Over the past few days, the total value locked up on all DeFi protocols has fallen below the $38 billion mark. This level was last exceeded in February 2021. What are the interesting things to watch

?

Total value locked into DeFi falls below $38 billion

In the cryptocurrency sector, the bear market can be measured at different levels. While falling prices are the major feature to observe, the total locked value (TVL) of decentralised finance protocols (DeFi) is also a particularly instructive statistic for judging investor interest.

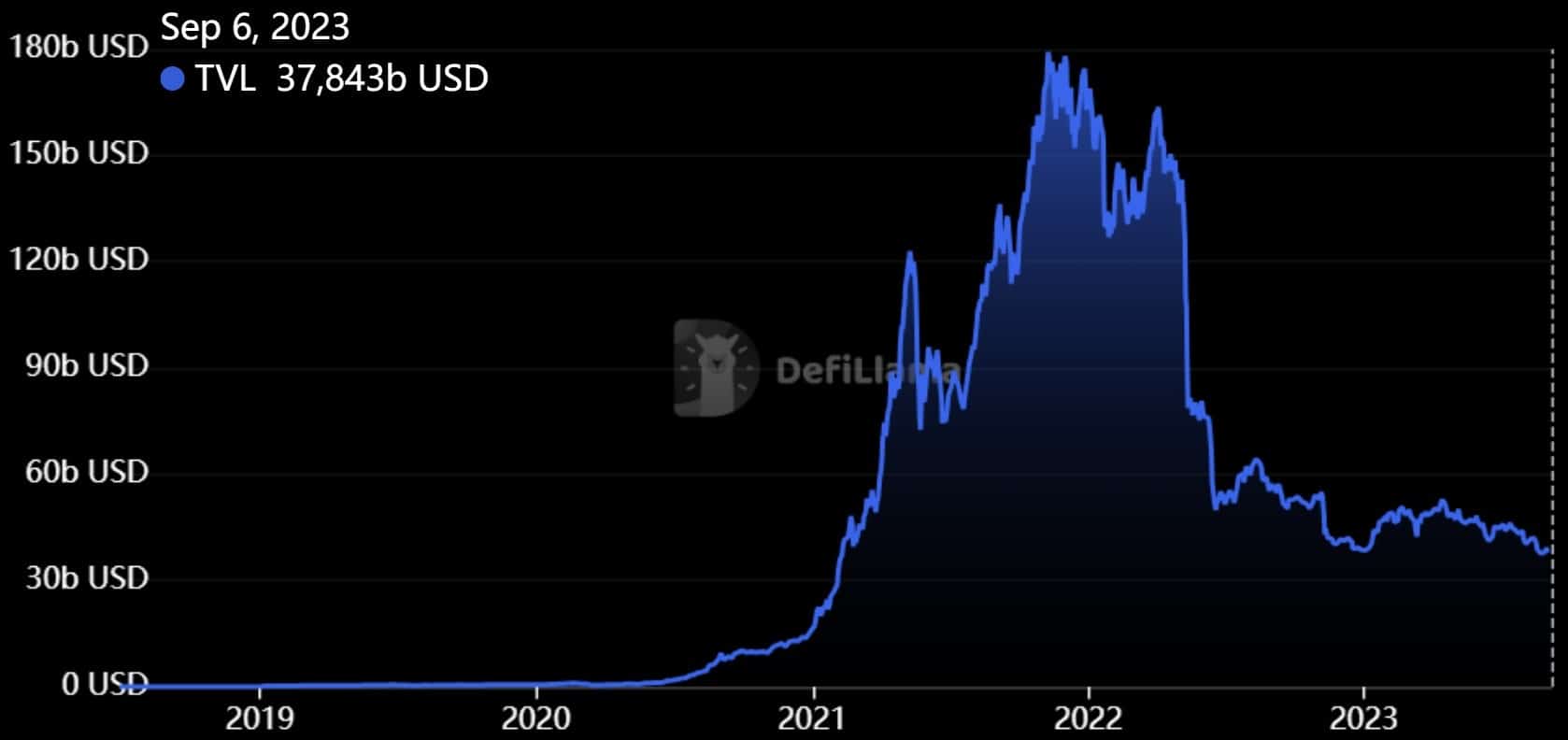

While we had already noted a 73% fall in TVL between the peak of the previous bull run and last April, this fall has become even more pronounced. Data from DefiLlama shows that, taking all blockchains together, DeFi’s TVL is now worth $37.84 billion.

This statistic has thus fallen below the $38 billion mark, a level which, despite a test last January, had not been broken since it was exceeded on 10 February 2021. Since November 2021, we have seen a fall of 78.88%:

Figure 1 – Evolution of TVL in decentralised finance

It is important to note that some data are deliberately excluded from this census. This includes double counting, which is the action of depositing liquidity on protocol A, then depositing the proof of deposit received in return on protocol B. In this case, only the first deposit is counted. Staking, which has more to do with the security of the underlying blockchain than with DeFi, is also excluded.

Under these conditions, the podium is made up of MakerDAO, Aave and JustLend, respectively with 5.05, 4.54 and 3.64 billion dollars of TVL.

An activity that contrasts with innovations

While DeFi activity is particularly low, it is interesting to note that this finding is in complete contrast to the way in which the various projects are building on the ecosystem.

In terms of protocols, leading applications such as Aave and Curve, for example, launched their own stablecoin during this bear market. In terms of networks, more and more layer 2s are also arriving on the market, such as zkSync Era and Base.

Coinbase’s blockchain made it into the top 10 with $408 million in TVL. Ethereum accounts for 56.28% of the DeFi ecosystem :

Figure 2 – Ranking of blockchains by TVL in the DeFi

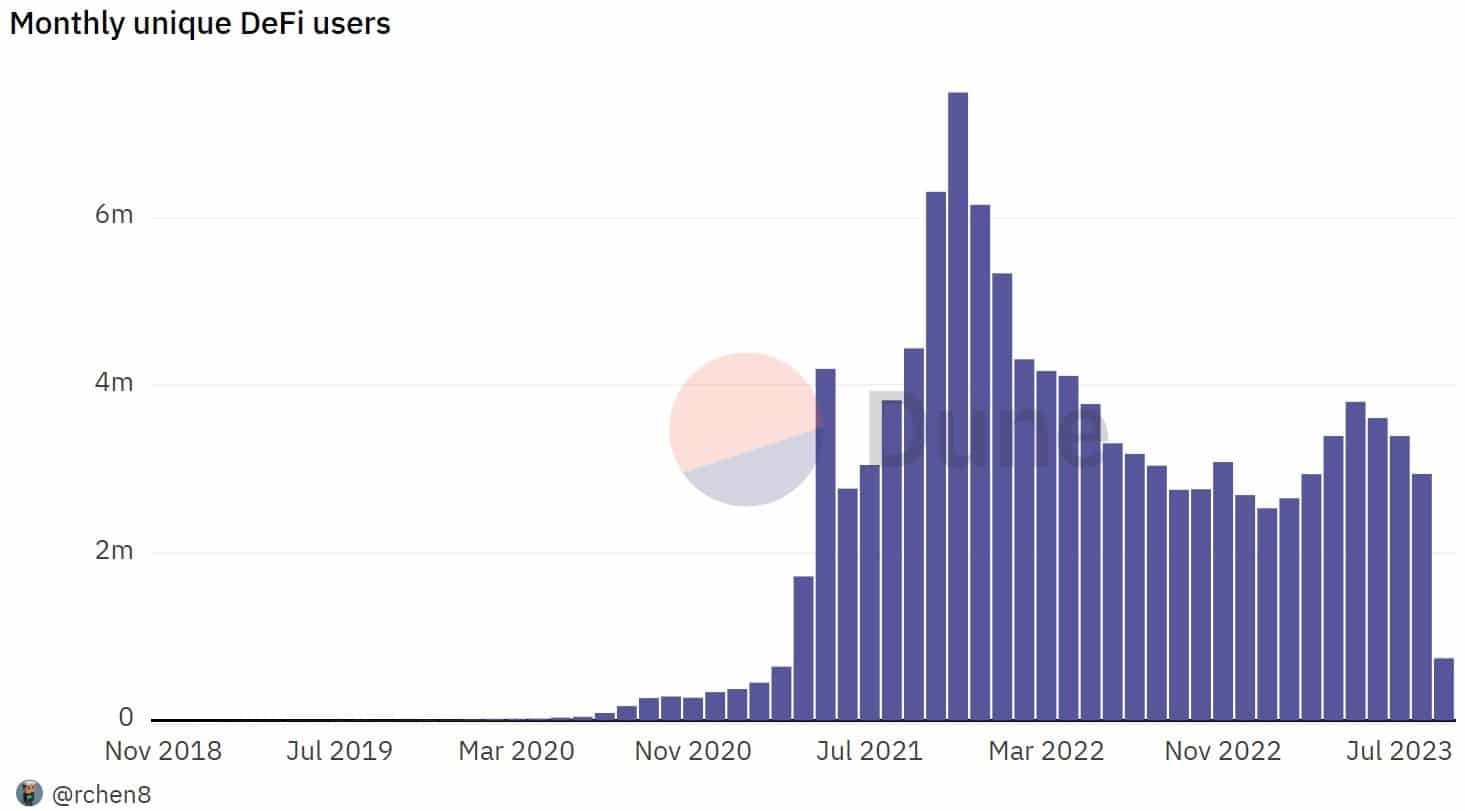

In terms of monthly active users across all blockchains, August saw a total of 2.94 million. While this is an improvement on the low point at the start of the year, we have nevertheless seen a decline since the spring.

However, we can also see that this result is 6.5 times higher than in February 2021, when the $38 billion TVL milestone was passed:

Figure 3 – Monthly active users across all DeFi blockchains

The evolution of prices over the coming months will allow us to look back at these statistics to see if there have been any changes.