After more than thirty rejections by the US regulator, the Securities and Exchange Commission (SEC) has finally authorised the deployment of a leveraged Bitcoin Futures ETF. The announcement has boosted the price of the king of crypto-currencies, which has once again surpassed an annual record by topping $31,000.

1st Bitcoin Futures ETF cleared by SEC?

Over the past few days, applications for a Bitcoin Futures ETF have been pouring in from financial behemoths. However, with tensions between the Securities and Exchange Commission (SEC) and the cryptocurrency industry still ongoing, few investors were considering validation of such a product.

Against all odds, after more than thirty rejections by the SEC, a leveraged Bitcoin Futures ETF has just been validated by the US regulator.

Called “Volatility Shares 2x Bitcoin Strategy ETF” under the ticker BITX, this investment product will be the first to be deployed in the US. Scheduled for launch on 27 June 2023, this ETF will offer users the possibility of using leverage.

An ETF is an acronym for Exchange-Traded Funds, and is an investment fund listed on a stock exchange that replicates a given index. When a Bitcoin ETF is deployed, it tracks the value of Bitcoin.

What’s new about BITX is that it enables investors to double their exposure to Bitcoin (BTC) thanks to its leverage effect. As a reminder, leverage allows you to fictitiously increase your capital by borrowing cash, thereby offering greater exposure to a given market. As a result, the gains and losses realised become greater.

For many companies, the registration of this first leveraged Bitcoin ETF opens the door to a new market. This event demonstrates the growing interest of institutional investors in the king of crypto-currencies.

Bitcoin crosses yearly high at $31,000

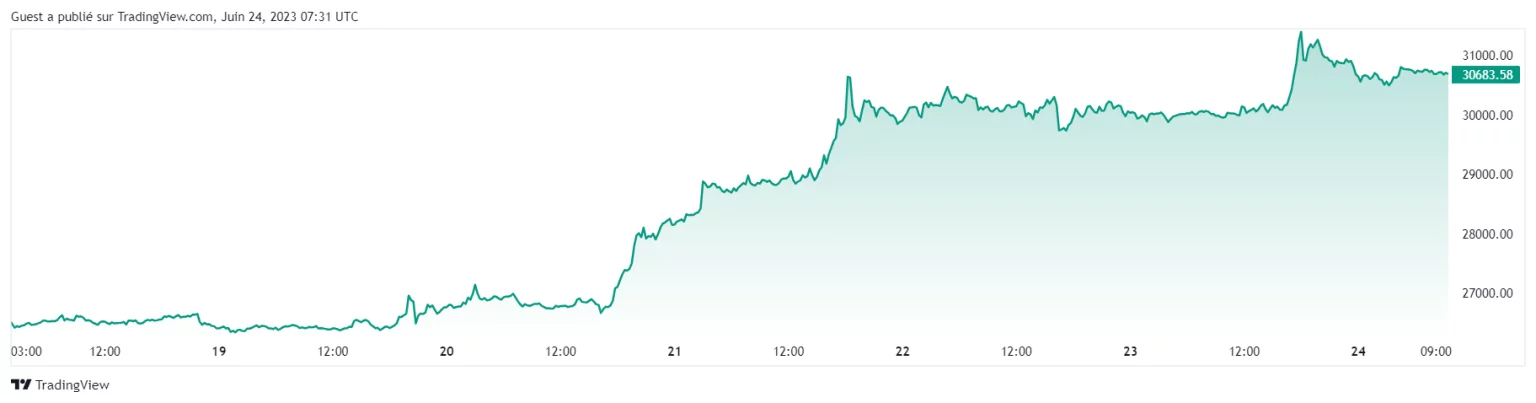

Following the SEC announcement, Bitcoin was propelled upwards by a green streak. The cryptocurrency created by Satoshi Nakamoto reached $31,250, before undergoing a slight correction. At the time of writing, its price is stagnating at around $30,500.

Bitcoin has thus broken the psychological barrier that was preventing it from bouncing back upwards. This milestone marks an annual ATH that has not been crossed since May 2022. In the last 7 days alone, its price has risen by 16.6%, a performance much appreciated by investors to combat the bear market.

Bitcoin (BTC) price rising from $26,500 to $30,700 over the last 7 days

As usual, Bitcoin has dragged altcoins with it. The BNB and SOL are up 1.6% and 2.6% respectively over the last 24 hours. ETH, meanwhile, is up just 0.4%.

Finally, the latest news surrounding the SEC and the appearance of the first Bitcoin Futures ETF are of particular benefit to the king of cryptocurrencies. By classifying many altcoins as “securities” under current US law, the SEC has encouraged investors to switch their focus to Bitcoin.

In fact, between January 2023 and today, Bitcoin’s dominance of the cryptocurrency market has grown significantly, from 42% to 51.7%.

This is a strong sign for the world’s leading cryptocurrency: while the events surrounding the Terra ecosystem (LUNA) and FTX have damaged the reputation of cryptocurrencies, companies and institutions seem to be reconsidering their positions towards Bitcoin.