Silvergate, the crypto-bank that announced the layoff of 40% of its staff earlier this month, has just revealed its balance sheet for the last quarter of 2022. The latter shows a net loss of more than $1 billion for the bank, as well as a notable drop in the value of its shares.

Silvergate in bad shape

Silvergate, the crypto bank, reveals a disturbing balance sheet: according to its latest report, it suffered $1 billion in net losses attributable to its various shareholders in the last quarter of 2022. This compares with a net profit of $40.6 million in the third quarter of 2022.

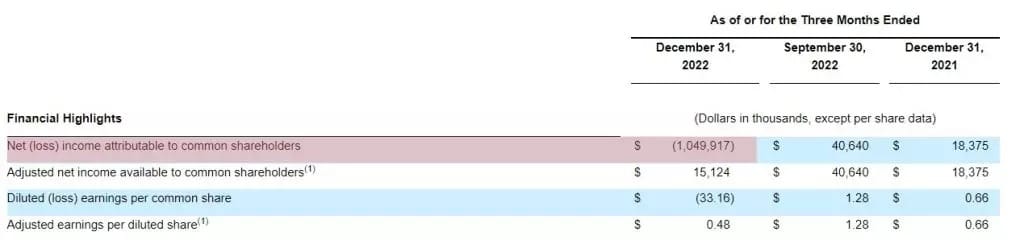

Figure 1 – Results for the last quarters of 2021 and 2022

According to the report, the crypto bank has in the meantime lost $33.16 per common share, and was able to observe a profit of $1.28 per diluted share as of 30 September 2022.

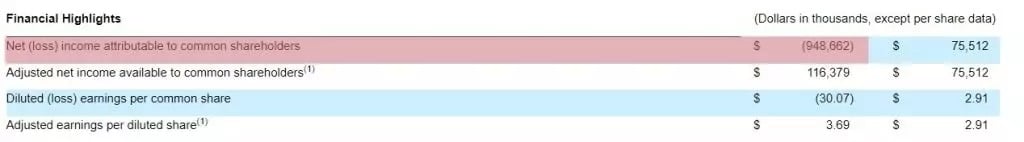

In comparison, over the whole of 2021, Silvergate’s operations had generated a net profit of over $75.5 million for the company. Here, for the full year of 2022, Silvergate has a net loss of over $948 million.

Figure 2 – Annual net losses attributable to shareholders

We can also see that in the last quarter of 2022, Silvergate’s customer deposits dropped significantly from $12 billion to “only” $7.3 billion, a difference of $4.7 billion.

According to Silvergate, there has been a “transformational change” noted within the cryptocurrency ecosystem, which is believed to be the result of a crisis of confidence on the part of investors and which has ultimately led to an exodus from centralised platforms. An observation to be made against the backdrop of FTX’s bankruptcy.

Crypto-banking wants to adapt to the market

Faced with this paradigm shift and forced to take action in the face of these considerable losses, Silvergate announces it is reconsidering the way its expenses as well as its portfolio are structured. To keep its cash flow afloat, the company says it has resorted to wholesale funding and debt sales.

For his part, Alan Lane, the company’s CEO, was keen to maintain a position of confidence in the crypto ecosystem:

“While we are taking decisive steps to navigate the current environment, our mission has not changed. We believe in the digital asset industry, and we remain focused on providing value-added services for our core institutional clients. To this end, we are committed to maintaining a highly liquid balance sheet with a strong capital position.

As we reported earlier this month, Silvergate was forced to lay off 40% of its staff, or approximately 200 employees, in response to this significant yet undisclosed decline.Finally, clarification is also expected regarding the relationship between Silvergate and FTX. Indeed, on December 6, three US senators wrote to the crypto-bank to assess its role in the loss of several billion dollars of the defunct exchange.