With the bear market and the drop in transaction volumes, the revenues of DeFi protocols have drastically reduced. To adapt to these economic changes, the CEO of the SushiSwap platform proposes in his new roadmap several new products to attract new users

SushiSwap on its way to conquer the DeFi

In December 2022, SushiSwap CEO Jared Grey said his company was facing some financial difficulties. The company’s cash flow would allow them to maintain their operations for 1.5 years. In order to avoid bankruptcy, he explained that “immediate action” had to be taken by his managers to right the ship.

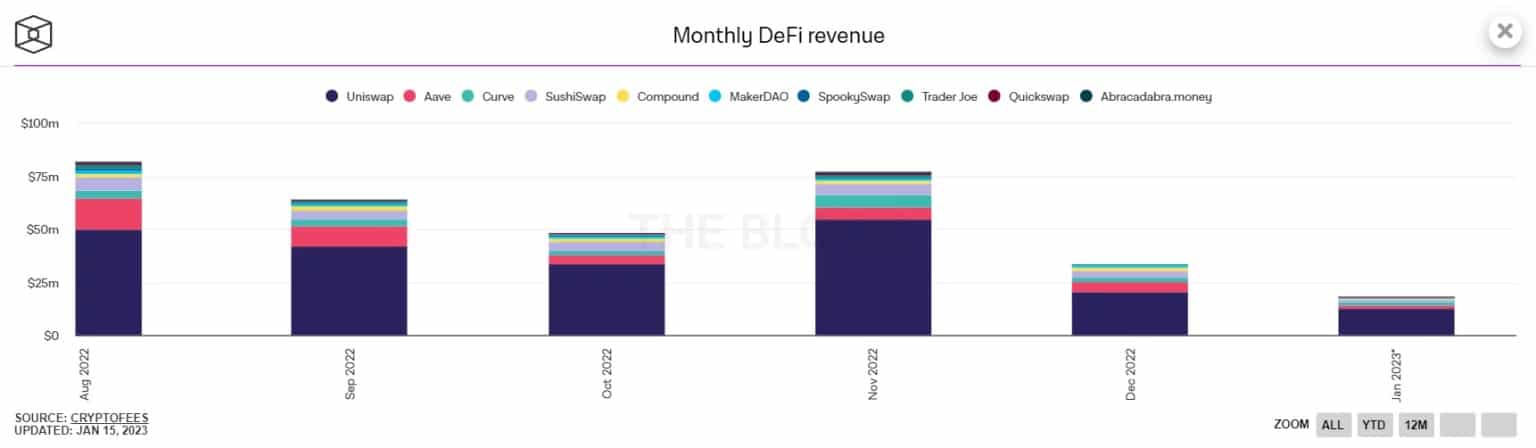

It is in this context that SushiSwap has published its new roadmap for 2023 and beyond. The decentralised exchange platform (DEX) intends to catch up with its main competitor Uniswap, whose monthly revenues are 6 to 10 times higher:

Monthly revenues of DeFi protocols between 1 August 2022 and 15 January 2023

Indeed, while Uniswap’s cumulative revenues over the last 6 months amount to $213 million, SushiSwap’s revenues are “only” $23 million, which is 9 times less than its competitor.

For his company to survive, Jared Grey says that his DEX needs to do more in the decentralised finance sector (DeFi). His goal is to increase his platform’s market share tenfold by 2024:

Today, SushiSwap represents [in terms of volume] about 2% of the MA market and 0% of the aggregator market. By implementing our vision, we intend to increase our market share by 10 times by 2023. “

Over the next twelve months, several major changes will take place for the company: in addition to a redesign of the platform’s tokenomics (SUSHI) and the launch of a DEX aggregator, SushiSwap plans to start a decentralised incubator called Sushi Studio.

SushiSwap’s new tokenomics

The transformation of SushiSwap (SUSHI) tokenomics was already mentioned by the CEO in December 2022. According to Jarey Grey, these changes are being considered to encourage long-term engagement with cash providers (LPs):

“The new proposal for the SUSHI token incentivises correct behaviour that benefits the entire ecosystem and all stakeholders by encouraging long-term LPs, directing fees to activities that generate profits and perpetually supporting the token principles. “

Despite the fact that a significant part of the community seems to adhere to the envisaged changes, this new model is not unanimous on one point: in its tokenomics, the platform plans to integrate a burn system that will remove the tokens from staking rewards.

When a user releases their crypto-currencies locked in the protocol before the maturity date of their contract, they will lose their financial reward. In this case, the tokens used as rewards will be permanently deleted from the network, and will be replaced by new tokens with an annual issuance ranging from 1.5% to 3%, keeping the supply in circulation at a stable level.

In addition, users opposed to this measure propose alternatives to reduce the financial penalty imposed on staking users. One proposal put forward by one of the users would be to reduce, at a linear or exponential rate, the quantity of tokens burned per day of staking: investors could then release their funds without saying goodbye to their rewards.

Currently, several discussions are taking place between users and SushiSwap executives to reach a consensus.

A first quarter full of new features

Economic changes related to tokenomics are being considered alongside the deployment of a DEX aggregator. Accessible from the first quarter of this year, its objective is to increase the number of SushiSwap users by offering the best prices in the cryptocurrency market.

As a reminder, a DEX aggregator is a DeFi protocol that allows crypto-currencies to be traded at the best prices by aggregating prices from different decentralized platforms in one place.

Regarding the decentralised incubator Sushi Studio, the company wants to strengthen its brand image by promoting developers who want to increase and improve its product range. Currently, two projects are in development and are expected to be launched before April 2023: a DEX focused on derivative contracts, and an NFT platform under the name Shoyu.