Tether, the issuer of the USDT, has published its first quarterly report for 2023, revealing record excess reserves of $2.44 billion. The company also shared the breakdown of its reserves into cash, short-term deposits, Bitcoin (BTC) and gold. Tether maintains its dominant position in the stablecoin market, with a market capitalisation of $82.87 billion, but some remain doubtful about its transparency.

Tether publishes its first quarterly report

Tether, the issuer of USDT, the largest stablecoin in the ecosystem in terms of market capitalisation ahead of Circle’s USDC, has just published its first quarterly report on its reserves for the start of 2023.

The report was produced by BDO Italia, the Italian branch of BDO, the world’s fifth largest audit firm behind the Big Four. According to Tether’s press release, its reserves have never been so high, with an “all-time high” of 2.44 billion dollars in excess.

According to the USDT issuer, which is using this report to demonstrate its ability to ensure the liquidity of its stablecoin, the majority of its reserves are now held in cash or cash equivalents, or short-term deposits.

Also, for the first time, the company has also revealed the share of Bitcoin (BTC) and gold in its reserves, which amount to 1.5 billion dollars (2% of the total) and 3.4 billion dollars (4% of the total) respectively.

According to Paolo Ardoino, Tether’s CTO, the initiative is designed to increase the transparency of its reserves:

“We have an extremely positive outlook and remain committed to transparency, which is why we have introduced new categories in the breakdown of reserves in our quarterly report to provide even more transparency to our users. “

Former SEC official speaks out

John Reed Stark, a former head of the US Securities and Exchange Commission (SEC), has made a – long – tweet of note, in which he claims that Tether could be “the next domino to fall”:

IMHO, Tether is a Mammoth House of Cards.

Having studied markets and financial statements for 35 years, including during my 18 years as an attorney in the SEC Enforcement Division, IMHO, Tether, could be the next domino to fall. https://t.co/38SFD2fsRk

Tether, the first… pic.twitter.com/fOy3pzImbS

– John Reed Stark (@JohnReedStark) May 9, 2023

According to him, the current US regulatory framework does not allow a stablecoin issuer like Tether to demonstrate true transparency as there are no audit or reporting requirements for this business.

Tether’s core business, the essence of everything Tether does, is tied exclusively to Tether’s financial reserves. Yet these reserves remain unaudited, unconfirmed and therefore questionable, leaving Tether’s customers to grapple with Tether’s remarkably condescending and ineffective PR blather, hype and bluster. “

To go further, he points out the difference between the report here published by Tether and a real audit:

“In any case, an attestation is not the same as an audit – and this kind of ‘unverified snapshot’ would never pass any regulatory test. “

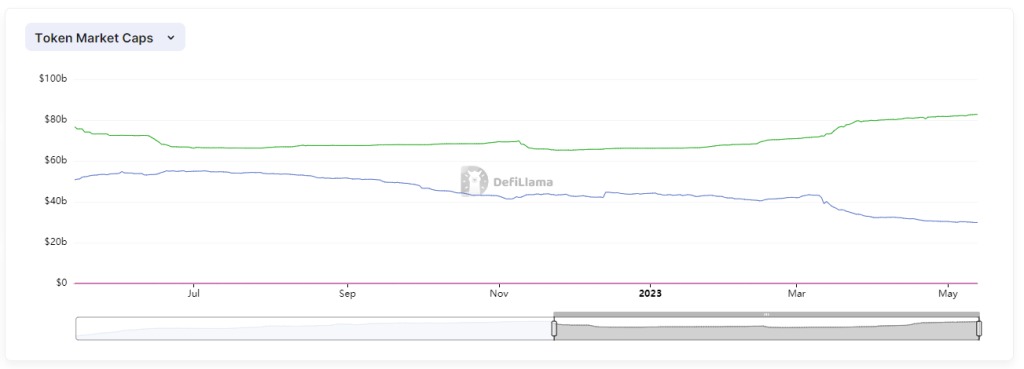

Be that as it may, since the temporary demise of its main stablecoin rival, the USDC, Tether has only gained more market share.

Market capitalisation of USDT (green) and USDC (blue)

The market capitalisation of the USDT is currently valued at $82.87 billion, giving it a 63.55% market share in stablecoins.