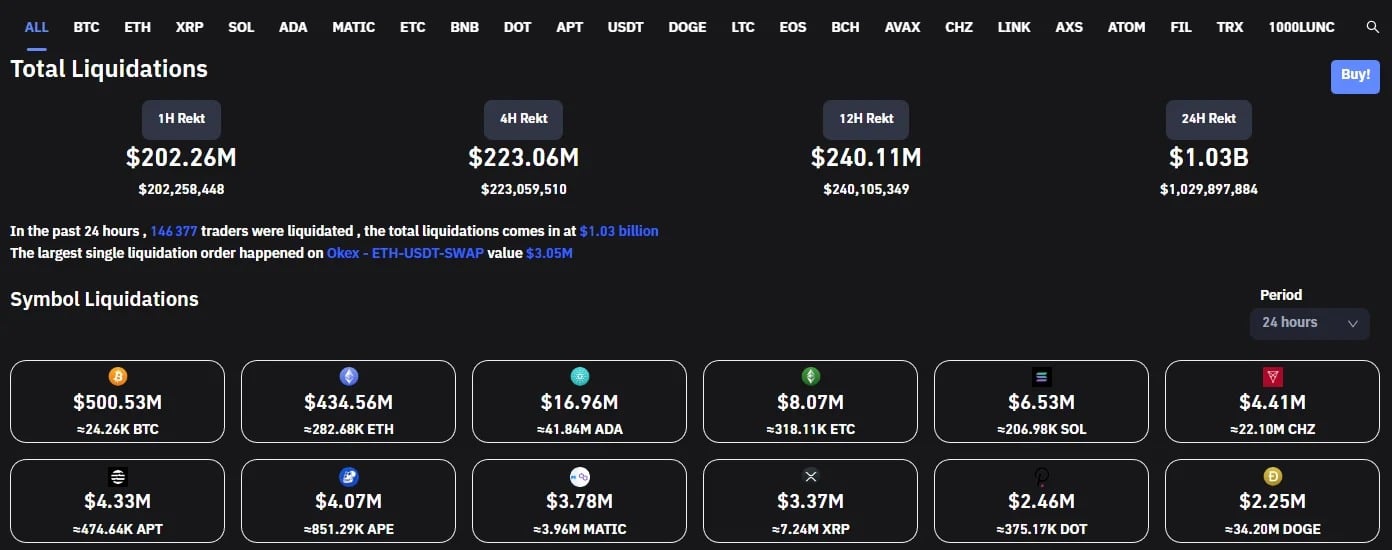

As with every major market move, some investors try to generate profit by betting on the rise or fall of a cryptocurrency. However, liquidations have literally exploded over the past 24 hours, surpassing the $1 billion mark.

24-hour liquidation status

Unsurprisingly, the overwhelming majority of traders involved in this wave of sell-offs were trying to short certain assets, i.e. betting on their decline. The vast majority of liquidations were in BTC ($500 million) and ETH ($434.5 million).

As the chart below shows, the wave of liquidations in the last 24 hours has far surpassed the previous wave of $305 million on September 9.

History of short (red) and long (green) liquidations with BTC price (yellow)

Ultimately, the cryptocurrency market has made its first truly notable move in a long time here, but it remains difficult to predict the future, as the financial market itself is in a complete fog.