For more than a week, one of the biggest centralized crypto services platforms, Celsius, has been threatened with insolvency. In this dossier, we explain in concrete terms what happened and why this case is a huge threat to the entire decentralised finance (DeFi) ecosystem.

Backgrounder: what happened with Celsius

What is Celsius?

Before we delve into the heart of this matter, it is important to put things into context and set the scene. Celsius is one of the largest centralised platforms in the ecosystem. It offers simplified access to decentralised finance (DeFi) services such as borrowing, lending and earning on cryptocurrencies.

Celsius has quickly positioned itself as a giant in its field. And for good reason, it offers attractive returns of up to almost 19% APY. In the space of a few years, the platform has raised $864 million, reached $3 billion in assets under management and exceeded one million clients.

In practical terms, Celsius is an asset manager. The platform provides regulated access to loans, borrowing and returns on cryptocurrencies, while receiving a fee for doing so. The benefit to the user is to profit without exposing themselves to the disadvantages and risks of managing their own DeFi positions.

In other words, Celsius does not offer its clients direct exposure to the underlying assets, but promises to buy back positions in case users want to withdraw their funds. This is a fundamental aspect to bear in mind in order to understand the rest of this case.

Furthermore, despite the use of processes that are very reminiscent of centralized finance, Celsius wishes to distance itself from it. This is why the platform has introduced a token, the CEL. This allows for discounts on services and bonuses on rewards.

Celsius suspected of payment default

Now that you have the basics down, let’s get to the heart of the matter. At the beginning of June, several observers began to warn that Celsius might default on its payments to users.

Initial rumours pointed to the fact that only 27% of Celsius’ positions in Ethereum (ETH) were liquid. Generally speaking, the rest would be locked up in smart contracts linked to Ethereum 2.0 and in particular stETH, a product issued by the Lido lending platform. A notable detail is that these are inaccessible before the transition of Ethereum to its new version.

Users quickly accused the platform of mismanagement of its funds, particularly following the collapse of the Terra ecosystem (LUNA) and its UST stablecoin. In the face of these rumours and in the context of a bear market, the situation quickly became alarming.

More and more users wanted their assets back, forcing Celsius to sell its positions at a loss and causing Ether to fall further. Far from putting out the fire, Celsius turned it into a full-blown inferno by announcing the suspension of swaps, withdrawals and transfers on the platform.

As a direct result, CEL fell by more than 75% in a matter of minutes. The platform’s token fell from around $0.36 to less than $0.09, before beginning an astonishing recovery.

So why is Celsius in such turmoil?

At the time of writing, there are two main reasons why Celsius, and its one million users, have found themselves in turmoil. First, there was a rumour that customer funds were being misused to make leveraged loans. Secondly, there was mismanagement of the stETH product.

A real mismanagement of client funds?

The core of Celsius’ problem was the desire to provide users with low borrowing rates and excessive returns. To do this, the platform had to resort to leveraged borrowing on standalone market makers, including Maker DAO, by leveraging user funds.

In practical terms, when a user buys Bitcoin (BTC), Celsius converts it into Wrapped Bitcoin (wBTC) and deposits it as collateral on the Maker protocol to borrow stablecoin DAI and generate returns with it. However, if the Bitcoin loses too much value, the collateral is no longer sufficient insurance and the protocol must liquidate the position.

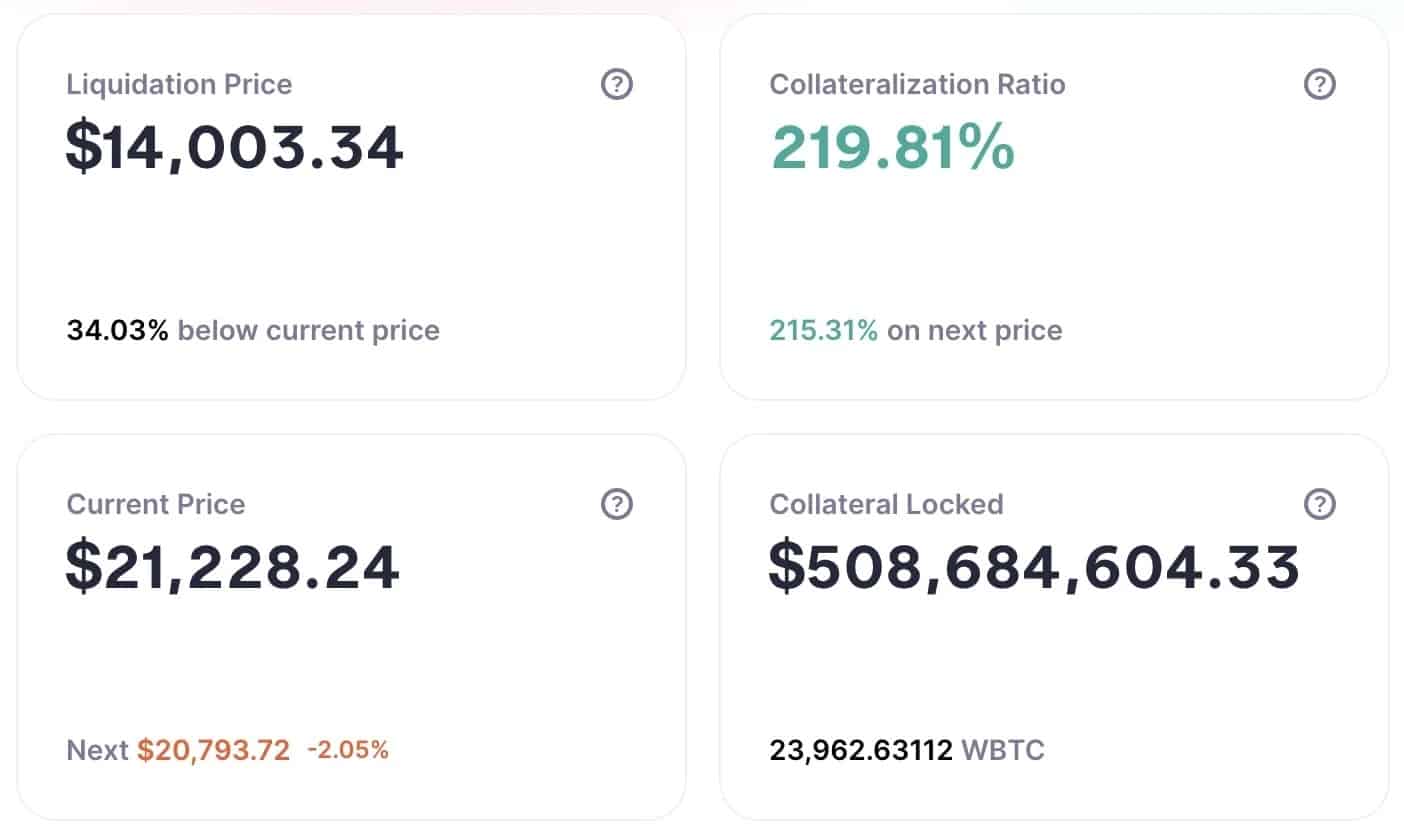

As you can see, as Bitcoin plummeted alarmingly, Celsius’ positions were at risk. As of 13 June, Celsius had over 17,000 wBTC leveraged on Maker and the threshold for liquidation was reached if Bitcoin fell below $22,500.

However, while many users expected Celsius to liquidate its customers’ positions to pay off its own, the platform simply bailed out. As the data from the Oasis app shows, Celsius now has almost 24,000 wBTC in collateral, with a liquidation price of $14,000.

Information on Celsius’ positions on Maker DAO

The storm seems to have subsided slightly, but for how long? The real question is whether Celsius will be able to continue to hold its position if Bitcoin falls, without having to liquidate its own customers.

Celsius overexposed to stETH

As you are probably aware, Ethereum is about to make its transition to a new blockchain, operating under a Proof-Of-Stake (PoS) consensus. Thus, it is already possible to lock your Ether on Ethereum 2.0 smart contracts and generate a 4.2% return.

In addition, Celsius offers its customers an attractive return of almost 8% on the same asset. How is this possible? Through an extremely interesting product, the stETH from the Lido lending platform. However, you will quickly understand why this is a problem.

The stETH is a token that certifies that a user has staked an Ether in an Ethereum 2.0 smart contract. In addition, these allow for even greater returns to be generated. In addition to earning staking rewards, stETHs can be lent or used to provide liquidity.

However, this product has one main drawback: although it can be exchanged for Ether on a secondary market, it cannot be used to recover the Ether originally staked. At least not until Ethereum 2.0 has been officially launched.

Furthermore, for various reasons, stETH has depeg and is currently trading at 0.95 ETH. In other words, Celsius has bought a lot of stETH, and it cannot be traded before the Ethereum Merge, or else with losses.

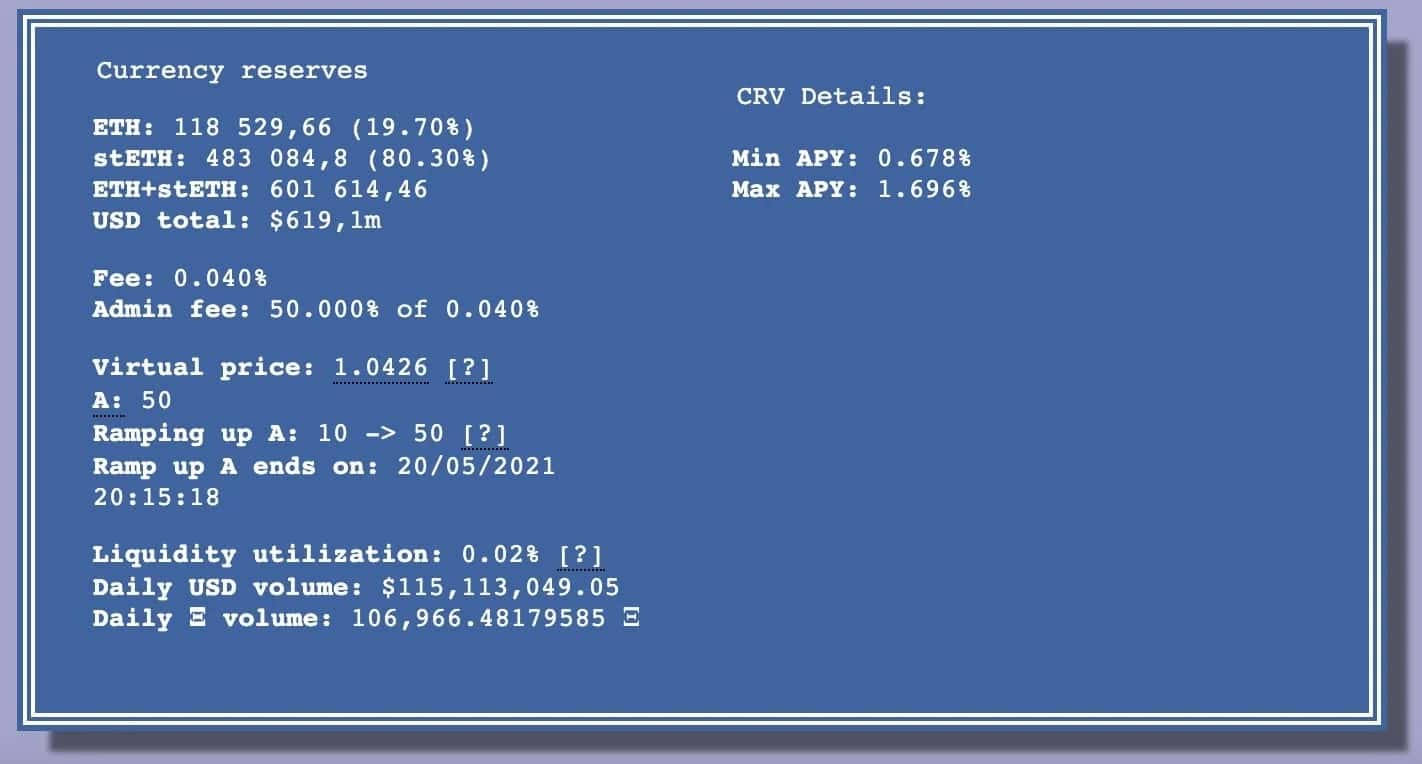

Worse still, there is not enough liquidity available for Celsius to get rid of its stETH. Indeed, the liquidity pool on the Curve Finance protocol is currently out of balance and has less than 120,000 ETH, while Celsius’ position stands at 445,000 stETH.

Information on the stETH / ETH liquidity pool on Curve

What are the current risks for DeFi?

The repercussions of the Terra case

The collapse of the Terra ecosystem (LUNA) and its stablecoin UST has had a far more profound impact than anyone could have imagined. Many platforms suffered significant losses, including Celsius. They were forced to sell their positions at a loss in order to pay back their clients and secure their positions.

Moreover, Celsius’ mismanagement is not an isolated case. The investment fund Three Arrow Capital is also facing massive liquidations and may become insolvent. All these cases pose a direct threat to the ecosystem.

The selling volumes of these investment funds, lending platforms and other centralised exchanges have led to the massive drop in cryptocurrency prices that we are currently experiencing. So much so, that they have put many DeFi users at risk.

At the time of writing, the Aave protocol is facing a wall of potential liquidations. If Ether drops below $984, then $200 million of positions will be on the verge of being liquidated.

It is important to note that this affects Celsius, but also many ordinary users whose collateralization factor was still relatively high a few weeks ago. The rapid fall of the market has put them in a complex situation, close to liquidation.

What can we expect for the future?

The question on everyone’s mind is: can we expect to get out of this? There are three scenarios to consider:

- The first of these is that the Ether does not go below $984.

- The second is that users bring in sufficient liquidity to re-collateralize their positions and avoid liquidation.

- Finally, the third scenario is that the price of Ether drops below $984 and those $200 million positions will be liquidated.

Now, the 5% fee that is being offered to liquidators may not be enough to make up for the drop in the Ether price if such a large amount is liquidated.

In other words, it is unlikely that anyone would trigger the liquidation mechanism in one go, as they would lose out. The last solution would therefore be to proceed with liquidations in stages, little by little. However, since gas fees on Ethereum are high, it is not certain that users will want to choose this option, which is very costly and therefore less profitable.

$200m being liquidated in decentralised finance

“We’re having a record day, if not THE record day in terms of difficulties and pressures for decentralised finance.”

@ValCryptoastCryptos Bitcoin pic.twitter.com/kY0GV1CBiU

– BFM Crypto (@BfmCrypto) June 15, 2022