With the Sui blockchain mainnet having been deployed almost 15 days ago, what is the current state of play? We take a look at the number of transactions, the number of addresses and the status of staking

An initial assessment of the Sui

blockchain

On 3 May, the Sui blockchain officially opened its mainnet. Since then, we’ve had some data to keep an eye on to analyse its first steps.

To date, the network has recorded more than 8.3 million transactions, with a peak on 11 May, when 185,007 transactions were carried out. On average, the blockchain has seen 3 transactions per second over these first few days of activity, although it is not yet appropriate to draw conclusions on this figure, given that adoption is still very low.

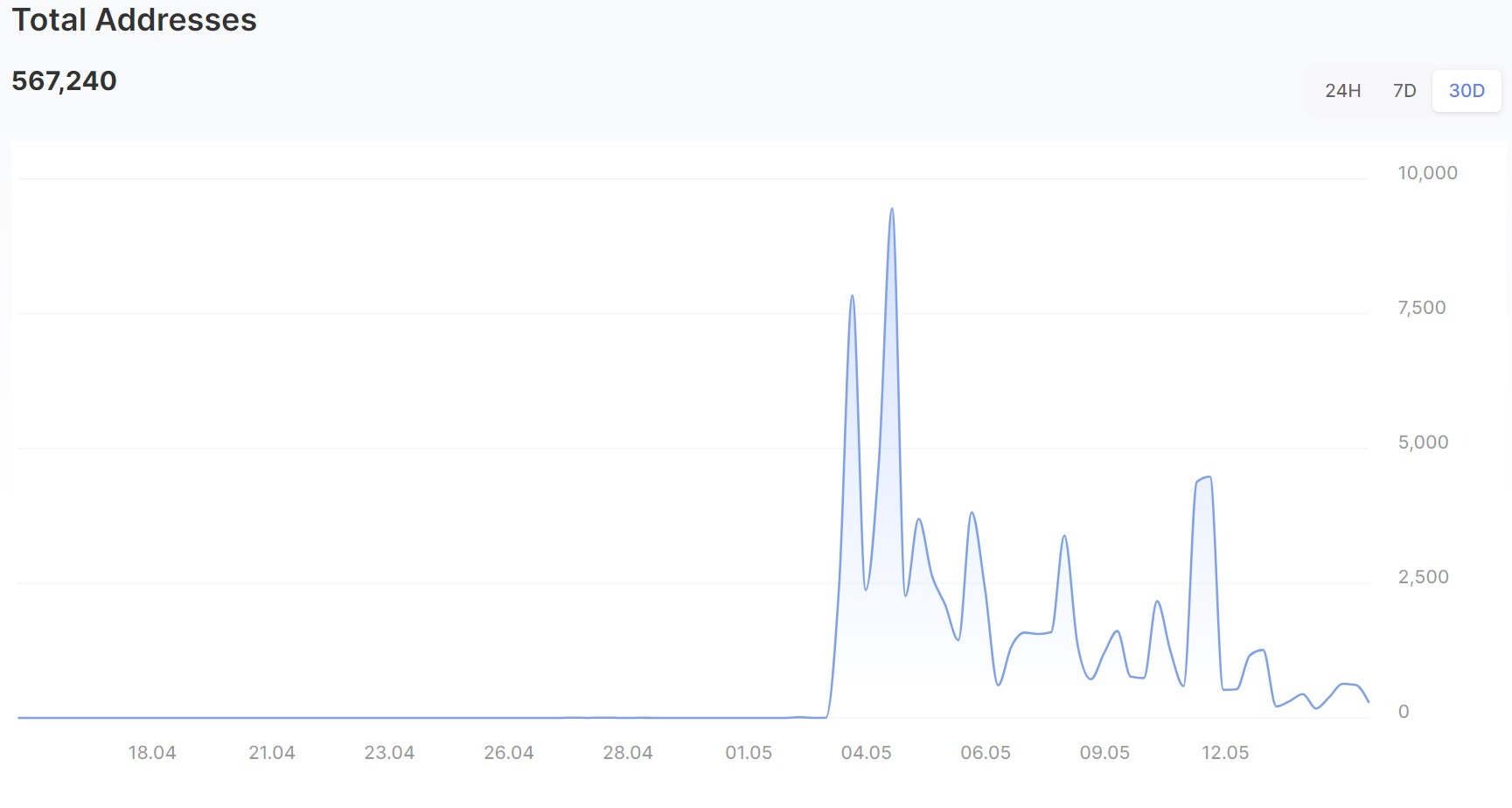

As far as the number of addresses is concerned, there were indeed nearly 570,000 at the time of writing, with a sharp slowdown in the creation of new accounts, just over 2,000 over the weekend :

Figure 1 – Number of addresses on the Sui blockchain

By way of illustration, Aptos (APT), which can be seen as a competing blockchain, has almost 3.75 million addresses since its launch in October 2022.

In addition, more than 564,000 non-fungible tokens (NFT) and 1,247 tokens have been created on the network to date.

Focus on financial data

The network’s main cryptocurrency, SUI, is trading at $1.22 each, with a capitalisation of more than $645 million, putting it in 73rd place in the CoinGecko rankings.

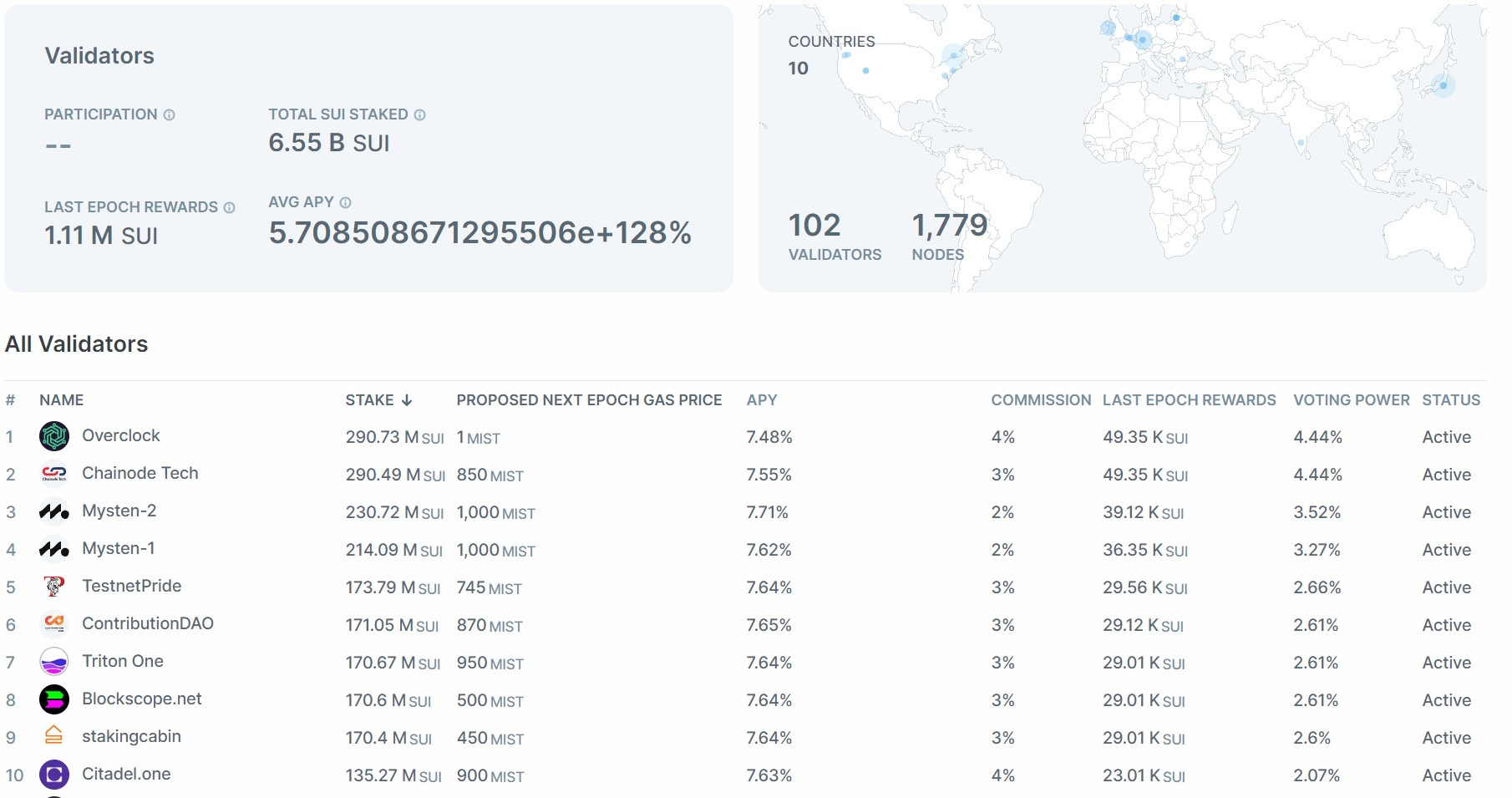

However, there is an inconsistency in the valuation of the asset. CoinGecko and CoinMarketCap base their valuation on around 528 million tokens in circulation. However, on-chains data indicates that 6.55 billion SUI are stored on the network’s various validators.

Figure 2 – Top 10 largest validators on Sui

In reality, a large proportion of these tokens are blocked by a vesting period. However, the fact is that if they are staked, they serve to generate returns by securing the network, and SUI’s capitalisation should therefore be put into perspective.

Taking this parameter into account, it would give a capitalisation of nearly $8 billion, or 12th place in the cryptocurrency rankings, which seems vastly overvalued for such a young ecosystem.

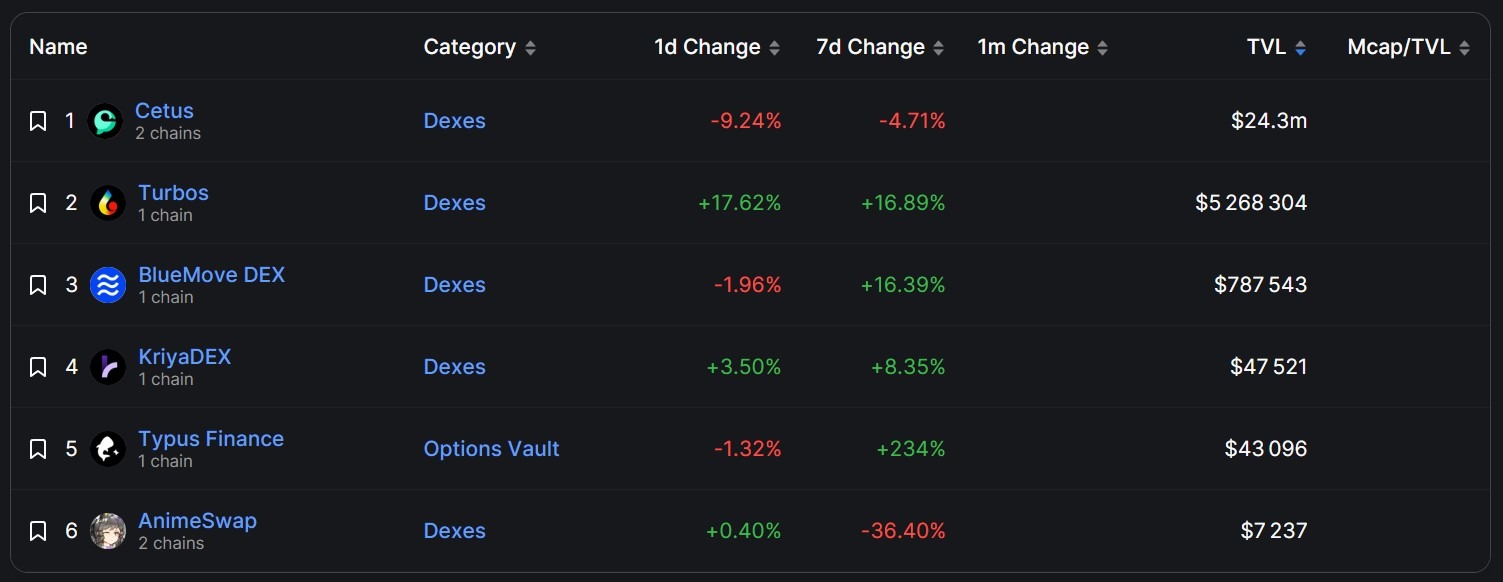

In decentralised finance (DeFi), blockchain’s total locked value (TVL) has risen to $35.32 million, according to DefiLlama. 6 protocols have been referenced on the latter, and the biggest is, for the moment, the decentralised exchange Cetus, with $24.3 million in TVL:

Figure 3 – Overview of SUI blockchain protocols

For the moment, Sui is still very young and we need to give it time to accommodate new protocols on its mainnet. It will then be appropriate to take stock again in a few months’ time to assess the progress of the various projects.